The Central Bank of Nigeria’s Monetary Policy Committee (MPC) was split in its decision to retain monetary interest rates at 12%, forcing an analyst to describe it as “hawkish”.

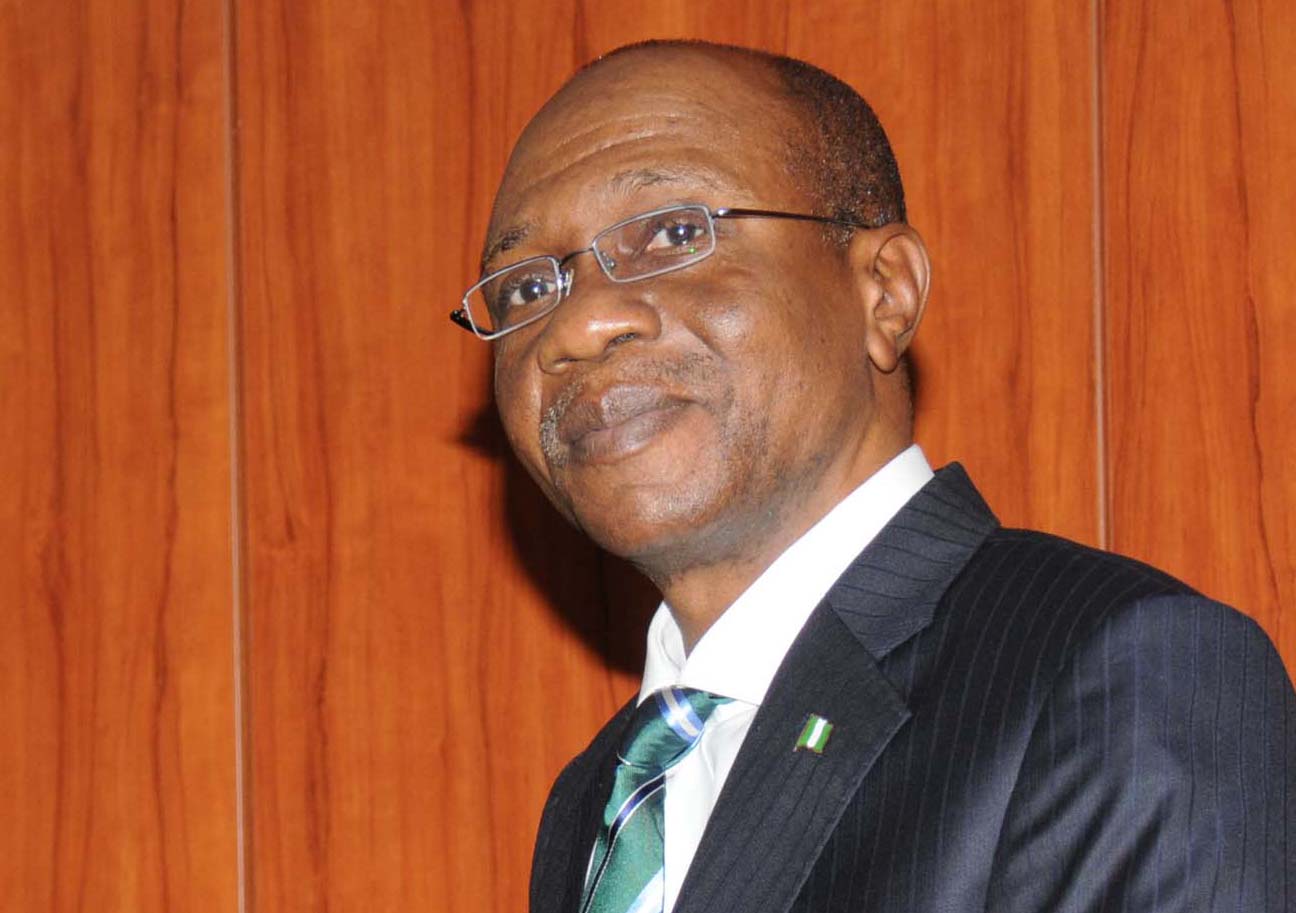

CBN Governor Godwin Emefiele (pictured) said the 12-member committee was divided in reaching a decision on the sustained interest rate.

While six members voted to retain the current stance of the policy, five voted for an increase while one member voted for an asymmetric move.

The MPC also held on to the Cash Reserve Ratio (CRR) for private sector and the public sector at 15% and 75% respectively.

Advertisement

However, head of Africa research at Standard Chartered in London, Razia Khan, said the decision itself poses “an unexpectedly hawkish stance” for the market and there may have been a drop in the standing deposit facility rate.

Commenting on the nature of the voting pattern, Khan said the meeting that precedes the final decision tells how the CBN is likely to be influenced if the current pressures that are only just starting to emerge actually worsen.

These pressures include weaker oil earnings (with both price and output contributing), global factors such as federal policy normalisation and the influence on investors putting new money into Nigeria, and also – significantly – domestic liquidity pressures.

Advertisement

While Khan admitted that the reason for the split is not obvious, she said until a more detailed individual policy statements from MPC member is released to shed more light on the issue, the reason will never be known as to why the MPC made the decision to retain the current interest rate.

Meanwhile, Emefiele expressed the committee’s satisfaction with the relative stability in the Nigerian economy and stated the risks that lay ahead.

He said “the key risks include the possibility of capital reversals as the Fed’s Quantitative Easing in the U.S. finally ends in October amid dwindling oil output, declining oil prices, domestic security challenges and upward trending headline inflation.”

The CBN governor said the oil sector grew by 5.14% in second quarter of 2014, a marked reversal from the decline recorded in the preceding four quarters.

Advertisement

He, however, expressed happiness on efforts made by government to curtail vandalism of oil facilities and crude theft in the Niger Delta region.

Emefiele reiterated the committee’s commitment to continue to support the efforts, in addition to facilitating other measures, aimed at promoting inclusive non-inflationary growth.

He said the committee noted the continued resilience of the economy as real Gross Domestic Product (GDP) grew by 6.54% in the second quarter of 2014 compared with 5.40% in the corresponding quarter of 2013.

According to him, the observed growth rate also surpassed the 6.21% recorded in the first quarter of 2014.

Advertisement

“The non-oil sector remained the main driver of growth, recording 6.71 per cent in the second quarter of 2014.

“This is lower than the 8.21% and 8.88% recorded in first quarter, 2014 and the corresponding quarter of 2013, respectively,’’ the CBN governor said.

Advertisement

He said the decline in growth of non-oil GDP was traced to the decline in agricultural output, construction, trade and services relative to the levels recorded in the first quarter of 2014.

Emefiele said the slowdown in agricultural output was attributed to the insurgency activities in the North Eastern axis and some parts of the North Central states.

Advertisement

According to him, the insurgency led to displacement of farming communities, thereby limiting agricultural activities and, hence, output from that region.

The CBN boss said growth in the services and industry sectors remained relatively stable compared with the corresponding period in 2013.

Advertisement

He said the committee commended the efforts by government to address some of the constraints and risks to economic activity such as insurgency in the north-east and the Ebola Virus Disease epidemic.

He added that the committee further expressed concern about high banking system liquidity and its potential effects on inflation and the exchange rate.

“The Committee notes that the policy challenges will include sustaining the stability of the naira exchange rate, managing the vulnerability to capital flow reversal and building fiscal buffers to insure against global shocks.

“The challanges also include managing inflation and exchange rate expectations and safeguarding the financial system stability, as well as a buildup in election-related spending.”

The committee, Emefiele said, also noted that as progress was made in these areas and in respect of other constraints like power and improving SME financing, the outlook for growth appeared bright and prospects for upward price pressure would be moderated.

He said the committee further noted that the restrictive stance of monetary policy provided important defences against structural liquidity in the banking system.

He reaffirmed the committee’s willingness to play a key role in managing expectations around exchange rate and inflation vulnerabilities.

“Consequently, adequate consideration will need to be accorded to the goal of reining-in banking system liquidity to safeguard the objective of price stability,’’ he said.

Emefiele said the committee expressed concern that banks were holding large excess reserves averaging over N300 billion even when there were ample opportunities for productive and profitable lending to the real sector of the economy.

“The concern was further strengthened by the reality of injecting an additional N866 billion into the system through the redemption of maturing Asset Management Corporation of Nigeria (AMCON) bonds in October.

“Given the apathy to lending, banks may be inclined more to placing these new funds in the SDF or use it to increase pressure on the exchange rate.

“The committee advised the CBN to explore ways of encouraging banks to lend such excess reserves to the real sector.”