The CBN governor, Godwin Emefiele, insists that the apex bank’s current monetary policies are the best for the majority of Nigerians. He blamed the current economic crisis on the failure of past governments to diversify the economy.

But the governor tried to answer very difficult questions, at that conference where his policies were vehemently criticized, with very simple answers.

Presently, the apex bank’s policies have resulted in ballooning inflation and foreign exchange instability (especially in the black market). These two maladies favor the very rich, and impoverishes the poor. And this is not in line with the President’s wish to take many out of poverty.

How?

Advertisement

Here’s the first theory every central banker should know: Inflation tends to encourage massive redistribution of wealth in favor of the wealthy who have the resources to hedge against inflation to the detriment of the poor who have neither the skills nor resources to do so.

Thus, it was not surprising to see rich Nigerians, when the naira started sinking, moving most of their cash holdings into other currencies and exiting the country’s stock market. (The stock market is currently one of the institutions badly bruised by Nigeria’s currency crisis.)

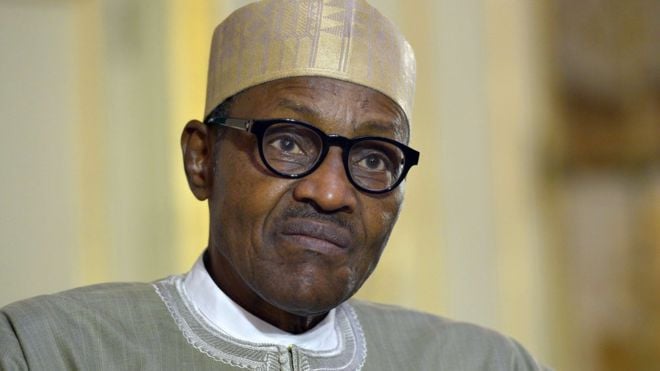

But the poor, who have little to live on and have been Buhari’s most genuine supporters, have nothing to use in protecting themselves against the muster of inflation, especially this cost-push one.

Advertisement

This is a major failure on the part of the central bank, whose duty is to protect the poor who have nothing to protect themselves against inflation.

On the exchange rate front, the CBN has further impoverished the poor — Buhari’s constituency.

Today Nigeria has about 11 exchange rates: Pilgrims rate, N197/$; Customs rate, N285/$; Budget rate, N305/$; Interbank rate, N315/$; Fuel Imports rate, N316/$; International Card rate, N319/$; Travelex rate, N345/$; Special Funds Airlines rate, N355/$; Western Union rate, N375/$; BDC rate, N399/$ and the Black Market rate, N497/$.

While the ordinary Nigerian gets the dollar at N497/$, big banks get the dollar at rates between N197/$ to N399/$ from the apex bank.

Advertisement

Yes, from the apex bank. Central banks have limited visibility to the public, they undertake transactions with commercial banks, and do not provide services directly to individuals. And when these ‘subsidies on the dollar’ get to the commercial banks, the elites who run these banks become richer. (There is no guarantee that a large chunk of these subsidized dollars won’t find their way to the black market.) But Buhari’s constituency — the poor — become worse off.

The central bank could argue that it tries to ameliorate the suffering of the poor with its various ‘well-intentioned’ intervention funds – such as soft loans to agricultural and aviation sectors — but this should be left for development banks, in a well-managed economy.

When the central bank concentrates on what it should know how to do best – such as providing good quality currencies, checking bank failures, keeping inflation low, and supporting non-cash transactions — the poor are better off.

And on the corruption angle – which the President is pioneering – strong non-cash payment systems have been efficient in reducing corruption to the barest minimum in Scandinavian countries, according to a recent report by Bloomberg. (Buhari should take note of this if he wants to help the poor by reducing corruption.)

Advertisement

Nobody can make good progress with the prevalent macro-economic conditions in Nigeria.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.