- TOP STORIES

Advertisement

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

Lagos, Kaduna lead FG’s 2025 ease of doing business ranking

December 5, 2025

FG approves N185bn to settle gas debts to boost power supply

December 4, 2025

Advertisement

- THE NATION

Advertisement

- INSIDE NIGERIA

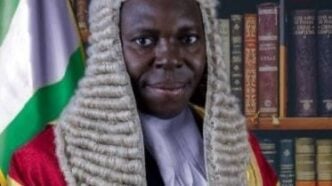

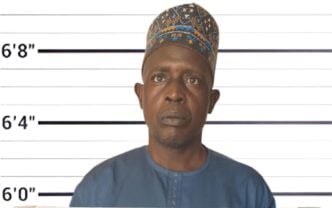

- CRIME & JUSTICE

EFCC arraigns Gombe magistrate over N1.4m bribery allegation

byTheCable

December 5, 2025

Advertisement

- SPORT

- Exclusives & Features

Advertisement

- fact check

- checkam for wazobia

- petrobarometer

Advertisement

- Policy Radar

- development

- climate

Advertisement

- VIEWPOINT

- YOUR SAY

- INTERNATIONAL

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

Wizkid, Asake announce joint EP ‘Real Vol. 1’

December 5, 2025

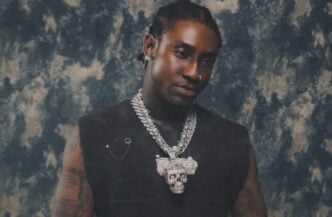

Bella Shmurda: Why I don’t like being called street artiste

December 4, 2025

Bisola Badmus: How a brain tumour almost took my life

December 4, 2025

Sabinus confirms end of two-year marriage

December 4, 2025

Advertisement

- Life & Living

Restaurants in Lagos, Abuja recognised at 11th Awari awards

December 4, 2025

BOOK REVIEW: OLOBUN — Matriarch of Ondo, Mother of Legacy

December 3, 2025

Advertisement

- STUDENT LIFE

Advertisement