- TOP STORIES

Advertisement

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

IN DETAIL: NGX trades surge 480% to N494bn in five days

September 28, 2025

Nigeria re-elected into international civil aviation council

September 27, 2025

Advertisement

- THE NATION

Advertisement

- INSIDE NIGERIA

Solid minerals ministry: 13, not 100, died in Zamfara mine collapse

September 28, 2025

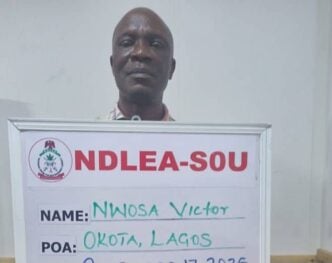

- CRIME & JUSTICE

Advertisement

- Exclusives & Features

Advertisement

- fact check

- checkam for wazobia

- petrobarometer

‘Not recognised by our constitution’ — NUPENG disowns PTD Elders group

September 28, 2025

Advertisement

- Policy Radar

- development

National health fellow sensitises women on maternal health in Osun community

byTheCable

September 28, 2025

- climate

Houses, vehicles submerged as flood ravages Lagos communities

September 24, 2025

Advertisement

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

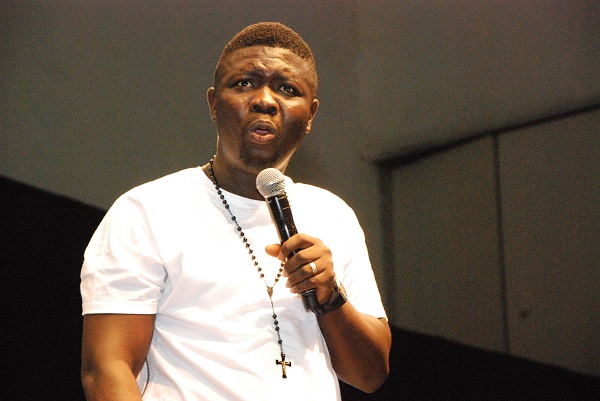

Seyi Law recalls ‘sacrifices’ that shaped his 20-year comedy career

September 28, 2025

Selena Gomez marries songwriter Benny Blanco in California

September 28, 2025

Advertisement

- Life & Living

Marriage and money: ‘He bought a powerbike and I was 8 months pregnant’

September 28, 2025

Gingerrr, One Battle After Another among 10 movies to see this weekend

September 27, 2025

Advertisement

- STUDENT LIFE

FG makes NERD compliance mandatory for NYSC mobilisation, exemption

byTheCable

September 28, 2025

Calls for scrapping of post-UTME grow as varsities differ on credibility

byTheCable

September 26, 2025

Ondo constitutes task force to arrest truant students, sanction school heads

byTheCable

September 24, 2025

Enrollment rate for Nigeria’s TVET reform crosses one million mark

byTheCable

September 24, 2025

Advertisement