- TOP STORIES

Advertisement

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

Advertisement

- THE NATION

Advertisement

- CRIME & JUSTICE

Advertisement

- SPORT

- Exclusives & Features

Advertisement

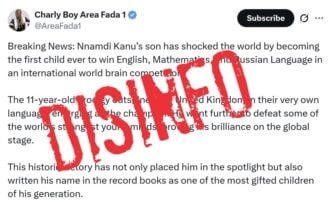

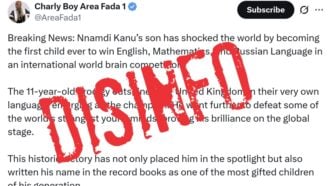

- fact check

- checkam for wazobia

- petrobarometer

Advertisement

- Policy Radar

- development

- climate

Advertisement

- VIEWPOINT

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

Advertisement

- Life & Living

Advertisement

- STUDENT LIFE

Advertisement