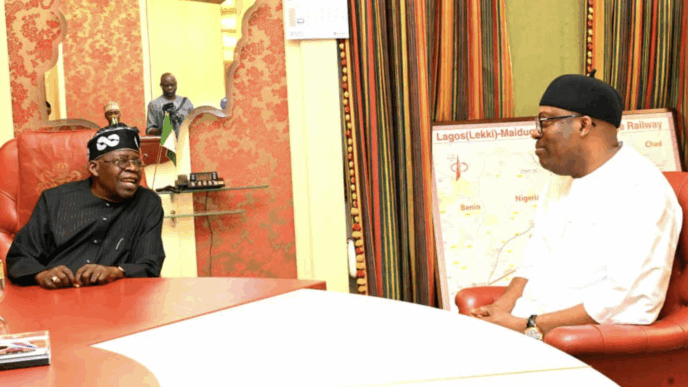

Tajudeen Abbas, speaker of the house of representatives, says the parliament stands behind President Bola Tinubu’s deployment of borrowed funds to transformative projects.

Abbas spoke on Monday at the African Network of Parliamentary Budget Offices (AN-PBO) conference in Abuja.

On September 8, Abbas, represented by Julius Ihonvbere, the house majority leader, said “reckless debt that fuels consumption or corruption must be exposed and rejected”.

Abbas later issued a retraction through a statement by Musa Krishi, his special adviser on media and publicity, clarifying that his remarks were not a call to reject borrowing outright but a call for a responsible approach to debt management — one that ensures borrowed funds deliver real value to Nigerians.

Advertisement

‘REPORTS WERE INACCURATE’

Abbas said the reports created the false impression that parliament opposes Tinubu’s borrowing strategy, describing them as misleading.

“We wish to state clearly that this interpretation is inaccurate and misleading. The 10th house and indeed the national assembly have consistently affirmed that, in the face of pressing developmental needs, strategic and responsible borrowing is an essential fiscal tool,” he said.

Advertisement

“Like every modern economy, Nigeria must sometimes leverage credit to finance critical infrastructure, stimulate growth, and protect vulnerable populations.

“What is important and what the president has assured is that all borrowing remains targeted, transparent, and sustainable, consistent with Nigeria’s medium-term debt strategy and guided by global best practices.”

Abbas said under Tinubu’s leadership, “borrowed funds are being channelled towards transformative projects that will expand revenue-generating capacity, such as power, transport, and agriculture, rather than for consumption”.

He said the house “stands firmly behind the president’s vision of using judicious borrowing as a catalyst for growth and poverty reduction, while simultaneously strengthening oversight mechanisms”.

Advertisement

Abbas said poverty remains widespread in Africa, with an estimated 464 million Africans living in extreme poverty as of 2024.

He said unemployment and underemployment, especially among young people, are urgent issues, and each year, 12 million young Africans enter the labour market, yet only around 3 million formal jobs are created.

Abbas said this opportunity gap highlights a potential demographic dividend that could become a demographic risk if we do not take action.

He said another key challenge facing Africa is revenue leakage through corruption, illicit financial flows, and inefficiency.

Advertisement

Abbas said African countries lose staggering sums that never find their way into development programs.

Citing data from the African Development Bank, Abbas said Africa loses over $587 billion annually to capital flight – money that flees the continent through corruption, illicit trade, mispricing, and profit shifting by multinational corporations, among other channels.

Advertisement

He said corruption is estimated to drain about $148 billion from Africa annually, and other illicit financial flows, such as trade malpractices and smuggling, siphon away additional tens of billions.

“This is money that should be used to build roads in Lagos, equip hospitals in Nairobi, or improve schools in Accra, but instead it vanishes,” he said.

Advertisement

Abbas said the parliament is increasing oversight functions and audit inquiries and strengthening anti-corruption laws.

He said the legislature is revising the fiscal responsibility and finance laws to enhance budgetary discipline and transparency.

Advertisement

Abbas said public accounts committees are being empowered to take decisive action on audit findings, while acknowledging that institutions are only as strong as the people who run them.

“Therefore, we are investing in developing the technical skills of our lawmakers and staff by training them in budget analysis, economics, and accounting so they can more effectively scrutinise government finances,” he said.

“Furthermore, we are strengthening Nigeria’s procurement laws, particularly through the ongoing reforms of the Public Procurement Act, to close loopholes, improve competitive bidding, and increase value for money in public spending.

“Alongside these reforms, anti-graft agencies are being empowered to plug leakages, tackling losses that cost Nigeria an estimated four per cent of its GDP each year.”

Abbas said that to tackle these fiscal and governance challenges effectively, African parliaments must embrace cutting-edge technology and artificial intelligence (AI) as critical reform tools.

He said worldwide, parliaments are already demonstrating how data analytics, machine learning, and digital platforms can transform budget scrutiny and anti-corruption efforts.

Abbas cited Estonia as an example, noting that AI-driven systems in the country streamline procurement oversight and flag irregularities in public contracts before they become scandals.

He said South Korea’s digital budget and accounting system integrates real-time expenditure tracking and has significantly reduced leakages by making every transaction transparent and auditable.

Abbas said Nigeria and its counterparts on the continent can “no longer rely on outdated manual practices that slow oversight and dilute accountability”.

“In our national assembly today, it is still common for committees to request up to 30 printed copies of documents from ministries, departments, and agencies (MDAs) for budget defence or investigative hearings,” he said.

“During sensitive investigations, some agencies have even resorted to deliberately inundating committees with mountains of documents, irrelevant annexes, duplicated files, and technical jargon, designed to confound and obfuscate.

“Over the years, these paper submissions have littered the basement and overflowed every storage space in the national assembly, creating inefficiency, waste, and a physical reminder of outdated processes.”

Abbas said by embracing modern tools, the trend can be reversed, adding that AI-assisted audit software can rapidly scan and analyse thousands of pages of financial records, identifying anomalies or trends that might otherwise be buried.