- TOP STORIES

Advertisement

ADVERTISEMENT

Advertisement

Advertisement

Latest

ADVERTISEMENT

Advertisement

- BUSINESS

Nigeria re-elected into international civil aviation council

September 27, 2025

PenCom raises capital base for PFAs to N20bn, PFCs to N25bn

September 27, 2025

Chinese firm to invest $50m in Ogun to expand detergent production

September 27, 2025

Ecobank completes Mozambique exit as FDH Bank takes over subsidiary

September 26, 2025

Advertisement

- THE NATION

Ezekwesili: Independent media becoming extinct

September 27, 2025

NAHCON cuts 2026 hajj fares by N200,000

September 27, 2025

Advertisement

- INSIDE NIGERIA

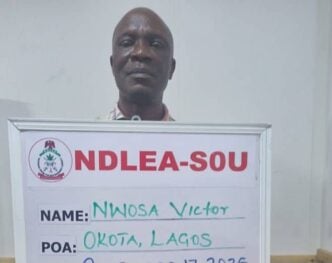

- CRIME & JUSTICE

Advertisement

- SPORT

- Exclusives & Features

Advertisement

- fact check

- checkam for wazobia

- petrobarometer

PENGASSAN commences strike after Dangote refinery sacked workers

September 28, 2025

Advertisement

- Policy Radar

- development

National health fellow sensitises women on maternal health in Osun community

byTheCable

September 28, 2025

- climate

Houses, vehicles submerged as flood ravages Lagos communities

September 24, 2025

Advertisement

- VIEWPOINT

- YOUR SAY

- INTERNATIONAL

Advertisement

- PROMOTED

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

- MOST VISITED

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Advertisement

Advertisement

Advertisement

Advertisement

- HOT CELEBS

Selena Gomez marries songwriter Benny Blanco in California

September 28, 2025

Skales: Why I started my own record label after leaving Banky W

September 28, 2025

Advertisement

- Life & Living

Marriage and money: ‘He bought a powerbike and I was 8 months pregnant’

September 28, 2025

Gingerrr, One Battle After Another among 10 movies to see this weekend

September 27, 2025

Amazon to pay $2.5bn for ‘tricking millions to sign up for Prime’

September 26, 2025

Advertisement

- STUDENT LIFE

Calls for scrapping of post-UTME grow as varsities differ on credibility

byTheCable

September 26, 2025

Enrollment rate for Nigeria’s TVET reform crosses one million mark

byTheCable

September 24, 2025

Jigawa approves N869m for Tsangaya school projects

byTheCable

September 24, 2025

Advertisement