- TOP STORIES

Advertisement

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

Advertisement

- THE NATION

Advertisement

- INSIDE NIGERIA

- CRIME & JUSTICE

Advertisement

- SPORT

- Exclusives & Features

Advertisement

- fact check

- checkam for wazobia

- petrobarometer

Fuel supply now exceeds Nigeria’s demand, says Dangote refinery

November 1, 2025

Advertisement

- Policy Radar

- development

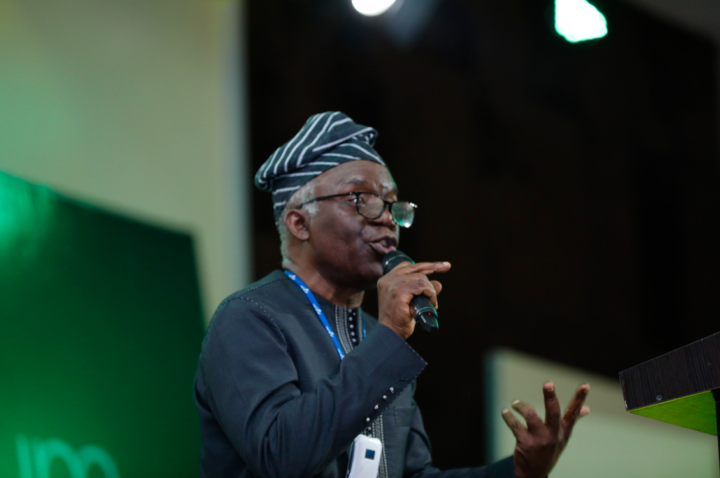

Africa poor because it’s not free, says Abdullah Tijani

October 30, 2025

- climate

Advertisement

- VIEWPOINT

- YOUR SAY

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

DOWNLOAD: Seyi Vibez seeks love in ‘How Are You?’

October 31, 2025

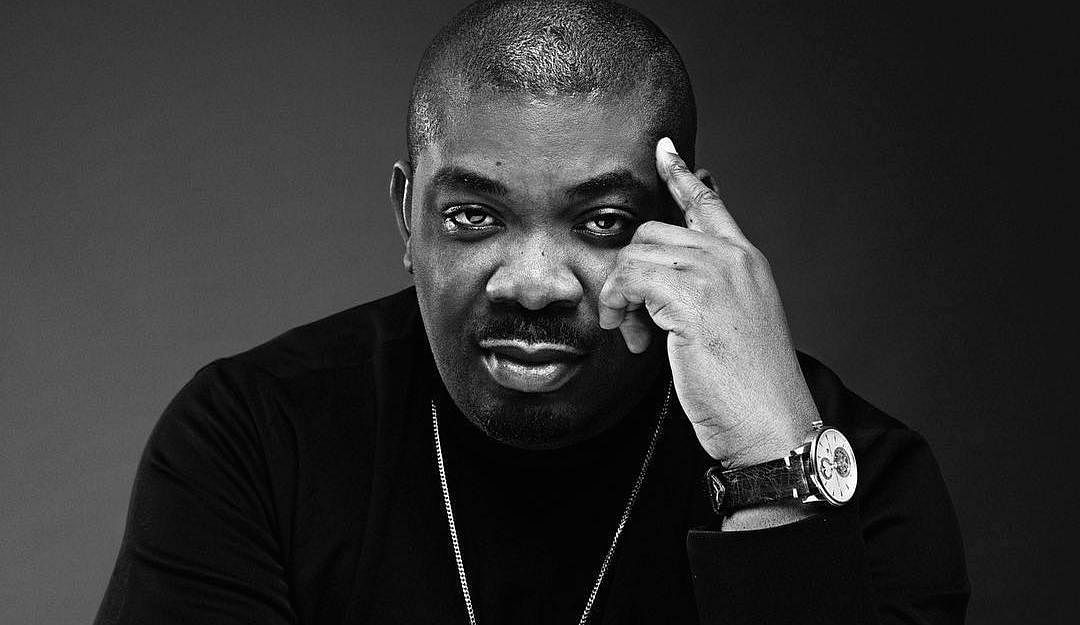

Don Jazzy: I nearly relocated abroad after Mo’Hits split

October 31, 2025

Advertisement

- Life & Living

Advertisement

- STUDENT LIFE

Lagos approves new LASU governing council, names Ogala as chair

November 1, 2025

FG releases N2.3bn to federal university unions to clear arrears

byTheCable

October 29, 2025

Advertisement