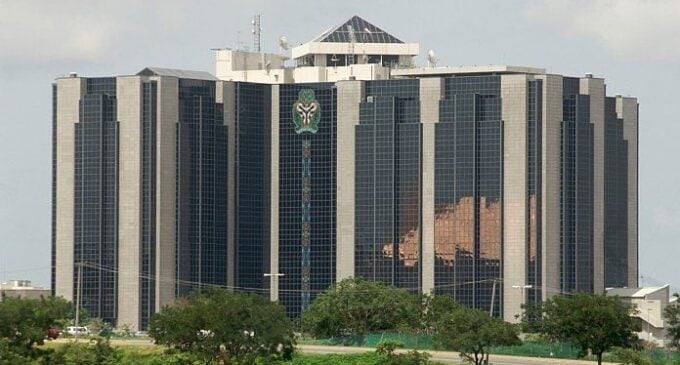

Commercial banks’ stock rise after CBN announced recapitalisation plan

Nigerian bank shares rose on Monday as investors responded favourably to the announcement that the Central Bank of Nigeria (CBN) will require them to increase capital buffers.

Leading the way, FBN Holdings Plc recorded its biggest one-day increase in five months by rising 10 percent to N22 per share, the maximum amount allowed in daily trading by the Nigerian Exchange.

On its part, Access Bank rose 4.32 percent to N18.10 per share – its biggest advance in almost one month.

United Bank of Nigeria (UBA) increased by 1.44 percent to N21.15 per share, while FCMB’s daily trading increased by 1.46 percent to N6.95 per share.

Zenith Bank intra-day trading went up by 1.73 percent to N35.30 per share and Sterling Bank jumped 5.07 percent to N3.73 per share.

Yemi Cardoso, CBN governor, had said the financial regulator will direct banks to recapitalise.

Recapitalisation is the process of infusing funds into banks to enable them to meet the mandatory capital adequacy set by a central bank.

Speaking at the 58th annual bankers’ dinner and grand finale of the 60th anniversary of the Chartered Institute of Bankers of Nigeria (CIBN), Cardoso said banks will be required to raise their capital base.

He said this is because banks lack the liquidity to support the $1 trillion economy that President Bola Tinubu hopes to achieve in the near future.

In 2004, Charles Soludo, the previous CBN governor, increased the banks’ capital base from N2 billion to N25 billion in 2004 — marking the last time the financial regulator directed banks to recapitalise.

There are no comments at the moment, do you want to add one?

Write a comment