Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), believes there is no reason for the country to be facing challenges as a result of the falling oil prices if it had introduced import substitution policies.

He said this in a keynote address delivered at the 48th annual bankers’ dinner organised by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos on Friday night.

According to Emefiele, the current situation in the country affords the opportunity to embrace import substitution in Nigeria.

He also said the recent devaluation of the naira and other monetary policy measures were to reduce the demand for forex by importers and ultimately conserve the country’s forex reserves.

Advertisement

“With respect to this, the CBN is already collaborating with the ministry of industry, trade and investment as well as the ministry of agric and rural development as well as the National Youth Service Corp to aggressively begin the first phase of the import substitution programme that would take advantage of the current situation.

“Let me seize this opportunity to call on banks to partner with the federal government in encouraging import substitution. It beats my imagination to understand why we cannot grow rice, produce milk and sugar in Nigeria. Before I was born, milk was being imported in Nigeria and today, it is still being imported. So, I ask, does it take rocket science to produce milk in this country?”

He assured Nigerians that the central bank would continue to provide resources to support entrepreneurs.

Advertisement

Emefiele said the recently-launched N220 billion micro, small and medium scale enterprises’ fund was meant to support entrepreneurs and boost job creation.

He urged Nigerians not to panic over the challenges facing the economy.

“The central bank has spent huge assets from the foreign reserves in ensuring that the official exchange rate is maintained,” he said.

“We must remember that in an import-dependent country like ours, the exchange rate operates like every other price in the market. The forces of demand and supply basically determine movement of the naira. When oil price falls, price moves up, when supply fall, price also rises as well.

Advertisement

“In recent times, Nigeria has faced a simultaneous dwindling supply of US dollars and rise in demand. Both forces have led to a rise in the price of the US dollars at both the interbank and bureau de change segments of the market. Also, the underlying factors that led to the dwindling supply of US dollars are mainly global and not country-specific.

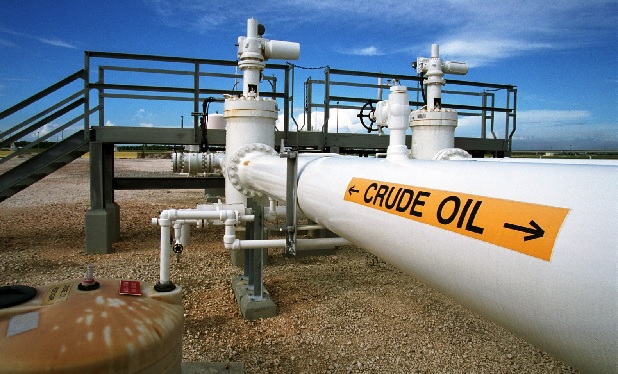

“As we all know, the main source of our forex supply is the sale of crude oil. However, during the year, we have seen oil prices fall by nearly 40 per cent from a peak of $116 per barrel in January 2014, to as low as $70 per barrel. The direct implication of this is a significant reduction in supply of dollar to the market.

“The other global factor which has significantly reduced the supply of dollar to the market is related to the end of the quantitative easing by the United States by Federal Reserve. This programme came to an end in October 2014, thereby significantly reducing the volume of supply of the dollar to the global economy.”

Advertisement