When President Bola Tinubu assumed office on May 29, 2023, he embarked on a reform spree that excited global stakeholders. The petrol subsidy was halted, and the naira was floated.

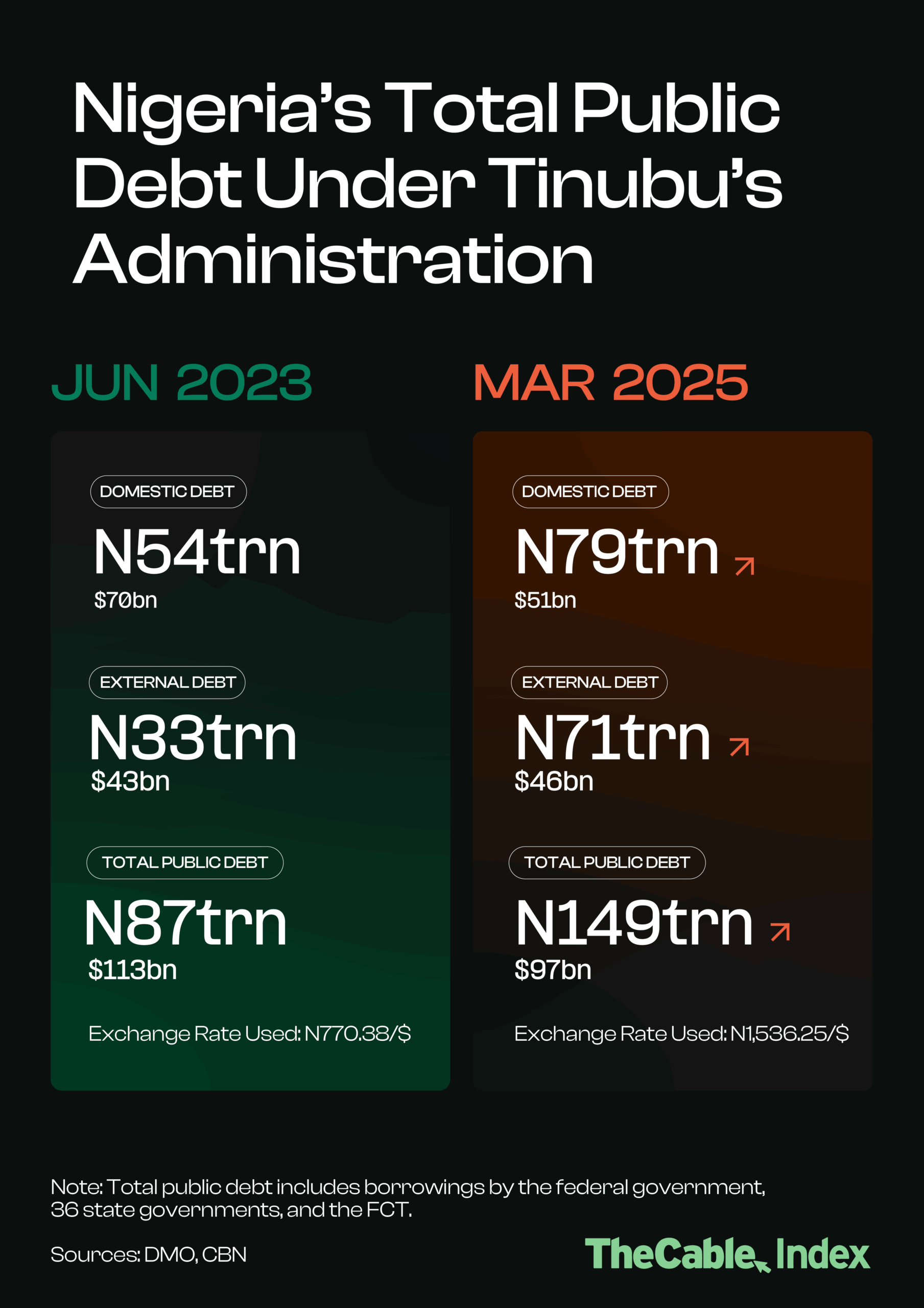

By June 30, 2023, Nigeria’s total public debt stood at $113.42 billion, according to data from the Debt Management Office (DMO). Fast-forward to March 31, 2025, the figure stood at $97.24 billion.

A cursory glance may reveal a $16.18 billion decline in less than two years. However, a closer examination reveals a different narrative that links Nigeria’s decreased public debt to the collapse of the naira — not to actual repayment or reduced borrowing.

In June 2023, the DMO used an official exchange (FX) rate of N770.38 to the dollar, as fixed by the Central Bank of Nigeria (CBN) on June 30. By March 2025, that figure had more than doubled to N1,536.25.

Advertisement

The local currency’s devaluation, caused by the CBN’s transition to a new FX market system, means naira-denominated debt now appears smaller in dollar terms.

HOW NIGERIA’S DEBT IS CALCULATED

Nigeria’s total public debt portfolio, published quarterly by the DMO, comprises the combined debt of the federal government, the 36 state governments, and the federal capital territory (FCT).

Advertisement

It also comprises both external debt (borrowed from foreign lenders and denominated in dollars) and domestic debt (borrowed in naira from local banks, pension funds, and capital markets).

While foreign debt is denominated in dollar terms, the DMO converts domestic debt to its dollar equivalent using the CBN’s official FX rate at the end of every quarter.

The implication is that any significant shift in the FX rate directly affects the domestic debt size in dollar terms, even if naira borrowing increases.

As of June 2023, Nigeria’s domestic debt stood at N54.13 trillion (equivalent to $70.26 billion), while external debt was $43.16 billion (N33.25 trillion), bringing total public debt to $113.42 billion (N87.38 trillion) at an FX rate of N770.38/$.

Advertisement

By March 2025, the domestic debt had risen to N78.76 trillion ($51.26 billion), external debt increased slightly to $45.98 billion (N70.63 trillion), totalling $97.24 billion (N149.39 trillion) public debt, calculated based on a weaker FX rate of N1,536.25/$.

It can be seen from the above that while naira-denominated debt rose sharply (from N87.38 trillion to N149.39 trillion), the total dollar figure decreased — showing the impact of the FX rate on Nigeria’s debt profile narrative.

The analysis by TheCableIndex also shows that Nigeria is borrowing more in naira, but a weaker currency makes the debt stock appear smaller in dollar terms.

THE UPSIDES AND DOWNSIDES OF TINUBU’S REFORMS

Advertisement

Experts believe Tinubu inherited a fragile fiscal landscape. Nigeria’s public debt had ballooned under previous administrations, especially during former President Muhammadu Buhari’s government.

Advertisement

Heavy reliance on borrowing and declining oil revenues pushed the country’s debt profile to record highs. The petrol subsidy and multiple FX rates further put pressure on the economy.

Tinubu’s response was immediate: the subsidy was removed, and the FX market was liberalised, allowing market forces to determine rates. The CBN also began clearing the FX backlog obligations to restore investor confidence.

Advertisement

Though the World Bank and the International Monetary Fund (IMF) applauded the policies, they also came with downsides, one of which is the impact of the FX rate on the country’s debt.

Ademola Oshodi, senior special assistant to the president on foreign affairs and protocol, said the president’s policies have been fruitful.

Advertisement

Under the current administration, according to Oshodi, foreign policy has become a tool for economic repair.

“The Tinubu administration’s bold reforms and high-level diplomacy have also translated to macroeconomic and foreign exchange stability and debt clearance,” he said.

“Strategic negotiations with the IMF and Afreximbank demonstrate how foreign policy was used to restore macroeconomic confidence and stabilise the currency, laying the groundwork for growth.

“The tangible result of this is over $10 billion in FX debt cleared, and foreign reserves rising from $3.99bn to $23.11bn.”

However, former Vice-President Atiku Abubakar had accused the government of favouring the wealthy while subjecting poor Nigerians to hardship through its policies.

Abubakar said the government has “deepened poverty across the country” and “set new records in wasteful public spending”.

“At a time when millions of Nigerians struggle to survive, government officials are living in excess and approving budgets that benefit the elite at the expense of the common man,” he said.

He added that beyond being the poverty capital of the world, Nigeria has, under the current administration, taken the “unenviable position of having the highest number of malnourished children in Africa, surpassing even war-torn Sudan”.

He cited the 2024 Global Hunger Index, which ranks Nigeria 18th among countries most affected by hunger and malnutrition.

“Policy after policy under this administration has targeted the poor while providing relief and advantage to the rich,” he said.

“From healthcare to education to identity management and basic public services, Nigerians are now faced with class-based systems where the wealthy enjoy VIP treatment, and the rest are left behind.”

THE DEBT-TO-GDP RATIO

The debt-to-gross domestic product (GDP) ratio is one way to assess debt sustainability. It is a key metric that compares a country’s total public debt to its GDP, measuring the nation’s repayment capacity.

In Q2 2023, Nigeria’s debt-to-GDP ratio jumped to 41.15 percent from 24.3 percent in Q1 2023, according to the CBN. The regulator attributed the sharp increase to the inclusion of the N22.7 trillion ways and means loan in the public debt stock.

Since the National Bureau of Statistics (NBS) is yet to release GDP figures for Q1 2025 due to the ongoing rebasing exercise, an estimate can be drawn using the most recent full-year data.

Based on Nigeria’s 2024 nominal GDP of N269.29 trillion and total public debt of N149.39 trillion as of March 2025, the debt-to-GDP ratio is estimated at 55.48 percent currently.

‘GLOBAL DEBT TO EXCEED $100TRN’

Meanwhile, the IMF has raised concerns over rising global public debt, projecting that it will exceed $100 trillion, or approximately 93 percent of global GDP, by the end of 2025.

In its Fiscal Monitor Report released in 2024, the global lender warned that debt “will approach 100 percent of GDP by 2030.”

“This is 10 percentage points of GDP above 2019, that is, before the pandemic,” the IMF said.

The report noted that while debt trajectories vary by country, the overall trend remains concerning.

“While the picture is not homogeneous—public debt is expected to stabilize or decline for two-thirds of countries—the October 2024 Fiscal Monitor shows that future debt levels could be even higher than projected….”

The IMF advised governments to confront debt risks early, through carefully designed fiscal policies that safeguard economic growth and protect vulnerable households while taking advantage of the ongoing global monetary policy easing cycle.