The Development Bank of Nigeria (DBN) says it is looking to grow its debt and equity capital financing to N1.3 trillion in five years.

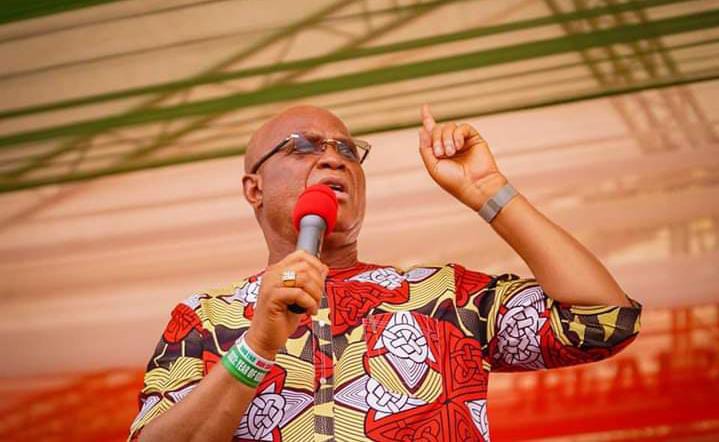

Speaking during a media chat on Thursday in Lagos, Tony Okpanachi, managing director (MD) of the DBN, said new funding would help to fund the bank’s job creation targets.

The managing director said the capital raising plan, which includes local and international funding, is part of the DBN’s strategy to expand its capacity to support micro, small and medium enterprises (MSMEs).

“Strategically, we have to first expand our sources of funding. Two, deepen [our relationship] with the existing ones. How can we get more? Three, how can we use existing ones to catalyse additional ones?” Okpanachi said.

Advertisement

The managing director said a number of development partners are eager to collaborate with the bank due to its strong reputation, “especially as they seek entry into the Nigerian market”.

He explained that to achieve the level of impact the DBN is targeting, it must “crowd in” more partners, both in terms of debt and equity financing.

“So, a lot of other partners want to come into Nigeria, work in Nigeria, and because of the reputation of DBN, want to use DBN,” he said.

Advertisement

“They want to work with DBN. We need to crowd it in for us to be able to make this impact we’re talking about. So, that is what I was saying, both in terms of debt and equity.

“We have had some debt sheets in terms of lending, some debt sheets, which we will not go into full detail. We have some debt sheets, as well, from the time when we knew we had some funding coming in, some from the AfDB, some from KFW, and then we have another conversation with other partners.

“In addition to that, we are trying to raise funds locally. We have a bond programme that will go out on the first phase. So, if the macro becomes favourable, we will do additional phase.”

DBN TARGETS 2 MILLION JOBS IN FIVE YEARS

Advertisement

The DBN chief said the bank aims to support the creation of two million jobs in the next five years — an increase from the 1.2 million catalysed over the past six years.

On the sectors with the highest job creation potential, Okpanachi said the DBN is intentionally prioritising labour-intensive sectors such as agriculture, manufacturing, and green energy.

“So we are consciously looking at what we find in those sectors that are more labour-intensive. Sectors that use more of technology, provide less jobs. And in Nigeria, we need more jobs. So, that is an area we are working on,” he said.

“Even when we are doing green energy, we are looking at manufacturing, where they are recruiting, where they have more people. So, we are deliberate in terms of working with sectors where we will make money. So, it is a strategic move we are making.”

Advertisement

In the next five years, the bank said it also wants to grow its guarantee issue to N500 billion, increase its outstanding loans to N1 trillion, and achieve a cumulative profit before tax (PBT) of N300 billion.

Advertisement