The Central Bank of Nigeria (CBN) says it is implementing reforms to strengthen the financial system, deepen inclusion, and stimulate productivity across key sectors of the economy.

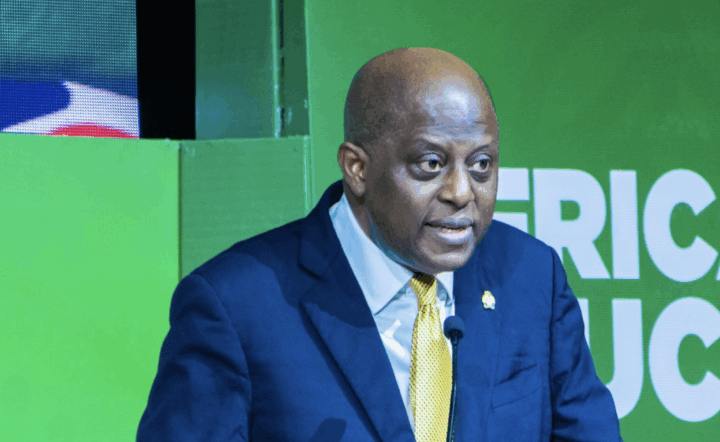

Olayemi Cardoso, governor of the apex bank, spoke on Tuesday at the CBN fair in Kano.

The event was themed ‘Driving Alternative Payment Channels as Tools for Financial Inclusion, Growth and Accelerated Economic Development’.

Cardoso, represented by Hakama Sidi, acting director, corporate communications department, said the bank is focused on promoting macroeconomic resilience through banking recapitalisation, foreign exchange (FX) market reforms, and measures to unify rates, improve transparency, and attract investment.

Advertisement

“We are working hard to deepen financial inclusion and sustain monetary and price stability,” he said.

“The role of SMEs and other key sectors in economic growth cannot be ignored.”

The CBN governor listed other initiatives to include catalysing specialised financial institutions, developing new regulatory frameworks, enhancing payment systems, and de-risking credit in housing, food, and healthcare to unlock growth opportunities.

Advertisement

Cardoso said the apex bank had also launched the Nigeria Payments System Vision (PSV) 2028 to accelerate digital transformation, alongside the unified complaints tracking system (UCTS) and a USSD code (*959#) for verifying licensed institutions.

“These measures are designed to protect customers, boost confidence in the financial sector, and expand access to services,” he added.

The governor further urged Nigerians to respect the naira by avoiding acts such as spraying, hawking, mutilation, and counterfeiting, describing the currency as “a vital national symbol”.

On his part, Aliyu Abubakar, acting divisional head of other financial institutions at the CBN in Kano, said microfinance banks play a critical role globally as alternatives for those excluded from commercial banking services.

Advertisement

“Those who cannot obtain services from commercial banks have only one alternative, the microfinance banks,” Abubakar said.

Salihu Umar, president of the Association of Mobile Money Operators of Nigeria (AMMON), commended the CBN for convening the fair, saying it provides a platform to showcase alternative payment solutions and drive inclusion.

According to Umar, expanding access to financial services, especially for underserved communities, will contribute significantly to Nigeria’s overall economic growth.

Advertisement