With the latest data from the advisory power team in the office of Vice-President Yemi Osinbajo revealing that the power sector lost a total of N530 billion in 2018, the industry is set to experience tougher times in 2019.

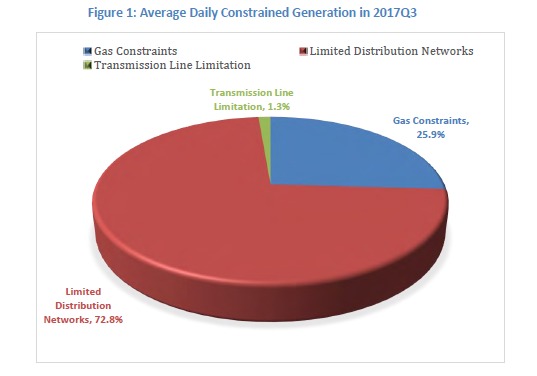

Operational constraints from the shortage of gas, poor transmission, weak distribution network, and water reserves factor have become permanent issues to reckon with in the sector.

Suffice it to say that the power sector is the wheel upon which the economy revolves; hence, the survival of other sectors of the economy depends on its performance. But recent data shows that power generation keeps plunging as power firms are battling a myriad of challenges to stay afloat.

POWER GENERATION DECLINES IN TWELVE MONTHS

When the Nigerian Electricity Regulatory Commission (NERC) released its quarterly report for the sector in 2018, it noted that the total electricity generated for the first quarter was 8,511,481 megawatts/hour – 2% less than the 8,705,606MWh generation recorded in the last quarter of 2017.

Advertisement

“With the decrease in generation, not surprisingly, the average utilization rate of the total available generation capacity declined by 1.1% from 54.4% recorded in the last quarter of 2017,” the report said.

With the release of the 2018 second-quarter report, the total electric energy generated was 8,350,174 MWh – 1.9% less than the level of generation in the first quarter.

Again, the commission noted that the utilisation of the total available generation capacity declined by 2.6% due to insufficient gas supply, limited transmission line, poor distribution networks and water management at the hydropower stations.

Advertisement

The recently released third-quarter report showed a further decline in power generation, as the total energy generated stood at 8,077,483 MWh – 3.3% less than the level of generation in the second quarter.

POWER GENERATION SET FOR FURTHER DECLINE AS N701 BILLION FUND EXPIRES

On March 1, 2017, the federal government approved the sum of N701 billion as power assurance guarantee fund for the Nigerian Bulk Electricity Trader (NBET) to pay for the electricity produced by the generation companies (GenCos) to the national grid for the period of two years starting from January 2017 to December, 2018.

The fund was geared towards tackling the monthly liquidity challenges faced by GenCos, as the distribution companies (DisCos) keep defaulting in paying for the monthly invoice of electricity received.

In the third quarter of 2018, the 11 DisCos were issued a total invoice of N162.5 billion for energy received from NBET, but they only paid a sum of N54.1 billion, creating a significant deficit of N108.4 billion.

Advertisement

On the other hand, the DisCos, at a press conference in July 2018, insisted that they cannot pay up their debts until the federal government addresses the tariff gap which has left a shortfall of more than N1.3 trillion on their financial books.

With the exhaustion of the payment assurance fund in December 2018 as earmarked, the GenCos are calling for an effective payment security and guarantees to cover their exposure to the market, lest they close their plants.

In a chat with TheCable, Joy Ogaji, executive secretary of the Association of Power Generation Companies (APGC), the umbrella body for the GenCos, said the implication of the exhaustion of the fund to power generation is indescribable as a number of gas suppliers have started shutting off supply to about four GenCos due to lack of clear payment plan for 2019.

Ogaji added that the exhaustion will, in addition, bring about high market liquidity squeeze, leading to GenCos inability to fund their operations, acquire spare parts and equipment for the power generation stations.

Advertisement

“Effective payment security and sovereign guarantee is inevitable to stabilize the Nigerian Electricity Supply Industry (NESI), given the current developmental stage of the electricity market and the default rate of GenCos in respect of their loan repayment obligations to their lenders,” she said.

“Without such instruments and the required sovereign backing, it becomes impossible for any bank or financial institution to provide any funding or credit accommodation to any GenCo, yet there is an obvious need for substantial additional investments and funding to develop the NESI and put the electricity market on the right growth trajectory.

Advertisement

“The foregoing makes it explicit that the GenCos are not threatening or constituting themselves as economic saboteurs via shutting down of their stations, but the forces of demand and supply imposed on them are making it inevitable for the units to shut down.”

GENCOS’ THREATEN TO SHUT DOWN POWER PLANTS AS SHORTFALL EXCEED N1 TRILLION

As things stand, nationwide blackout looms as the generation companies have threatened to shut down their plants over the unresolved challenges they are battling with. The liquidity challenge facing the GenCos has metamorphosed to a shortfall exceeding N1 trillion.

Advertisement

In August 2018, the GenCos said their were going to shut down over the inability of the Transmission Company of Nigeria (TCN) to transmit available volume of electricity generated into the national grid.

Ogaji said the TCN could only transmit an average of 3,985.15 megawatts, 53 percent of the available capacity of 7,484.88 megawatts produced daily. She added that operating the plants outside baseload conditions is leading to a reduction in efficiency, with implications for an increase in consumption of gas for thermal plants by as much as 15 to 20 per cent (extra cost not recognised by the Nigerian Bulk Electricity Trading (NBET) nor captured in the Multi-Year Tariff Order (MYTO).

Advertisement

Last week, the GenCos again threatened to shut the power plants across the country as gas supply is being cut off due to their inability to pay for the product.

As long as the challenges in power generation and weak distribution are not being addressed, the country is set to experience more decline in electricity supply in 2019. But the most salient question close observers have been asking is why the federal government keeps pumping billions of naira in palliatives or interventions after it privatised the sector in 2013.