AI-generated image

Artificial intelligence has become the latest bait in a growing wave of Ponzi schemes targeting Nigerians. In this investigation, The ICIR’s NURUDEEN AKEWUSHOLA uncovers how fraudsters are exploiting the illusion of AI to lure unsuspecting citizens and breathe new life into old Ponzi schemes.

For a long time, Chibuzor David, 28, lived modestly on the proceeds of his small Point of Sale (POS) shop in Ikorodu, a suburb of Nigeria’s commercial city, Lagos. Then his girlfriend introduced him to an investment platform where all he needed to do was deposit money and watch ‘his money work for him’.

The Crypto Bridge Exchange (CBEX), she told him, was an Artificial Intelligence (AI)-powered trading system that promised a 100 per cent return on investment in just 30 days. Tempted, David started with ₦150,000 in February, and as his earnings grew, he kept adding the same amount every week, hoping for bigger profits.

One morning in April, the platform shut down, taking with it 1.3 trillion naira($1.2 billion) in investor funds, including David’s expected 10 million naira profit.

Advertisement

At first, he heard it was only a temporary glitch that would be fixed in no time. However, fixing it was taking longer, and despondency spread from one CBEX WhatsApp group to another. He and other impatient CBEX investors began asking questions, but there were no satisfying answers. Finally, it dawned that they had fallen for a classic Ponzi scheme.

“I was so sad,” he said, but quickly moved on. His girlfriend couldn’t. She had invested way more money in the scheme and was devastated by the loss.

“It was money she really worked hard for,” David explained. “When you’re investing, you think of the time, the energy, and the work you put in to make that money. Losing it like that is painful.”

Advertisement

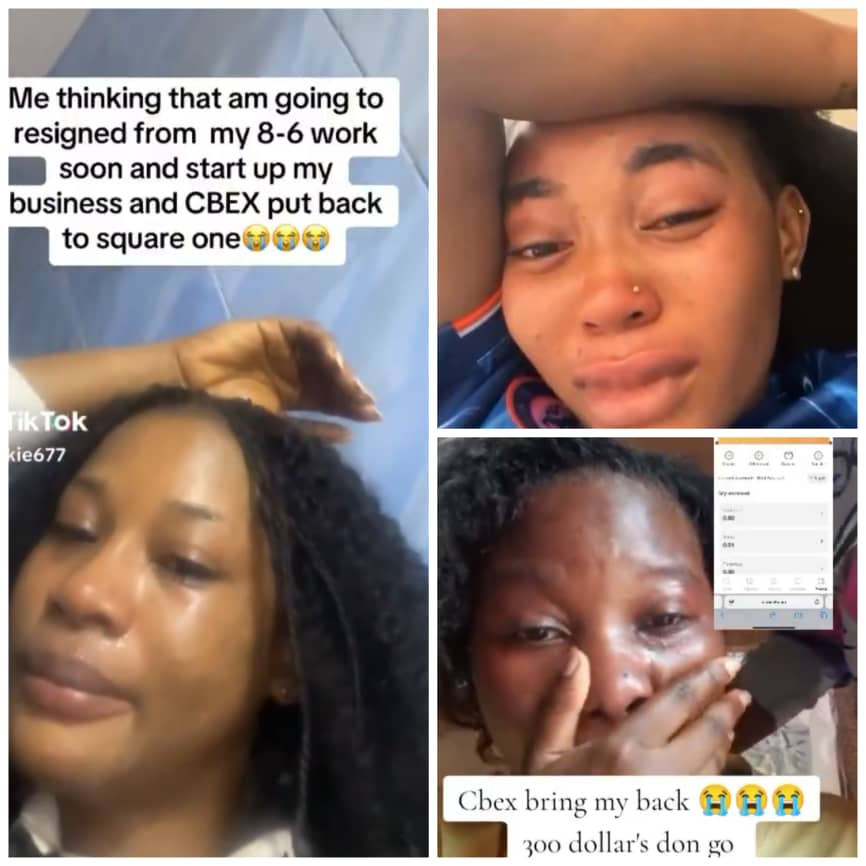

The despair didn’t stop at David and his girlfriend’s doorstep. For days in April, thousands of CBEX investors took to social media to lament. Others wailed on the streets and on social media. In Ibadan, angry investors stormed the CBEX office, destroyed the premises and looted properties.

Drawn into the investment scheme for the daily earnings and impressive 10 per cent referral bonus, they had all invested their life savings, and it has now vanished.

David said he didn’t immediately believe in the scheme, but his girlfriend’s explanation was convincing.

Unlike previous schemes, CBEX had a sophisticated plan, riding on the AI wave and touting itself as using AI for smart trading that guarantees high returns for investors.

Advertisement

The interface of the CBEX app was easy to navigate, he explained. Twice a day – in the afternoon and at night – the platform released notifications on its app and WhatsApp groups for users to log in and participate in simple tasks that looked like games. Once David accepted the instructions, his wallet reflected the profits within 15 to 20 minutes.

“It felt easy,” he said. “You just click, wait, and see the money appear.”

When the scheme collapsed, the organisers resorted to an AI-generated video (archived here) to reassure investors that their money was safe. But it was too late — their modus operandi had already been exposed, authorities had declared it a Ponzi scheme, and a manhunt was underway.

NIGERIA’S EVERGREEN PONZI INDUSTRY

Advertisement

Following the collapse, a familiar conversation began across Nigerian social media forums, newspaper platforms, and breakfast shows about why Ponzi schemes continue to sweep away people’s money.

In the last few years, Nigerians have lost trillions of naira to several fraudulent investment schemes. As one collapses, another one sprouts almost in no time.

Advertisement

Since 2016, when the most notorious Mavrodi Mundial Movement Ponzi scheme (MMM Nigeria) collapsed with N18 billion($12 million), many more like Inksnation, Loom, Racksterli, and Twinkas have emerged and drained millions from the Nigerian masses under the guise of investment schemes.

Although they became popular in the mid-2010s, Ponzi schemes have a long history of scamming Nigerians of their money, and they have strikingly similar tactics: invest and watch your money grow. They also offer mouth-watering referral bonuses, which the schemes always depended on.

Advertisement

For instance, MMM and CBEX offered 10 per cent referral bonuses. To maximise these bonuses, participants often register multiple accounts for themselves using their referral links.

Ponzi schemes are illegal under Nigerian laws. The Investment and Securities Act (ISA) 2025, which repealed the ISA 2007, grants the Securities and Exchange Commission (SEC) oversight powers over digital assets and imposes stiffer penalties on promoters of fraudulent schemes, which include a minimum fine of ₦20 million, a 10-year prison term, or both.

Advertisement

Despite this, enforcement remains reactive. Regulatory agencies such as the SEC and the Economic and Financial Crimes Commission (EFCC) typically intervene only after platforms have collapsed and victims are stranded. But Ponzi operators adapt easily, each time exploiting lax regulations and loopholes in laws. Previous SEC guidelines and arrests over the years have had little deterring effect.

To combat unregistered investment operators and clamp down on Ponzi scheme activities, Director-General of the SEC, Emomotimi Agama, said the SEC plans to launch an Unstructured Supplementary Service Data (USSD) code that will enable Nigerians to verify the authenticity of capital market operators.

“The SEC is leaving no stone unturned in ensuring that Nigerians have the right information to make wise investment decisions,” he said.

Experts said the widespread financial illiteracy, lax regulation, peer pressure, economic hardship, and greed fuel Nigerians’ susceptibility to Ponzi organisations.

With more than 100 million Nigerians living in poverty, according to the National Bureau of Statistics (NBS), conventional routes of economic mobility such as stable jobs, affordable loans, or social safety nets remain out of reach for many.

Ponzi schemes combine aggressive advertising, social media hype, referral incentives, and short-term payouts to build trust before collapsing.

“Any investment in Nigeria that promises to double your money in 30 days, or offers interest rates far above inflation, is a scam,” said Mayowa Tijani, the Director of Projects at TheCable.

Tijani, who is also researching artificial intelligence, noted that this desperation makes Nigerians especially vulnerable to the lure of Ponzi schemes, which promise fast and outsized returns but inevitably end in ruin.

AI ENTERS PONZI GAME

In February, popular Nigerian social media influencer, Ola of Lagos, introduced his over 7 million followers across Facebook, Instagram and TikTok to Squared Options, a new investment platform that promises multiple returns.

“Join @squaredoptions and get VIP signals 100% FREE—but only for a limited time!,” he posted, asking interested users to follow a Telegram group. “No experience? No wahala! There’s a full guide to help you use the signals like a pro.”

The post quickly garnered over 194,000 likes and more than 3,000 comments on Instagram alone.

“My babe don cash out with Ai, stop playing,” Ola claimed.

Unknown to his followers, what Ola of Lagos just introduced them to is another ‘AI-powered’ Ponzi Scheme.

Since AI became a buzzword for smart systems in Nigeria, Ponzi operators have co-opted it into their operations.

In Nigeria, the attraction of “AI” itself is a psychological lever. Many view it as cutting-edge technology associated with innovation and financial opportunity. As a result, orchestrators of Ponzi schemes and their promoters exploit this buzzword, rebranding age-old Ponzi structures as “AI-driven trading,” “AI-powered crypto arbitrage,” or “machine learning wealth platforms.” This language resonates with the aspirations of a digitally curious yet economically vulnerable population.

While many have heard of AI, most do not know how it works or its capabilities. Using this naivety, Ponzi scheme operators have used the AI illusion to create faux credibility for themselves.

The scammers are not necessarily developing groundbreaking AI models; instead, they are repurposing existing generative AI tools to polish their deception, like AI-generated videos of non-existent beneficiaries and the simulation of endorsements by public figures like politicians, journalists and celebrities to lend an illusion of credibility.

In CBEX, for instance, AI-powered dashboards show faux trading simulations and live trading activities using algorithmic precision that convinces subscribers.

INSIDE SQUARED OPTIONS

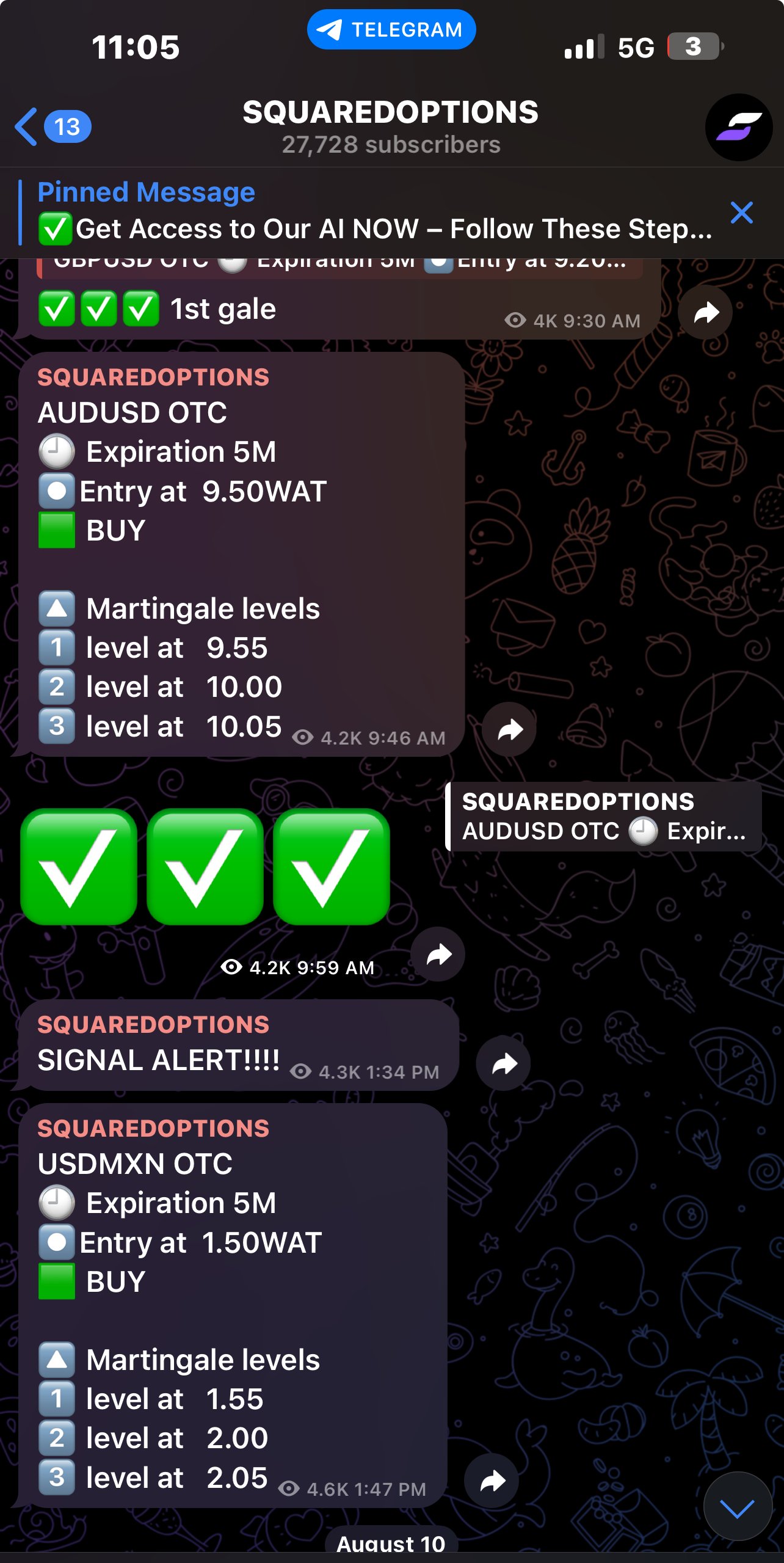

Following Ola of Lagos’s Telegram link, this reporter signed up on the platform to test how the scheme operates.

The group welcomes new users with a bold promise splashed across the page: “Get Access to Our VIP AI – Follow These Steps!”

The first requirement was to open a trading account through a referral link on another platform called IQ Option, after which users were instructed to fund it with a minimum of $20. The deposit, the scheme claimed, would unlock access to another Telegram group where “AI-forwarded trades” would be shared daily.

With $100, investors were told they would gain entry into another site called SquaredOptions.com, complete with live streaming and what the administrators described as the “full AI signal experience.”

At $500 and above, the offers became even more ambitious: SMS alerts, VIP web and Telegram access, and what they marketed as Sync AI — a supposedly automated system that traded on behalf of users. The entire sales pitch revolved around the illusion of artificial intelligence doing the work while investors simply watched their money grow.

Going by Nigerian laws, any company into trading is mandated to register with the SEC. However, SquaredOptions is not listed on the SEC’s Company Verification Portal, created to help members of the public check whether an investment company, fund manager, broker, or capital market operator is registered and licensed to operate legally in Nigeria.

Records obtained from WHOIS, a public database of domain registration information, show that the domain name squaredoptions.com is registered with Namecheap, Inc., a U.S.-based domain registrar headquartered in Los Angeles, California. However, the details of the actual registrant have been hidden through a privacy service provided by Withheld for Privacy ehf, a company based in Reykjavik, Iceland. This layer of anonymity is usually deployed by webmasters to mask the actual individuals or organisations behind a website, in this case, Squared Options.

The records reveal that the domain was only registered on January 24, 2025, and is set to expire in January 2026. The short registration window and the deliberate concealment of ownership details are typical red flags associated with fraudulent online investment platforms.

Meanwhile, platforms like Quotex, Pocket Option and IQ Option, which have been flagged in many countries, including Nigeria, are also involved as brokers in this scheme.

WHEN ‘AI-GENERATED HUMANS’ RUN A COMPANY

In June, a YouTube advertisement launched, targeting Nigerians.

“Good day, Crypto Enthusiasts,” said an AI-generated presenter.

Dressed in a shirt and an overused false ‘African accent’, he encouraged people to join Quantum AI, another AI-powered auto trading tool that helps refine strategies and gain insights.

“This AI trading assistant is an absolute game-changer,” the video said, encouraging viewers to get started with a ₦420,000 deposit.

Quantum AI promises lightning-fast data processing, pattern recognition, and smart trading decisions across assets like cryptocurrencies, stocks, and forex.

According to its creators, Quantum AI is designed for beginners who want an easy-to-use automated trading tool, experienced traders looking for AI-driven insights to refine their strategies and investors who want exposure to multiple markets with minimal effort. Many advisors also posted a video like this one on YouTube advising Nigerians to invest.

The platform claims it can manage real-time market fluctuations with precision, allowing traders to make smarter decisions.

Despite these assurances, it has been linked to several high-profile scams. The Financial Conduct Authority has also flagged the platform. Also, videos and images falsely portraying figures such as Elon Musk have been used to promote it.

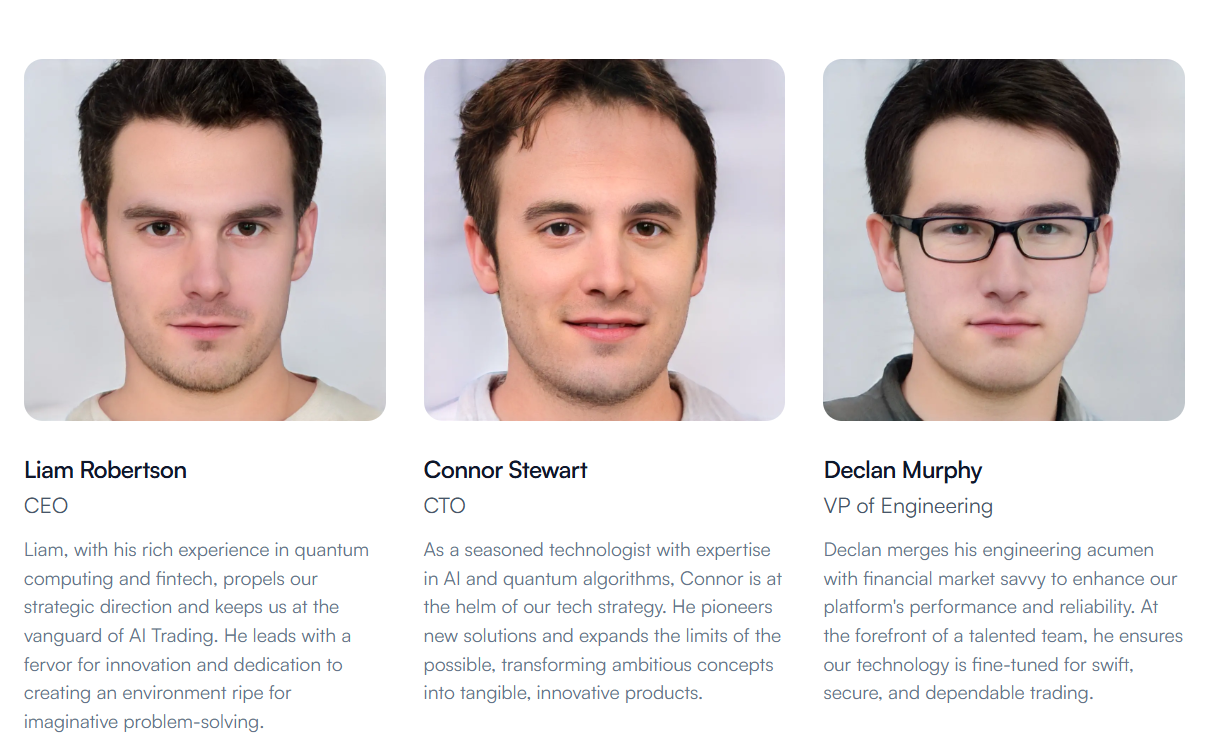

However, the biggest scandal that would turn out is that all members of the team listed on its websites are not real humans. The names, profiles and headshots plastered on the website were AI-generated. This includes the Chief Executive Officer (CEO), Liam Robertson; Chief Technical Officer (CTO), Connor Stewart; and Vice President of Engineering, Declan Murphy.

Many investors had already expressed regret about putting money into the platform before it even reached Nigeria. For instance, a user from Switzerland posted on Reddit under the thread “Quantum AI Trading – Beware!” saying, “This is something I regret doing. Please save your money.”

There are several videos on YouTube which speak well of the platform, but some of them are AI-generated. Comments and the reviews posted by real people on some of the videos confirm the suspicious nature of the platform.

On YouTube, one user wondered why the platform has failed to remove the fraudulent ads.

“Why are these scams allowed to post these fraudulent ads? They should be taken down. Shame on anyone allowing them to play these fake ads and rob vulnerable people. Thank you for sharing this. It is a horrible thing to be scammed for everything.”

THE QUANTUM AI-MODMOUNT TANGO

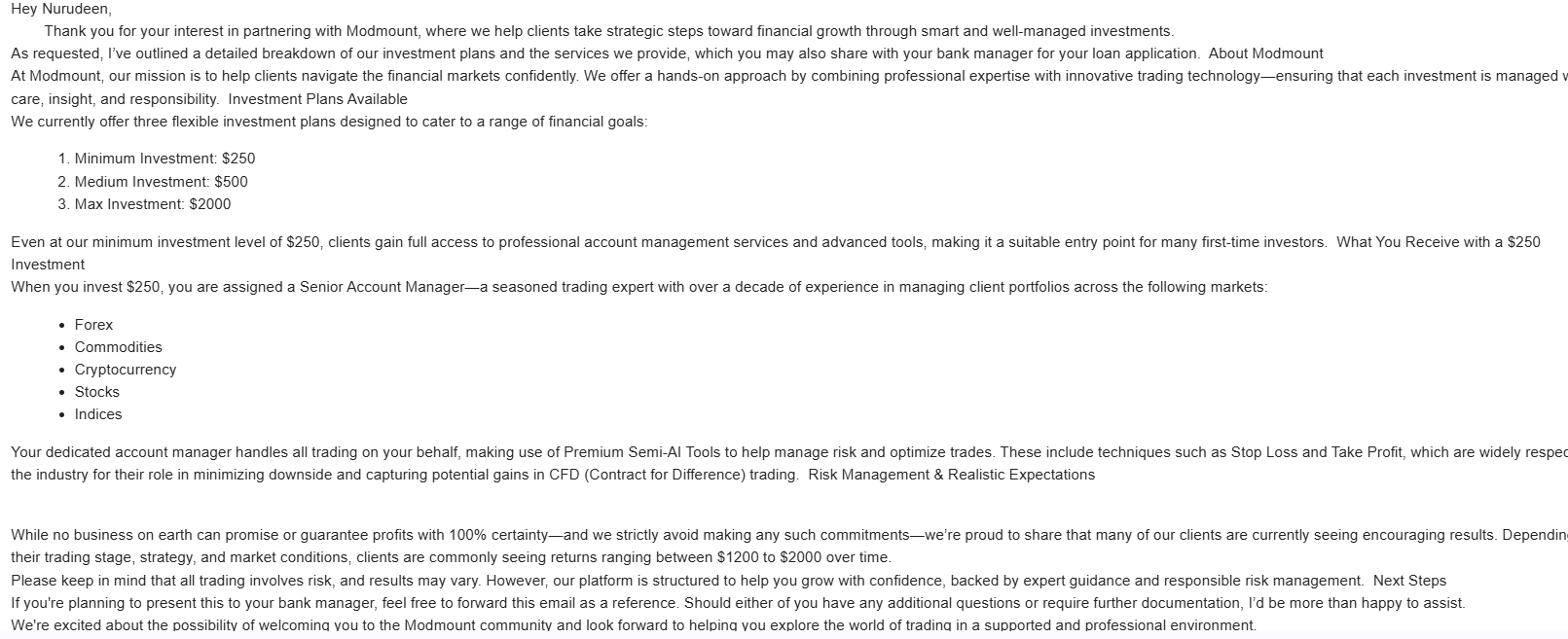

When this reporter followed the link on the Quantum AI advertisement, it led to another AI-driven platform, Modmount Limited.

Shortly after signing up, a man who introduced himself as Shahid Mishwani called and introduced himself as an account officer who would guide this reporter through the registration process. He said the platform works hand in hand with Quantum AI and can turn this reporter into a millionaire. With as little as $250, he said, this reporter could make over $500.

He smooth-talked the reporter, who posed as a student, into believing there’s no guarantee he would secure a job after graduation, offering instead Modmount as a way to financial freedom.

“Your dedicated account manager handles all trading on your behalf, making use of Premium Semi-AI Tools to help manage risk and optimise trades,” Mishwani said in an email sent to this reporter.

However, both Quantum AI and Modmount are fraudulent initiatives. Authorities in Malaysia and the States of Guernsey have warned citizens against investing in the platform.

On Reddit, one victim of their fraudulent activity posted that he lost all he invested despite assurances by an account manager who guided him.

Users have also rated the platform low on Trustpilot, a review website that hosts reviews of thousands of businesses worldwide.

“This platform is proposing unrealistic plans with fake returns to lure investors into investing their hard-earned funds, write to s𝙤𝙩𝙚𝙧𝙞 g𝙪𝙖𝙧𝙙 for recuperation of stolen funds from this scam organisation,” one user, Alex Tang, posted.

On X, one Nigerian, Salaudeen Adio, raised concerns about the platform, asking people to be wary of it.

“It’s camouflaged as a trading platform, but their MOD is something else,” he posted. “Don’t let anyone take your money in the name of trading. CBEX uses the same strategy.”

AI-GENERATED ADVERTS, FALSE ENDORSEMENTS

To target Nigerians, Quantum AI fabricated a post, claiming the charismatic Labour Party’s Presidential Candidate in Nigeria’s last election, Peter Obi has endorsed the platform.

“…Give me 250 dollars, and with the Quantum AI platform I’ll make a million in 12 to 15 weeks,” the platform falsely quoted Obi as saying.

In another false endorsement, Quantum AI falsely claimed that popular podcast host Chude Jideonwo endorsed the platform.

“What’s made me successful is jumping into new opportunities quickly – without any hesitation. And right now, my number one money-maker is a new cryptocurrency auto-trading program called Quantum AI,” they claimed Chude said.

The success of Ponzi schemes in Nigeria has usually been linked to their endorsement by high-profile individuals and influencers. Racksterli scammed Nigerians of billions of naira after popular Afrobeats singer, David Adeleke, also known as Davido, endorsed them. Previously, the Ponzi operators deceived such individuals, paid them or had them on board to get these endorsements.

With AI, these endorsements have become easier to obtain. Orchestrators create convincing videos, audio clips and infographics of public figures seemingly endorsing their platforms. These endorsements circulate widely on WhatsApp groups, Facebook, and TikTok, giving an aura of legitimacy.

For instance, a video surfaced on Facebook in June alleging that a lawmaker, Saliu Mustapha, a Senator representing Kwara Central, endorsed a government-backed financial investment platform during a live television interview.

In the AI-generated video, the voice of Mustapha, a popular philanthropist in Nigeria, was cloned to appear as if he had said the scheme has an AI-powered analytical function, which allows it to predict trends, and subscribers could invest N395,000 to earn N1,580,000 per week.

Despite the video showing Senator Mustapha in what appears to be an interview on Arise TV, analysis of the video shows that it was AI-generated. There were clear signs of digital manipulation, including unnatural facial expressions and a lack of lip movement synchronisation, indicating the use of deepfake technology.

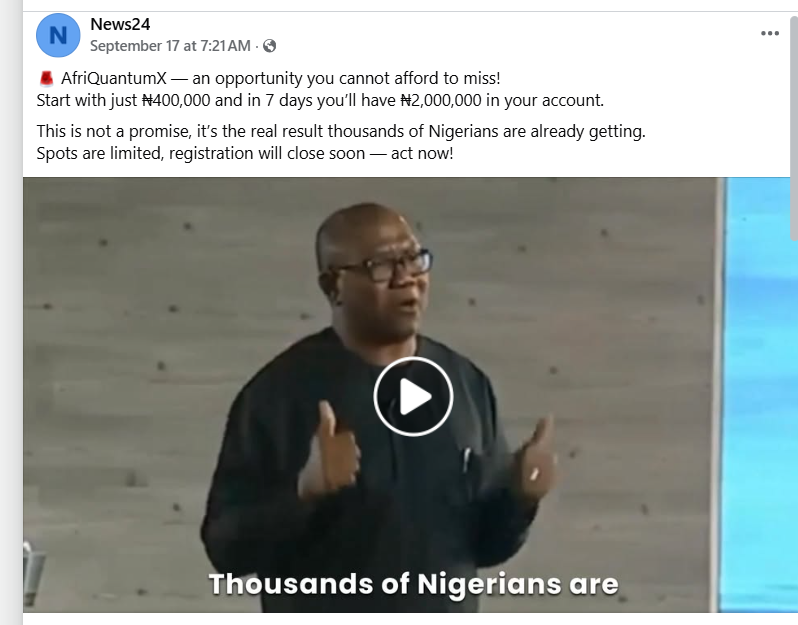

In September, a video showing Peter Obi, presidential candidate of the Labour Party (LP) in the 2023 elections, purportedly advertising an investment platform called “AfriQuantumX”, trended online.

In the video posted by a Facebook page, News24, Obi was seen purportedly telling people to invest in the platform and earn a sum of “N7 million” every month. The former LP presidential candidate reportedly stated that the investment platform was created with his backing and the support of the federal government.

Using the InVID-WeVerify tool, The ICIR extracted keyframes from the video and conducted reverse image searches and the result showed that it was actually Peter Obi’s speech at the May 2017 edition of The Platform Nigeria, a programme organised by The Covenant Nation to debate political, economic, and social issues. This confirmed that the video was doctored, while the supposed investor testimonials, including those of other public figures featured on the AfriQuantumX website, were also AI-generated.

A quick Google search of “AfriQuantumX” revealed that GCB Bank in Ghana had already distanced itself from the platform after its logo was misused in promotional material. In a statement, the bank described the posts as fraudulent, warning the public that the adverts were not linked to GCB, and urging people not to share personal information or transfer funds.

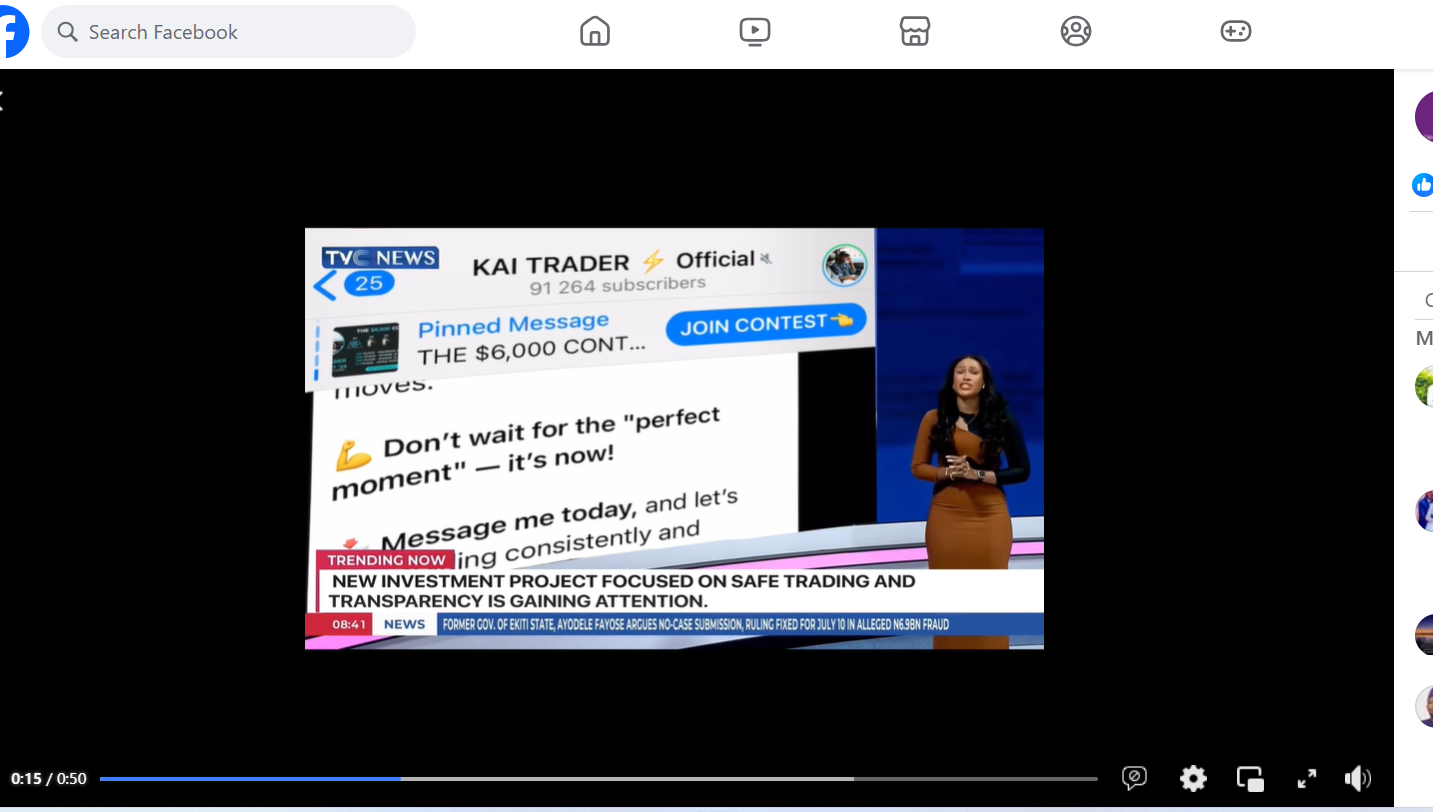

Some weeks after the collapse of CBEX, a Facebook video ad spotted by The ICIR in May (archived here) showed a TVC News anchor endorsing a trading platform, Kai Traders, while using the CBEX platform that had already collapsed months earlier, as an example of why people should trust Kai Traders.

The presenter’s face and voice seemed real, but a closer look revealed signs of an AI generation with unnatural eye movement, misaligned lip-syncing, and distorted transitions between frames. The audio from the video was also extracted and checked on Loccus.ai, an audio tool that looks for specific forensic traces left by voice generators.

The result showed a 99% probability that the audio was generated with an AI tool.

The ICIR identified the presenter to be made to look like TVC news anchor, Olamide Odekunle.

The video, posted on May 22, garnered over 18,000 views. Comments beneath it quickly identified the video as fake and flagged it as a financial scam. Yet, as of September, the post and others mentioned above remained online, unflagged by Meta’s moderation systems.

META, YOUTUBE’S FAILURE IN CURTAILING SCAMS ON ITS PLATFORMS

Adverts promoting suspicious investment platforms like SquaredOptions, Quantum AI investment, Modmount and others are numerous on YouTube despite its Spam, deceptive practices & scams policy, which forbids content that “promises viewers they’ll make money fast” or leads people off-platform to fraudulent or harmful sites. This includes videos that use misleading financial claims.

The platform did not respond when contacted for comment.

Similarly, the deceptive contents mentioned above also violate Meta’s policies, which clearly prohibit the use of manipulated media, especially when such content could mislead users into believing that a person has said or done something they never did.

The company says it removes videos generated by artificial intelligence or other digital tools if they materially deceive users in a way that could cause harm.

Its advertising rules are even stricter, banning “unacceptable business practices” such as scams, deceptive financial promotions, and false claims of guaranteed returns. In theory, this framework should protect users from AI-driven Ponzi schemes and fraudulent endorsements that have become increasingly common across its platforms.

But in practice, enforcement has proven inconsistent. While Meta introduced a global policy in May 2024 to label AI-generated content, many scam videos in Nigeria, such as deepfakes of politicians, fabricated endorsements by TV anchors, have remained live and unflagged.

Even when users identify the content as fake in the comments, moderation systems often fail to act swiftly, allowing thousands of views and engagements to accumulate.

META REACTS, REMOVES AI-GENERATED FRAUDULENT ADS

When The ICIR drew Meta’s attention to the fraudulent ads, the platform said it remains committed to combating scams and misleading advertisements.

“Scammers are relentless and continuously evolve their tactics to try to evade detection, which is why we’re constantly developing new ways to make it harder for scammers to deceive others—including using facial recognition technology,” Meta stated in an email.

After ICIR’s report, Meta confirmed that it removed and disabled all the doctored ads, accounts, and pages flagged during this investigation.

“It’s against our policies to impersonate public figures. We have removed and disabled the ads, accounts, and pages that were shared with us,” the company said.

Experts, however, warn that artificial intelligence continues to tilt the balance in favour of scammers. “AI makes scams harder for ordinary people to spot Ponzi schemes,” said Gondwe Gregory, an Assistant Professor of new media technologies at California State University-San Bernardino.

In Nigeria, where digital literacy is already limited, Gregory noted that the ability to distinguish synthetic media from authentic content is slim. “When you add economic desperation—high unemployment and inflation—people become more likely to believe in ‘miracle’ AI investments. Fraudsters also use AI-powered WhatsApp bots to chat with victims, making their platforms look legitimate and professional,” he added.

To curb the problem, Gregory recommended tighter regulation and stronger public education. He suggested that agencies like the EFCC and SEC should vet any platform advertising AI-driven investments before approval, while public awareness campaigns through radio, schools, churches, and WhatsApp could help citizens recognise red flags such as “guaranteed profits.”

On his part, Tijani observed that scammers are increasingly drawn to AI tools because they make deception look real. “With as little as ₦20,000, fraudsters can now buy cloning apps that mimic people’s voices or appearances, even showing up on live calls as someone else. This makes scams look credible, especially to the untrained eye,” he said.

According to Tijani, the bigger challenge is that society still largely believes what it sees or hears. While early deepfakes were easy to spot, he warned that AI has now made them hyper-realistic. “Even trained eyes may miss the facts now,” he said, stressing the urgency of broad digital literacy programmes.

He urged government agencies to lead awareness efforts, particularly in schools, places of worship, and communities where older and less tech-savvy Nigerians gather.

WHAT ARE NIGERIAN AUTHORITIES DOING?

The Nigerian Government said it would intensify efforts to curb the rise of Ponzi schemes following the monumental losses suffered by many Nigerians to CBEX.

“We are introducing the code system that will allow mobile phone users to verify a capital market operator using USSD codes. They do not require an internet connection to be able to do this, which means any Nigerian with a mobile phone will be able to perform this function,” Director-General of the SEC, Emomotimi Agama, said.

“If anyone comes to you claiming what they are not, all you need to do is check with the code to know the status of their registration,” he added.

Agama emphasised that the recently signed Investment and Securities Act 2025 has introduced stiffer penalties for Ponzi schemes, now referred to as “prohibited schemes.”

He added that the Commission now has the power to take legal action against social media influencers and celebrities who promote such schemes.

AS SEC, META FIDDLE, SCAMMERS’ FIELD DAY CONTINUES

David is now back to his POS business after losing his hard-earned money, but scammers like the ones who defrauded him are at large, already hunting for new victims.

With Meta and YouTube’s regulations failing to spot and remove false investment advertisements and the Nigerian government’s failure to act proactively, thousands of Nigerians like David are susceptible to several fraudulent investment platforms springing up almost daily.

This story was supported by the Pulitzer Center.