- TOP STORIES

Advertisement

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

Netflix to acquire Warner Bros for $82.7bn

December 5, 2025

Lagos, Kaduna lead FG’s 2025 ease of doing business ranking

December 5, 2025

FG approves N185bn to settle gas debts to boost power supply

December 4, 2025

Advertisement

- THE NATION

Advertisement

- INSIDE NIGERIA

- CRIME & JUSTICE

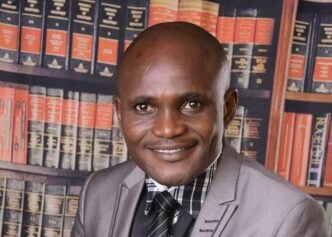

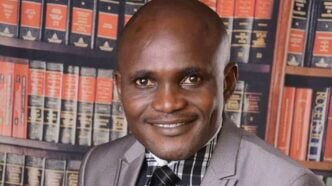

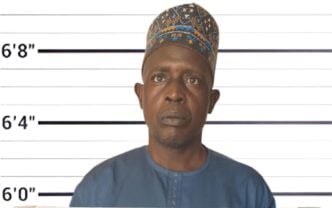

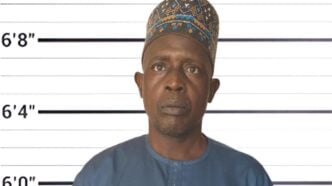

EFCC arraigns Gombe magistrate over N1.4m bribery allegation

byTheCable

December 5, 2025

Advertisement

- SPORT

- Exclusives & Features

Advertisement

- fact check

- checkam for wazobia

- petrobarometer

Advertisement

- Policy Radar

- development

- climate

Advertisement

- VIEWPOINT

- YOUR SAY

- INTERNATIONAL

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

Kcee: Why I am a Biafran

December 5, 2025

Wizkid, Asake announce joint EP ‘Real Vol. 1’

December 5, 2025

Advertisement

- Life & Living

Advertisement

- STUDENT LIFE

Advertisement