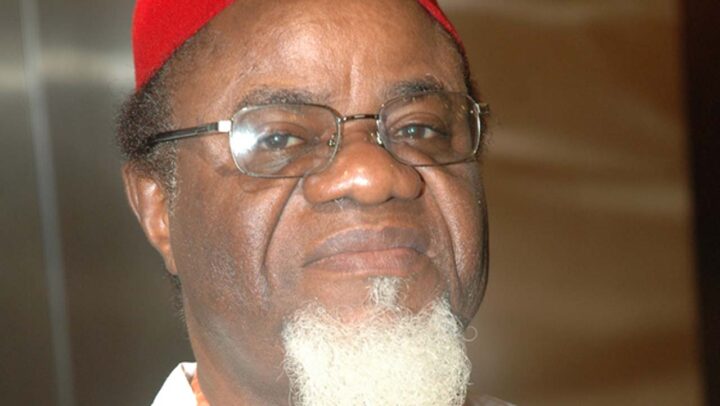

Zacch Adedeji

Since assuming office, Zacch Adedeji, chairman of the Federal Inland Revenue Service (FIRS), has been on a mission to improve Nigeria’s tax sector. President Bola Tinubu and Dr Adedeji are working closely to tackle the country’s tough economic challenges. At the forefront of their agenda is the introduction of the proposed “emergency fiscal bill”, which promises substantial benefits for Nigerians.

In late February, Adedeji announced unveiling plans to introduce this bill to the National Assembly. The primary goal is to clarify the country’s fiscal direction. While the bill has not been made public, its importance cannot be underestimated. It signifies a vital move towards addressing pressing fiscal issues in Nigeria’s turbulent economic environment. In the face of inflationary pressures, foreign exchange fluctuations, and an impending food crisis, legislative action is necessary to stabilise the economy and pave the way for sustainable growth.

The emergency fiscal bill, also known as the Emergency Economic Intervention Bill (EEIB), emphasises the need to revamp how the government manages finances. Adedeji is not just identifying problems; he’s also focusing on solutions. He advocates for the harmonisation of revenue collection under a single agency, drawing parallels with global best practices. This approach aims to improve organisation and efficiency, like successful practices in other countries.

But what exactly constitutes an emergency fiscal bill? Unlike the annual finance act, this legislation is tailored to address urgent tax-related matters requiring immediate attention. It serves as a tool to amend existing fiscal provisions swiftly.

Advertisement

By tackling issues such as multiple taxation which simply means, paying different taxes at the same time on the same income, different types of taxes on the same income and also paying, the same type of taxes to different persons or agencies.

Ease of business barriers to business and tax payment will take away problems or issues that hinder tax compliance, enabling more customer-friendly ways of collecting tax levies through the automation of tax collection. Also, in a situation where businesses are subjected to various taxes and levies imposed by different levels of government, it can result in a significant burden on the businesses’ financial resources. Support for business cash flow and support entrepreneurs/SMEs.

The bill also aims to create a conducive environment for economic growth and investment. Moreover, it seeks to alleviate the burdens of inflation and socioeconomic hardships, fostering resilience and prosperity across society.

Advertisement

It is imperative to commend Adedeji for his forward-thinking approach. His dedication serves as a testament to his suitability for the role, which also reflects President Tinubu’s discernment in appointing competent leaders. This move also demonstrates Adedeji’s readiness to serve the country and its people diligently, signifying a positive step forward in promoting economic prosperity and welfare.

The unveiling of the emergency fiscal bill is a stopgap to address the existing challenges identified in fiscal and tax legislation. This is the time for the national assembly to act decisively. This urgency is important to ensure that Nigerians benefit from the dividends of democracy and the realisation of the renewed hope agenda.

Arabinrin Aderonke currently serves as a technical assistant on broadcast media at the Federal Inland Revenue Services, FIRS.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.