- TOP STORIES

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

Advertisement

- THE NATION

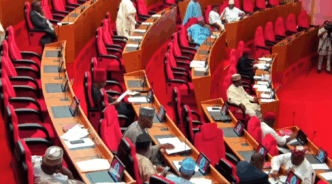

Reps move to prohibit banks from hiring casual, contract staff

December 15, 2025

Yilwatda appoints Abimbola Tooki special adviser on media

December 15, 2025

Advertisement

- INSIDE NIGERIA

- CRIME & JUSTICE

Advertisement

- SPORT

- Exclusives & Features

Advertisement

- fact check

- checkam for wazobia

Video wey tok sey Nigerian church dey on fire na lie, na Ghana school

December 12, 2025

- petrobarometer

Advertisement

- Policy Radar

- development

- climate

Advertisement

- VIEWPOINT

- YOUR SAY

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

Actor Rob Reiner, wife found dead with knife wounds in LA home

December 15, 2025

Mr Eazi teases fourth wedding with Temi Otedola

December 15, 2025

Tonto Dikeh: How I masturbated, smoked cigarettes for 27 years

December 15, 2025

Ayo Benzi crowned ‘Next Afrobeats Star’, secures N150m deal

December 15, 2025

Advertisement

- Life & Living

Advertisement

- STUDENT LIFE

JAMB begins inspection of 848 exam centres for 2026 UTME

byTheCable

December 15, 2025

FG: At least 100,000 Nigerians undergoing skills training in TVET scheme

byTheCable

December 15, 2025

FG bans SS3 student admission, transfers to curb exam malpractice

byTheCable

December 14, 2025

Advertisement