- TOP STORIES

Advertisement

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

Advertisement

- THE NATION

Advertisement

- INSIDE NIGERIA

- CRIME & JUSTICE

Advertisement

- SPORT

- Exclusives & Features

Advertisement

- fact check

- checkam for wazobia

- petrobarometer

Advertisement

- Policy Radar

- development

- climate

Advertisement

- VIEWPOINT

- YOUR SAY

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

Crayon loses mum, says it’s an everlasting scar

October 11, 2025

DOWNLOAD: Joeboy, Shoday explore love, commitment in ‘Ring’

October 10, 2025

Advertisement

- Life & Living

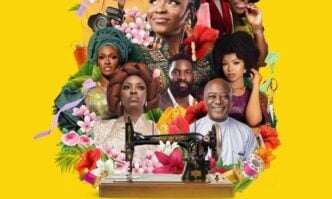

Almost Perfect, Tron 3 among 10 movies to see this weekend

October 11, 2025

Ibadan to host 2025 Afroculture Fest on December 20

byTheCable

October 9, 2025

Advertisement

- STUDENT LIFE

Advertisement