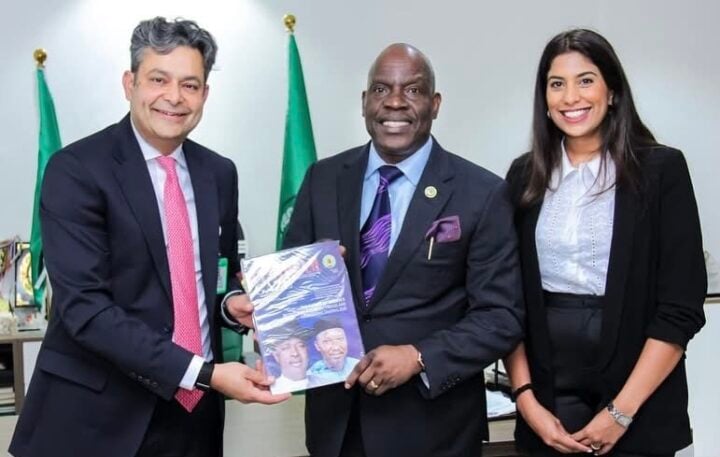

Gbenga Komolafe and Barclays Bank officials

The Energy Governance Alliance (EGA) says reforms in Nigeria’s petroleum sector under President Bola Tinubu are attracting fresh capital inflows.

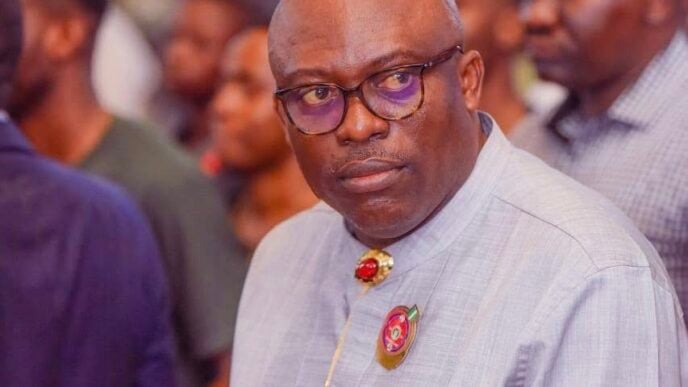

EGA, a coalition advocating transparency and reforms in the industry, also commended the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and Gbenga Komolafe, its chief executive, for restoring investor confidence in the country’s oil and gas sector.

In a statement on Sunday, Kelvin Sotonye William, executive director of EGA, said the environment for international investors had become “hostile” before the Tinubu administration and leadership at NUPRC.

He said regulatory bottlenecks, policy inconsistency and frequent disputes with host communities forced many international oil companies (IOCs) to scale back or divest.

Advertisement

“Under previous regimes, the perception was that Nigeria’s upstream environment had become too unstable to guarantee the kind of long-term commitments that global energy investors demand. This was why many IOCs either left or significantly reduced their exposure,” Williams said.

The group said reforms spearheaded by Tinubu, particularly the implementation of the Petroleum Industry Act (PIA), have changed the situation.

EGA said Komolafe’s stewardship has also provided regulatory clarity, predictability and investor assurance that had long been absent in the sector.

Advertisement

EGA pointed to recent developments such as the production sharing contract (PSC) between the Nigerian National Petroleum Company (NNPC) Limited and TotalEnergies, and the renewed participation of IOCs in bid rounds, as evidence of restored investor confidence.

“These milestones reflect a new reality: IOCs are now returning to Nigeria. Far from being a country in retreat, Nigeria under the present dispensation has become an investment hub once again,” the group said.

EGA added that the recent visit of Barclays Bank Plc officials to NUPRC headquarters in Abuja reinforced this trend, as global financiers now show readiness to fund oil and gas projects in Nigeria.

“The presence of Barclays Bank executives at the Commission is symbolic. It signals not only renewed confidence in Nigeria’s petroleum reforms but also a willingness by international financiers to backstop investments in the sector,” the group said.

Advertisement

“This would have been unthinkable a few years ago when divestments were dominating the headlines.”

The coalition said Barclays’ interest was part of a broader pattern of international recognition of the reforms.

On September 16, Komolafe said Nigeria’s reform agenda has attracted 28 field development plans (FDPs) worth $18.2 billion in investment commitments.

Advertisement