The United Bank for Africa (UBA) has reported a profit after tax of N56.7 billion in its 2019 half-year financial results, a 29.6% increase from the N43.8 billion reported in half-year 2018.

Details of the financial report analysed by TheCable showed that the bank’s total assets grew by 4.8% to N5.10 trillion.

Here are other figures from the half-year financials of the bank:

- Gross earnings on the Nigerian Stock Exchange (NSE): N293.7 billion up 14% from the N257.9 billion recorded in half-year 2018

- Customer deposits: N3.51 trillion up 4.8% from N3.35 trillion in December 2018

- Total Assets: N5.10 trillion

- Shareholders’ fund: N542.5 billion

- Profit before tax: N70.3 billion, up 21% from N58.1 billion in June 2018.

- Profit after tax: N56.7 billion up 29.6% from N43.8 billion in June 2018.

- Profit of half-year 2019 (annualised return on average equity): 21.7%

- Interim dividend: N0.20 per share for every ordinary share of N0.50

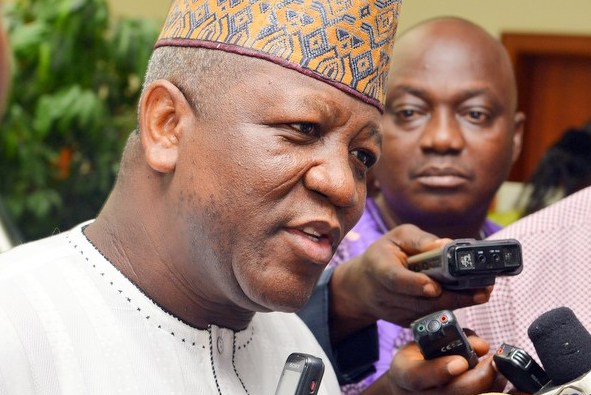

Commenting on the results, Kennedy Uzoka, UBA’s group managing director, said: “I am pleased with the half performance of the Group, having delivered 14% growth in gross earnings and 21% growth in profit before tax.

Advertisement

“Despite the subdued yield environment in some of our large markets, we achieved a 9% growth in interest income and defended the net interest margin. We also achieved a 39% growth in our electronic banking revenues, as we broaden and deepened our digital banking play across Africa.

“Revenues from our remittance and funds transfer businesses grew 69% and 53% respectively. All these factors attest to the efficacy of our strategies and the resilience of our business model.”

“I am very optimistic that the ongoing Group-wide transformation program, will in the quarters ahead, enable the Bank to deliver substantial operational efficiencies and best-in-class customer service, which will ultimately boost earnings.

Advertisement

“We sustained our asset quality with the NPL ratio down to 5.62%, from 6.45% as at 2018FY. We will continue to adopt best practice standards to grow and manage the portfolio in the quarters ahead.”

The bank was founded 70 years ago with operations in 20 African countries, the United Kingdom, France and the United States of America.