The Central Bank of Nigeria (CBN) has urged the public to protect the dignity of the naira.

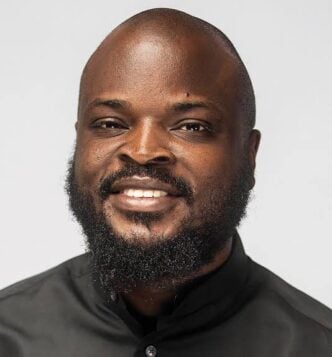

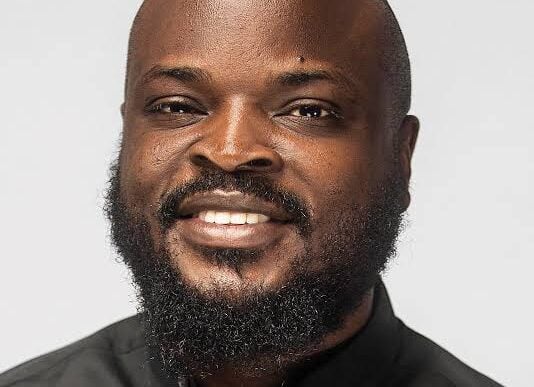

Hakama Sidi-Ali, acting director of the CBN’s corporate communications department, spoke during its currency education and financial inclusion campaign to residents of Lagos on Tuesday.

The sensitisation exercise, called CBN Fair, was themed ‘Driving Alternative Payment Channels as Tools for Financial Inclusion, Growth and Accelerated Economic Development’.

The event brought together entrepreneurs, financial institutions, fintech operators, consumer protection agencies, market leaders, students, and youth groups.

Advertisement

Speaking at the forum, Sidi-Ali said the fair was designed to create direct engagement between the bank and stakeholders on policies that drive sustainable growth.

She said the Olayemi Cardoso-led CBN remained committed to stimulating productivity, promoting financial inclusion, and ensuring monetary and price stability.

“Our core objective is to sensitise members of the public on how the bank’s policies and innovations can enhance their lives and livelihoods,” Sidi-Ali said.

Advertisement

“We also urge you to preserve the dignity of our currency by avoiding abuse, do not spray, hawk, mutilate, or counterfeit the naira. Respect and keep it clean.”

Paul Onuoha of the CBN’s currency operations department took participants through an interactive session on identifying counterfeit notes and the security features of the naira.

“Naira is one of the strongest currencies in the world when it comes to security features,” he said.

Sunday Daibo, branch controller of the CBN in Lagos, said the fair was more than an exhibition of initiatives, describing it as “a celebration of our collective commitment to economic stability, financial inclusion, and national development”.

Advertisement

He noted that technology was redefining financial services and that alternative payment channels had become vital tools for connecting underserved populations to the formal financial system.

“Let this fair be a launchpad for initiatives that will carry the benefits of alternative payment channels to every corner of our nation,” Daibo said.

Ayodeji Ojo, CBN’s other financial institutions (OFI) supervision department, explained how the unit protects savings, promotes access to credit, reduces financial exclusion, and strengthens public trust in licensed institutions.

“What we are saying is that our banks are now stronger,” he said.

Advertisement

Other speakers discussed open banking, payment system innovations, and the role of a strong naira in attracting investment and fostering a vibrant economy.

Advertisement