Global Markets: The US Stock markets took a hit on Tuesday as the vulnerability from the Shanghai Composite Index dispersed into the US trading session. With manufacturing data in China falling to a three-year low, market participants received confirmation that the nation was in a period of deceleration and this weighed on investor sentiment throughout the global markets.

The weak US manufacturing PMI combined with the events of China translated into temporary USD weakness. Saying that, the USD has recovered some of its momentum during the overnight Asian session. The US economy needs an impressive NFP result this Friday to strengthen the data on which a US rate hike taking place by the end of the current year is dependent.

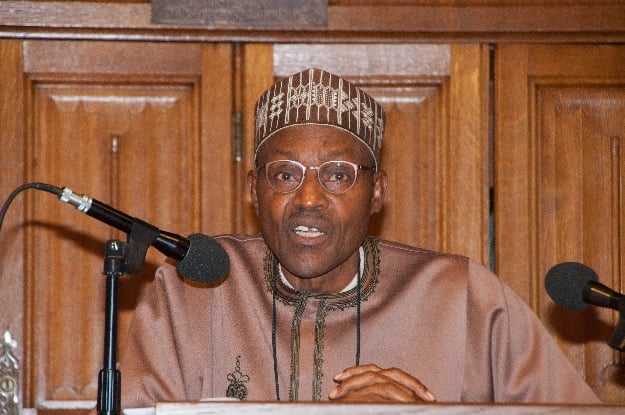

WTI has experienced a hefty decline over the past 24 hours. The gains following the unexpected comments from OPEC regarding finding a fair price for suppliers were looked upon positively by market participants, but they were later erased. Investors might begin to monitor the news from Nigeria, where two major pipelines have been shut down over the last week for clues on how this could impact the oversupply in the markets. From a technical standpoint, WTI has experienced an engulfment on the daily timeframe thus re-entering bearish territory. The events of China and appreciation of the USD appear to have put a limit on how high WTI can rally.

Although the GBP was previously unaffected by the global market events, it has taken a serious hit over the past couple of days. Even though the United Kingdom has a minor trading relationship with China, the increased financial volatility and risk-off trading environment have added bearish pressure onto the GBP. The GBPUSD is looking very weak technically and has recently extended below its 50, 100 and 200 MA. Investor sentiment towards the pair is clearly weak and although the UK economic outlook remains robust, external factors such as the risk-off environment can lead to further losses.

Advertisement

Gold continues to range in the background with some of the momentum of its safe-haven attraction looking weak. The events of last week saw the precious metal sold off, whilst other safe haven currencies like the JPY and an unexpected EUR are in demand. Fundamentally Gold still remains bearish simply because of the low inflation expectations and continual speculation that the FED will begin tightening monetary policy before the end of 2015.

EURGBP

The current weakness within the GBP has given an opportunity for the EURGBP bulls to surge. This pair is technically bullish on the daily timeframe because lagging indicators such as the 20 SMA and MACD point to the upside. Yesterday’s session offered a break above the 0.7370 resistance; this may open a path to the next relevant level at 0.7450. A move back below 0.7244 invalidates this daily bullish outlook.

Advertisement

GBPJPY

This risk-off environment has provided the JPY with consistent strength. GBPJPY is technically bearish on the daily timeframe. Previous support at 185.0 may become resistance which may send prices to the next relevant support at 181.0. A move back above 187.50 invalidates this daily bearish outlook.

NZDUSD

Sentiment for the NZD still remains bearish because of the ripple effect coming from the developments in China. Leading and lagging indicators suggest that the NZDUSD is technically bearish on the daily timeframe. Prices have breached the previous 0.6500 support which has become resistance. There may be a further decline to the 0.6050 on the condition that the 0.6500 resistance holds.

Advertisement

CADJPY

Falling prices of oil have put pressure on the CAD as a whole. This pair is bearish and may trade back to the lows of 87.40 on the condition that the 92.40 resistance holds. With the candlesticks below the daily 20 SMA the bearish view has been reconfirmed.

For more information please visit: ForexTime

Advertisement