Sterling Bank lost profit margin in the third quarter against the second quarter position and the profit growth rate for the current year has slowed down. The bank needs a strong growth in profit this year in which its volume of shares has increased in order to show a reasonable improvement in earnings per share and dividend prospects. This isn’t likely to happen going by the significant slowdown in profit seen at the end of the third quarter. The strength to improve earnings per share and dividend is missing for Sterling Bank as per the third quarter performance.

Despite the slowdown in the third quarter, the bank is still expected to achieve an accelerated profit growth at full year. It has succeeded in improving profit every year since 2010 and a new profit high is expected in 2014. It has also maintained a continuing growth in revenue in the past three years, which is expected to be maintained this year. Its drawback in the third quarter is a sharp increase in operating cost, which claimed an increased share of gross income and eroded profit margin.

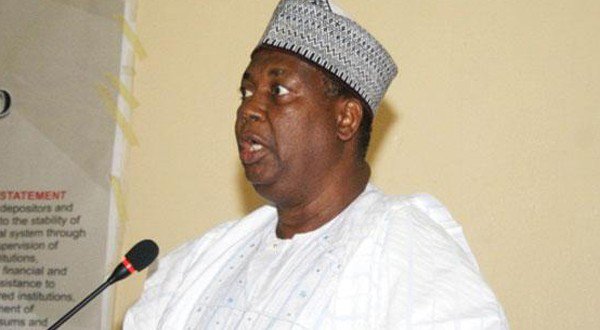

Mr. Yemi Adeola, the bank’s group managing director/chief executive officer, saved costs in two major areas but an increase in operating cost margin hindered him in converting revenues into profit in the third quarter. He therefore could not maintain the cost-income ratio he recorded in the second quarter. While he seems to have improved his bank’s position from a year-on-year decline in profit in the second quarter to s slight improvement in the third, the full year outlook has moderated.

Gross earnings amounted to N73.70 billion at the end of the third quarter, which is an increase of 12.1% year-on-year. This is a slowdown from an increase of 16.4% in the second quarter. Based on the third quarter growth rate, gross income is projected at N98.5 billion for Sterling Bank in 2014. This will be an increase of 7.5% over the gross income of N91.63 billion the bank posted at the end of 2013. This will be a sharp deceleration from the growth of 33.1% the bank recorded in 2013.

Advertisement

Interest income led revenue growth during the review period at almost 15%, a slow down however from 20.5% in the second quarter. Investment and other income dragged down overall revenue growth rate with a marginal increase of 3.7%.

From a decline of 6.7% in after tax profit in the second quarter, the bank shows a rise of 39.2% year-on-year in the third quarter to N7.06 billion. The high growth indication could be misleading and happened because the bank reported a lower profit figure in the third quarter of last year [N5.07 billion] than it posted in the second quarter [N9.92 billion]. Based on the third quarter growth rate, net profit is projected at N9.6 billion for Sterling Bank at full year. This will be an increase 16.1% over the full year profit of N8.27 billion in 2013.

Profit growth is therefore expected to slow down from 19% in 2013. It will however be a continuing growth since it returned to profit at the end of 2010. At 9.7%, net profit margin declined from 11.3% in the second quarter but is slightly better than the 9.0% at the end of last year.

Advertisement

The bank achieved cost reductions in two major areas: interest expenses and loan loss provisions. Interest expenses declined by about 2.5% in the third quarter against an increase of 14.8% in interest income. That enabled the bank to grow net interest income by 32.7% to over N32 billion in the third quarter. Loan loss expenses dropped by 29.6%, which saved significant revenue for the bank.

Operating expenses grew well ahead of revenue and claimed much of the revenue saved from the other expenditure lines. That raised operating cost margin from 44.6% in the corresponding period last year to 50% at the end of the third quarter. This accounted for the loss of profit margin in the third quarter. Sterling Bank shows one of the lowest net profit margins in the banking industry.

The bank earned 33 kobo per share at the end of the third quarter, marginally up on the 32 kobo in the prior period. The inability to improve earnings per share is due to an increase in the volume of shares during the review period. It is expected to earn 44 kobo per share based on the full year profit expectation.

Sterling Bank Plc: 3rd Quarter Earnings Report |

|||

| Sept 2014 | Year-on-Year Growth -% | Full Year Projection Nb | |

| Gross Earnings – Nb | 73.0 | 12.1 | 98.5 |

| Asset Turnover | 0.07 | – | – |

| After Tax Profit – Nb | 7.06 | 39.2 | 9.6 |

| Net Profit Margin – % | 9.7 | – | 9.7% |

| Earnings per Share – Kobo | 33 | 1.2 | 44 Kobo |

| Dividend per Share (2013) | 25 Ex Div | – | – |

| NSE Closing Price 11/11/14 – N | 2.39 | – | – |

| Share Price Year-to-Date – % | -4.4 | – | – |

Advertisement