The controversy generated by the sale of a customer’s collateral by Sterling Bank Plc has continued to fester, with more accusations and counter-accusations being made by all parties.

TheCable had investigated and reported the accusation by Grant Properties Limited — a property development company promoted by Olajide Awosedo — that Sterling Bank excised 10 hectares from a 50-hectare collateral and illegally sold it to a front company of a very senior director of the bank.

A Lagos high court ruled that the collateral was illegally sold, but there is also suspicion that the Asset Management Corporation of Nigeria (AMCON) has teamed up with Sterling Bank to undermine the judgment.

While AMCON has denied collusion, Sterling Bank said the collateral was not sold to its director.

Advertisement

However, in a statement sent to TheCable by Awosedo, along with documents, he is disputing the claims made by AMCON and Sterling Bank in their responses.

The full text below.

ISSUE 1

Responding to TheCable’s enquiry, Sterling Bank said the proceeds of sale of the 10 hectares was passed to Grant Properties. “It is instructive to note that the proceeds of sale of the 10 hectares was passed to Grant Properties/Chief Awosedo for onward transmission to the subscribers that had demanded for a refund,” Olubukola Adejokun, the bank’s spokesperson, wrote in the email sent to TheCable.

Advertisement

OUR RESPONSE

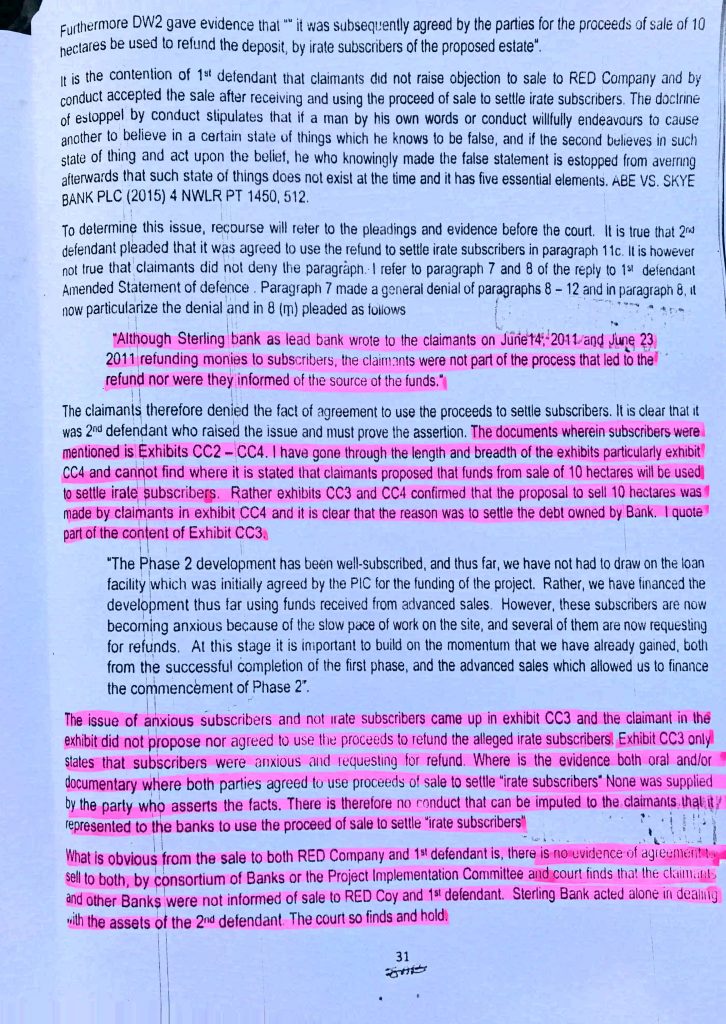

We were not aware of the sale, we were not carried along at all. Sterling Bank/Knight Rook made this argument in court, and it was rebuffed. The court found that there was no evidence that we were involved in the sale, or that we were informed of the origin of the refunds. The court also found that there was no evidence that we authorized the use of the sales proceeds to refund depositors, as it was clear from our letters to the banks that we intended for the sales proceeds to be used to settle our loan obligations to the banks. And please see page 31 of the judgment of the Lagos State High Court in Suit No. LD/576/12 of 2nd June 2017. (highlighted pages attached).

ISSUE 2

The bank also said the 10 hectares was sold to RED and not Idowu.

Advertisement

OUR RESPONSE

It is true that the land was sold to a company called RED (Real Estate Development Company), but this was just a surrogate for Yemi Idowu, as he was aware that it would be illegal to buy the land through a company directly identified with himself. We can establish a clear connection between Yemi Idowu, and Sterling Bank and its associated companies through various correspondence.

We have an offer letter on the letterhead of SAMTL (Sterling Assets Management & Trust Ltd) dated 13th April 2015;

SAMTL & SAMTL Properties are both related to Sterling Bank, and in fact Yemi Adeola’s (MD of Sterling Bank) brother is on the board. Also, Yemi Idowu used to be chairman of SAMTL. The company website is http://www.samtlng.com/

Advertisement

The company named as developer is Aircom Nigeria Ltd, which is Yemi Idowu’s Company. Aircom’s website is http://www.aircomng.com/index.php.

Yemi Idowu’s Wikipedia page: https://en.m.wikipedia.org/wiki/Yemi_Idowu

Advertisement

His Linked-In professional page: https://ng.linkedin.com/in/yemi-idowu-931421128

Kola Ayeye’s text message to Asiwaju Awosedo on 19th July 2017 makes it clear that Yemi Idowu bought the land, and that AMCON is aware of this fact.

Advertisement

“Secondly, with regard to Cardogan and Yemi Idowu, the culprit in all this debacle is yourself and your associates. Yemi Idowu has discharged his obligations in line with AMCON’s mediation several years ago. Your demands on Cardogan/Yemi Idowu are unjust and unconscionable.

Thirdly, on account of your sale of at least 12 out of AMCON’s 14 hectares, we have imposed further payments on some innocent parties, namely Yemi Idowu and Mr Bisi Onasanya. These are perhaps the most distasteful demands I’ve had to make in my banking career – insisting that innocent parties out up funds while the guilty party is yet to pay.”

Advertisement

Given the foregoing, it is difficult for Sterling Bank to deny selling the land to Yemi Idowu through a surrogate company. It is a disingenuous argument.

We also note that Sterling Bank/Knight Rook did not plead the purported settlement by AMCON in their case at the Lagos State High Court, because they knew that it would confirm their guilt. They did not plead the fact that after paying an initial N1.85 billion for the land, they purportedly paid an additional N501 million to AMCON to ratify the illegal Title. This point is clearly very fundamental to AMCON, and we are certain that Sterling Bank would have pleaded it in court if they believe that it would exonerate them.

To us, the fact that the bank purportedly agreed to pay another N501 million years after originally purchasing the land is an admission of guilt.

Incidentally, we have always maintained the innocence of Mr Onasanya to AMCON, because his property was not part of the land that was illegally sold by Sterling Bank, therefore his title was secure, yet AMCON asked him to pay to ratify his title.

ISSUE 3

“Sterling Bank could not have singlehandedly sold any part of the land as the security was pledged to the banking consortium that financed the project,” Adejokun explained, adding that “the decision to sell the 10 hectares was a joint decision between the consortium of banks (Wema, Skye, Unity and Sterling) and the developer (Grant Properties/Chief Olajide Awosedo).”

OUR RESPONSE

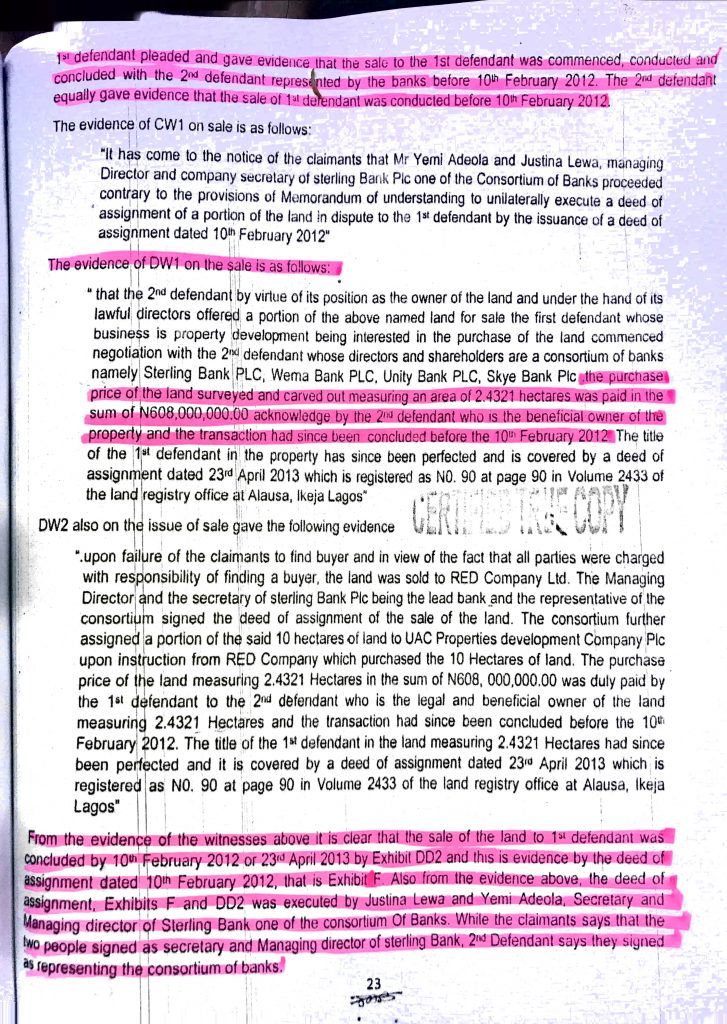

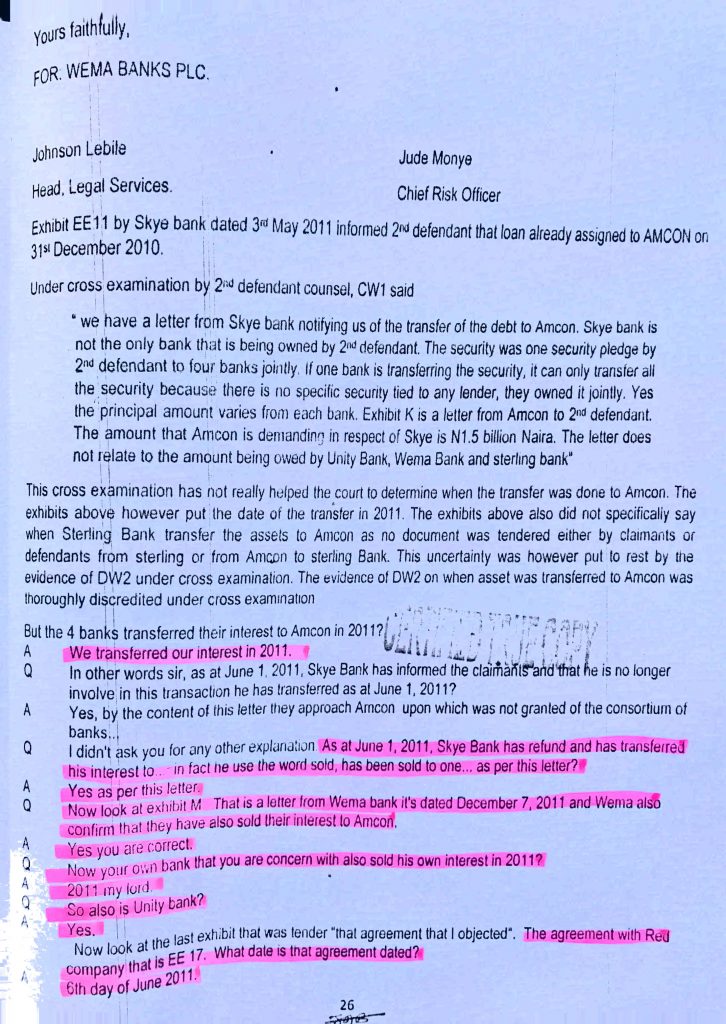

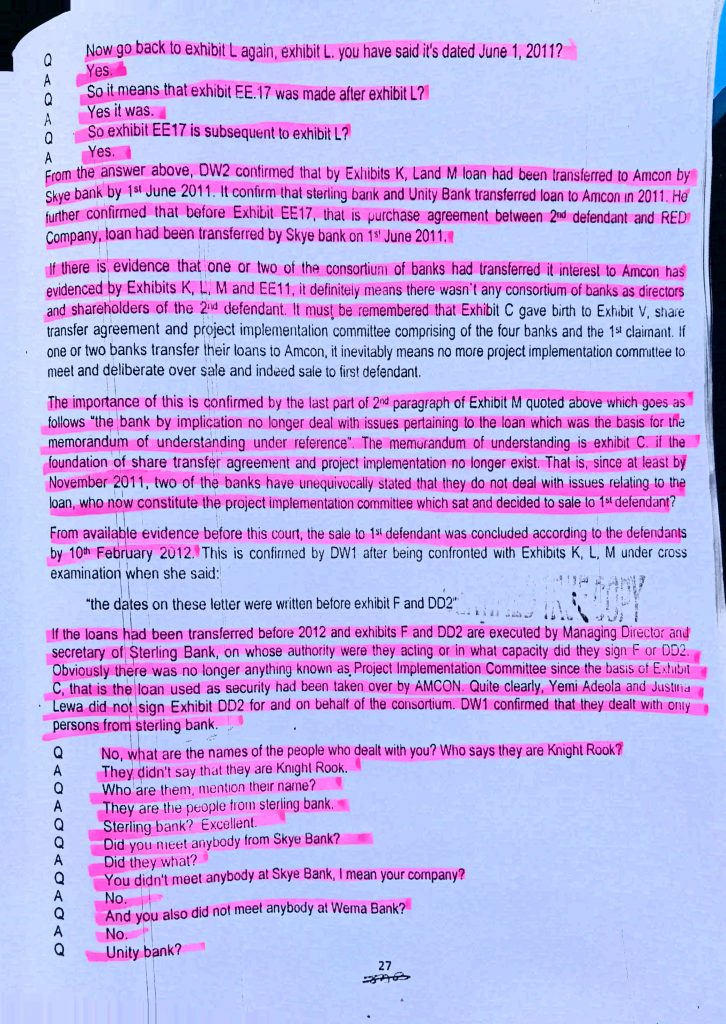

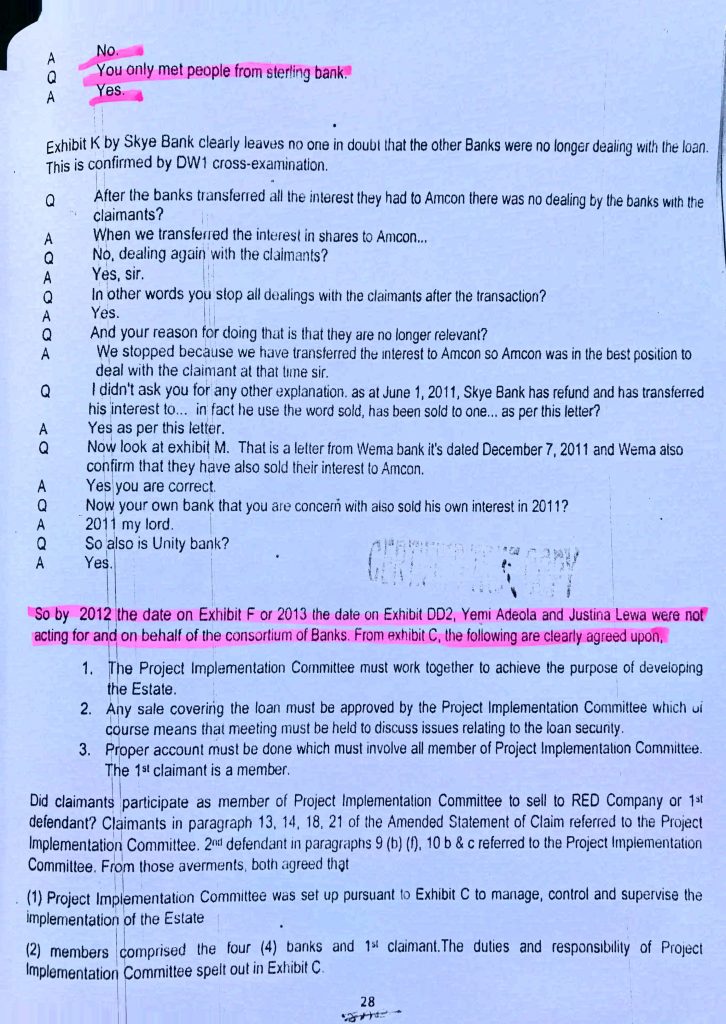

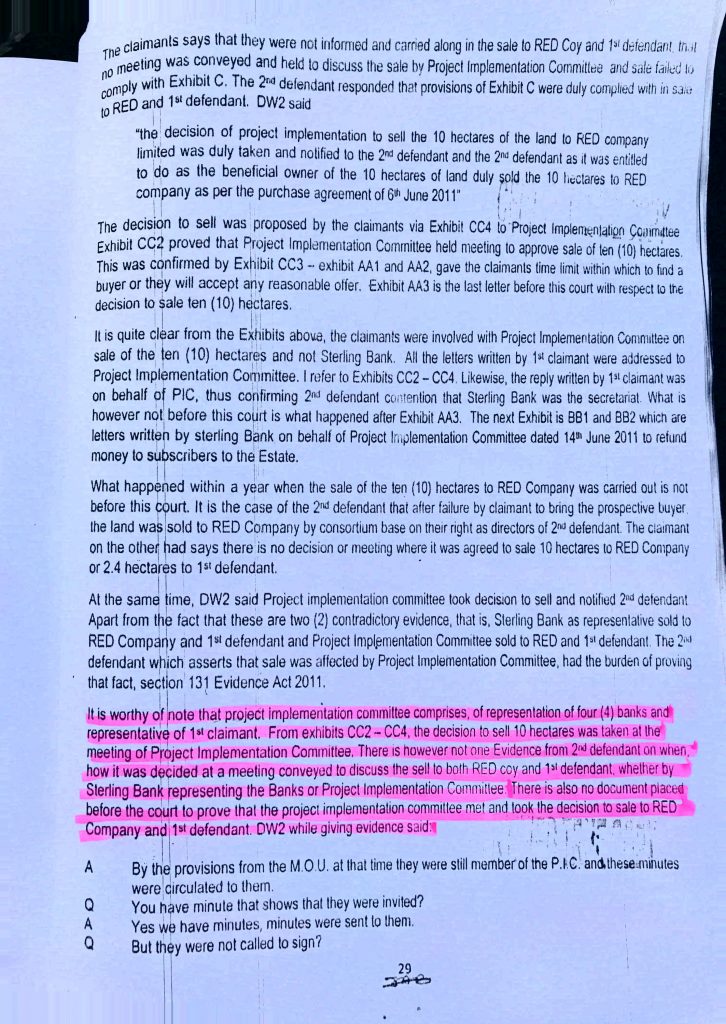

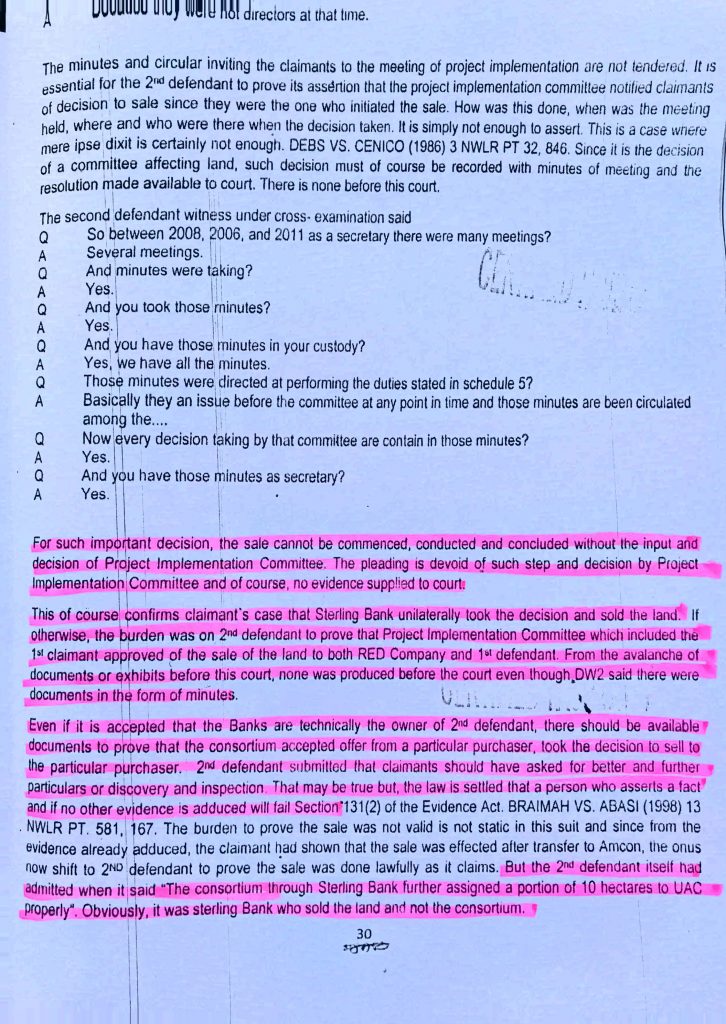

They also made this argument in court. It was clear that Sterling Bank acted alone. The timelines were established in court that at the time the land was sold, both Skye and WEMA Bank had already written to notify us that they had sold their interest to AMCON. The court found that there was no consortium any longer, since the banks had divested their interest to AMCON.

UPDC also testified that they did not meet any representatives from the other banks, and that the transaction was negotiated and concluded with Sterling Bank and not Knight Rook. Even payment of N608 million was made by RED to Sterling Bank without a letter explaining why or giving authorization for such payment.

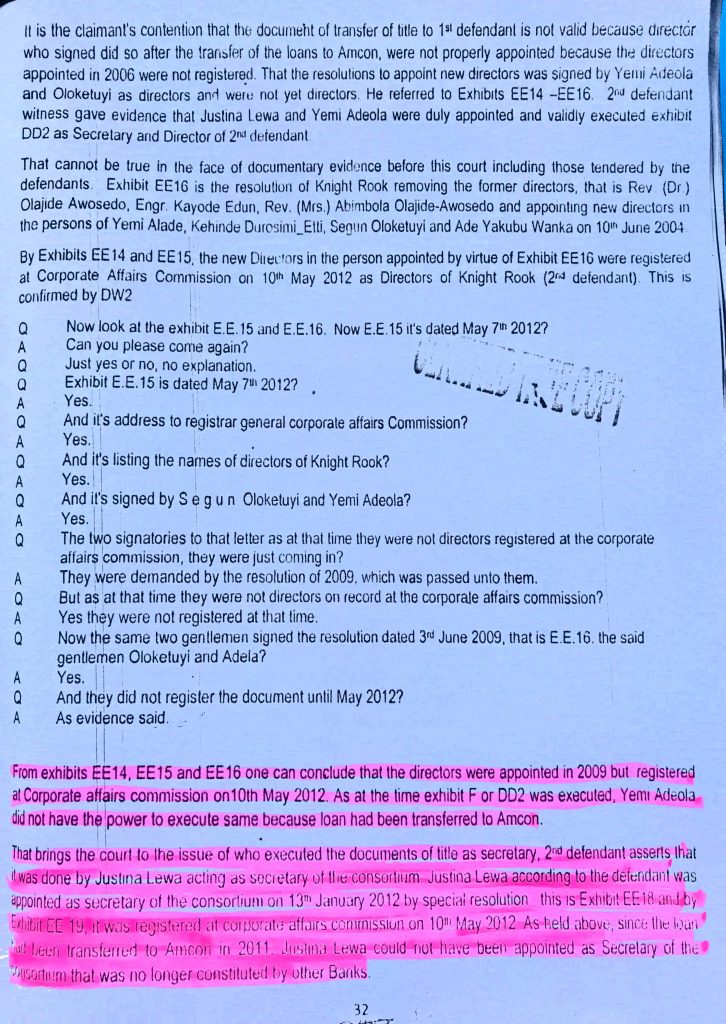

The court held that there was no evidence that the other banks were involved. The court found that Sterling Bank, Yemi Adeola and Justina Lewa acted alone without informing the other banks or ourselves. See pages 23 – 33; page 35; and page 40 of the judgment.

The court also found that even though we had been part of the decision to sell the land, we were not informed about the sale to RED, nor did we authorize the proceeds to be used as refunds to depositors.

ISSUE 4

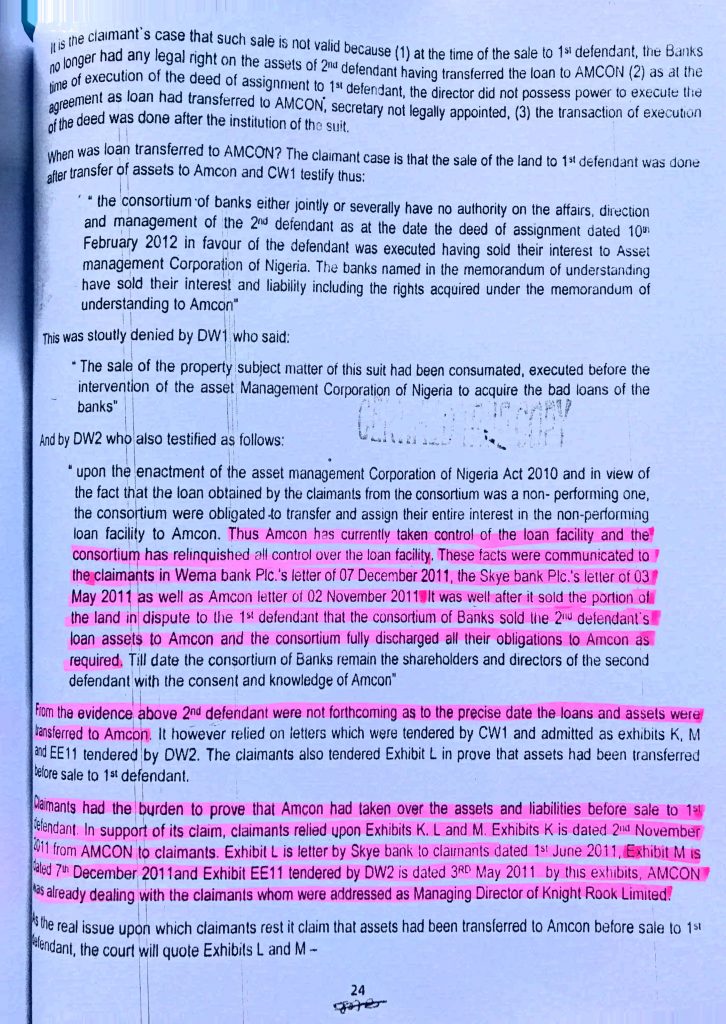

Asked if the sale was is in line with the AMCON Act which states that an eligible financial institution, Sterling Bank and others in this case, must hand over all assets to the corporation, Sterling Bank said “the 10 hectares had been sold before the transfer of loan to AMCON and therefore did not form part of the assets transferred to AMCON by the consortium of banks.”

OUR RESPONSE

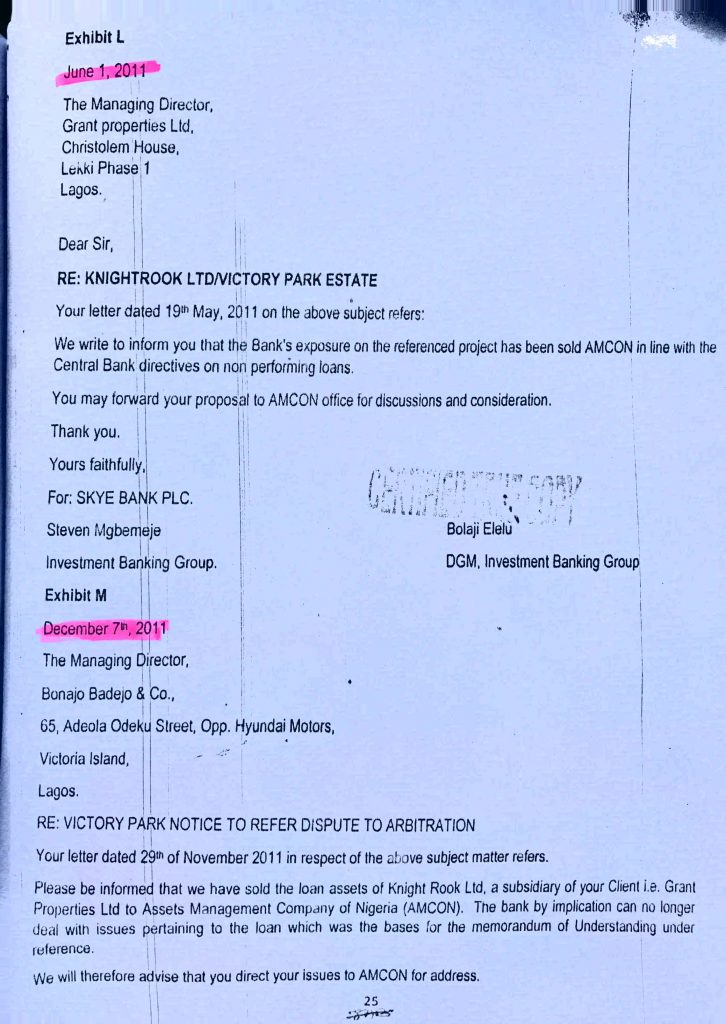

There is no doubt that the land was sold after the loans were transferred to AMCON based on the timelines. Sterling Bank and UPDC both admitted that the transaction was concluded in 2012, whereas Skye Bank had written since June 1st 2011 to notify us of the transfer of their share of the debt to AMCON. In fact, during the trial it was established that the date of the purported sale to RED was 6th June 2011, 5 days after Skye Bank notified us (on 6th June, 2011).

The court also found that the sale of the land was concluded after the sale of the loans to AMCON. See pages 23-29.

It is logical to conclude that the actual transfer of Skye Banks’ portion of the loan to AMCON would have occurred before they notified us on 1st June 2011, since there would have been a period of negotiations before the conclusion, and the final notification from AMCON to Skye Bank.

ISSUE 5

The bank also said that it is not true that the court pronounced the sale illegal. “The court ruling related to only 2.4 hectares out of the 10 hectares which the RED Company subsequently sold to UAC Property Development Company (UPDC) and this is now subject of an appeal at the Court of Appeal Lagos.”

Although the case was between Grant Properties and UPDC— with a larger focus on the 2.4 hectares sold to the latter — the judgment, as against Sterling Bank’s claims, declared that the sale to either RED company or UPDC was done after the banks had transferred its right and interest to AMCON. This is against AMCON’s Act, and may render the sale illegal.

OUR RESPONSE

There is little doubt that the Judgment of June 2nd has rendered the sale illegal, since it clearly established that the land was sold after the sale of the loan obligations to AMCON. This unmistakably proved that the sale violated the terms of the AMCON Act, and as a result it is undeniable that the sale is illegal.

The fact that it is an insider trade which violated several laws of the Stock Exchange, the Securities and Exchange Commission and the Banking industry itself makes it an illegal trade.

ISSUE 6

“Grant Properties is just throwing wrong news everywhere,” Ayeye said. “You guys should be careful of somebody who was owing banks for about five years before AMCON took over, and for eight years that AMCON has taken over, the company has not paid us one penny.”

OUR RESPONSE

We have always maintained that we wanted to settle the loan obligations. We mad several proposals to AMCON which they rejected, in some cases, after considering the proposal for years. We maintained that the land was crucial to repaying the account, but AMCON refused to retrieve its collateral. It is instrumental to note that even now that we have retrieved our collateral through the judgment of the court, AMCON is refusing to take the simple option to recover its money. Rather than take the benefit of the court judgment AMCON is going after innocent parties who bought property in Victory Park, in a bid to protect Sterling Bank, the guilty party. Naturally, the innocent buyers have fought back, and they are challenging AMCON’s assertion that their titles are void in the court. Several residents and property owners have filed suit, which is yet another avoidable complication, that can be resolved by taking the benefit of the judgment.

ISSUE 7

“… this is now subject of an appeal at the Court of Appeal Lagos.”

OUR RESPONSE

It is true that UPDC Plc have appealed the judgment. However, Knight Rook have not appealed, and they cannot appeal because the judgment is in their favour. The main grounds for UPDC’s appeal is that we had no Locus Standi, or legal standing to bring the original action to court, because we have divested our shares in Knight Rook.

First, we must point out that our transfer of the shares was not a permanent sale, but as a security arrangement to cover the loans we took from the banks. The banks only hold those shares as security. We have a reversionary interest in the shares, which is clearly captured in the MOU and Share Transfer Agreements which form the basis of the transaction.

Second, the banks recognized our rights, through our membership of the PIC, and the fact that we were carried along in all the decisions of the Committee.

They made this argument in court, and it was indeed examined by 2 different trial judges, who that we have locus, because of our reversionary interest in the Knight Rook shares. The fact that we have a right of reversion over the shares gives us a right to determine how the shares and the Knight Rook assets are managed.

The court determined that the transfer of the shares to the banks was not absolute (see page 11).

On page 12, the court stated as follows:

“This is exactly the grouse of the claimants in this suit and by Exhibit C, it is in no doubt that the land in Exhibits A and B was used as security to obtain loans to develop the estate. The transfer of the land in Exhibits A and B was temporary and the claimants have the necessary locus to ensure that their reversionary interest which is threatened is protected. Court find the claimant have the necessary locus standi to institute this action.” (see page 12 of the judgment)

Based on this, we believe any appeal is bound to fail, coupled with the fact that UPDC cannot have the support of Knight Rook/AMCON in the appeal, because as stated earlier, AMCON cannot appeal a judgment in its favour.

THE COURT PAPERS

Add a comment