From April, banks will charge N4m on every N40m cash withdrawal

The Central Bank of Nigeria (CBN) has announced that charges on deposits will be re-introduced.

In a circular released on its website, the apex bank said the decision was made at the 493rd bankers committee meeting that held on February 8.

The apex bank also said it would extend its cashless policy to the remaining 30 states.

“Please be informed that the bankers committee at its 493rd meeting held on February 8 reviewed the cashless policy charges on withdrawal and deposit and decided that the policy be extended to the 30 remaining states of the federation,” the circular read.

For individuals, deposits ranging from N500,000 to N1 million will attract a 1.5% charge, while withdrawals within the range would attract 2% charge.

Deposits of amounts above N1m to N5m will attract 2% and withdrawals will attract 3% charge. Deposits and withdrawals above N5m will attract 3% and 7.5% charge respectively. In the corporate category, deposits and withdrawals below N3m will not attract charges.

Deposits and withdrawals between N3m and N10m will attract 2% and 5% respectively, while deposits and withdrawals between N10m and N40m will attract 3% and 7.5% respectively. Deposits and withdrawals above N40m will attract 5% and 10% respectively.

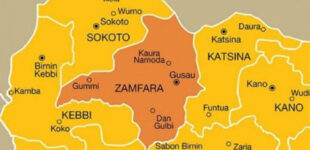

“The new charges would take effect from April 1 in the existing cashless states (Lagos, Ogun, Kano, Abia, Anambra, Rivers and the FCT). The policy shall be implemented with the charges taking effect on May 1 in the following states: Bauchi, Bayelsa, Delta, Enugu, Gombe, Imo, Kaduna, Ondo, Osun and Plateau,” the circular read.

“The policy shall be implemented with the charges taking effect on August 1 in Edo, Katsina, Jigawa, Niger, Oyo, Adamawa, Akwa-Ibom, Ebonyi, Taraba and Nasarawa. The policy shall be implemented with the charges taking effect on October 1 in Borno, Benue, Ekiti, Cross-River, Kebbi, Kogi, Kwara, Yobe, Sokoto and Zamfara.”

CBN said the income generated from the charges would be shared between it and the banks in a ratio of 40:60.

It said exemptions would only be available for the government, embassies, diplomatic missions and aid donor agencies.

How reasonabe is it? Is this one of the methords for devaluation of Naira which will lead to overivoicing budget padding etc. Anyway people will resolve to keeping their mńeys away fr om banks

The idea is to discourage people from carrying large amounts of cash around. There are alternative means of paying for goods and services without necessarily using cash…

My brother, there is nothing wrong with CBN promulgating polices. i give the kudos for doing such. But when when such policies provide canopies under which looting thrives, every thing becomes wrong. Also, such policies negate the ideals of Change as preached by the present government. To me, policies that encourage or legalize looting are anti-people and should be reviewed to reflect the ideals of this present government or conveniently deposited in the garbage bin.

sometime i wonder what type of policies this government are put in place, are they helping the people or trying to exploit them through various means. why will you exempt government,embassies,diplomatic and aid donor agencies. what do you expect cooperate organisation to do, that mean the cashless system is about to be stop. people will start working with cash . they are just doing try and error with policies in this economy.

You make laws that guide and make people’s lives better. You make laws that help build the nation, not stifle the man who has made N500k or 1m. Honestly. Honestly. If, this is truly A Federal government. Please, Change that thing. This is a democratic land. Government of the people. By the people and for the people. This “policy” will & does not represent the bulk of Nigerians interests. This “policy” makes it look as though it’s a crime to be a hard worker. I hope, cost of living will not raise because of deductions to be made. I hope the CBN have actually tried to “anticipate” the immediate effects of this policy.

Kindly of law is dis CBN STOP STEALING FROM NIGERIA ARE STILL STRUGGLING AND YOU MAKE A POLICY THAT HOT MIDDLE CLASS OF NIGERIA.

V wrong government bank policy. Anti-the poor. It must b stopped. When will dis government start working wt d poor in mind, fr God’s sake? Too bad!

Policy…policy…policy…. This is a good avenue for the government looters to keep their money with d banks…knowing well that he preferred the %tage is deducted and remaining funds is intact in the bank for him…the banks chiefs also take their own cut of the looted fund for keeping it for them….meanwhile,cashless is a good thing but I don’t it will favour lower and middle class because of the %tage…if u deposit…u will pay and if you withdraw…u will pay…till today #50 is been deducted on every cash deposit u make…what will happen to that market women that make up to 500 and 1million everyday on their business… Dey will be fear to keep in banks just because of charges….let the government think very well before people will start removing money from banks and keep in a soak away..