Weeks after the Federal Competition and Consumer Protection Commission (FCCPC) said it generated N56 billion and remitted only N22.4 billion to the federation account in 2022, the federal government has issued a circular directing “automatic” 50 percent remittance of the total revenue of all its self-funded enterprises.

It is unclear if the two events are related, but a presidency source told TheCable the reform was “long overdue”.

Previously, self-funded agencies, also called “Super Agencies”, were allowed to claim up to 50 percent of their revenue as expenditure and keep 20 percent of the balance as “operating surplus” — the excess of revenue over expenditure.

“Super Agencies” — so called because of the enormous financial resources at their disposal — keep a combined total of over N1 trillion annually from the revenues collected by them.

Advertisement

Although they receive no budgetary allocation from the federal government, questions have been raised over the huge sums they retain — with some agencies getting more than the legislative and judicial arms of government.

Some of the major agencies affected are the Federal Inland Revenue Service (FIRS), the Nigerian Ports Authority (NPA), the Nigerian Communications Commission (NCC), the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and the Nigerian Customs Service (NCS).

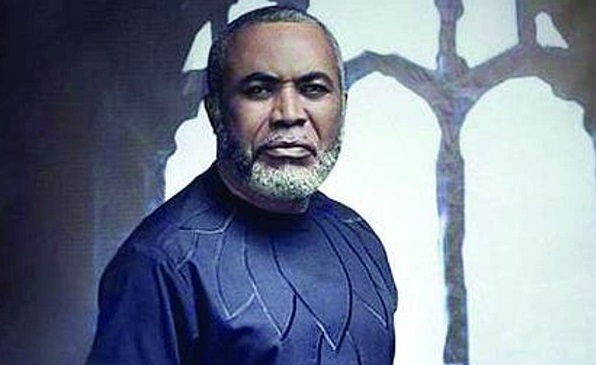

Waziri Adio, executive director of Agora Policy, the respected public policy think-tank based in Abuja, recently raised an issue with the funding arrangement, warning that “these cash-saturated agencies become founts of mind-blowing profligacy and sleazy vehicles for patronage and rent-extraction. A variant of Parkinson’s Law states that expenditure always rises to meet income. In short: more money in this form leads to more expenses, not more sense. And this is exactly what happens to these agencies.”

Advertisement

IMMEDIATE IMPLEMENTATION

The implementation of the new order followed a presidential directive, according to a circular from the ministry of finance, dated December 28, 2023.

The directive was sequel to a similar circular dated December 20, 2021, addressing agencies’ revenue remittances to the consolidated revenue fund (CRF).

The 2021 circular had asked all self-funded federal government agencies and parastatals to remit only 80 percent of the 50 percent accruable to the sub-recurrent account (SRA), allowing such agency to retain 20 percent in its general reserve as operating surpluses.

Advertisement

This means that if 50 percent of an agency’s total revenue is N20 million, N16 million (80 percent) will go to the SRA. The remaining N4 million (20 percent) will be kept in the agency’s general reserve.

However, issuing fresh guidelines for implementation in the latest circular, the finance ministry directed agencies and parastatals to remit 50 percent of their gross internally generated revenue (IGR) to the SRA — a sub-component of the CRF.

While there was no mention of accruals into the general reserve of agencies, the deductions will also be implemented on all statutory revenue lines like tender fees, contractor’s registration, sales of government assets, TheCable understands.

In addition, the finance ministry said all ministries, departments and agencies (MDAs) that are fully funded through the federal government budget and on the schedule of the Fiscal Responsibility Act, 2007, should “remit one hundred percent (100%)” of their IGR to the SRA.

Advertisement

“All partially funded Federal Government Agencies/Parastatals (receiving capital or overhead allocation from the Federal Government Budget) should remit fifty percent (50%) of their gross Internally Generated Revenue (IGR), while all statutory revenue like tender fees, contractor’s registration, sales of government assets etc should be remitted one hundred percent (100%) to the Sub-Recurrent Account,” the finance ministry added.

According to the circular, the deductions will be implemented in the accounts of 68 agencies listed under the Fiscal Responsibility Act of 2007.

Advertisement

NEW ACCOUNTS FOR AGENCIES

For effective implementation, the office of the accountant-general of the federation (OAGF) was instructed to open new treasury single accounts (TSA) for all the agencies listed in the Fiscal Responsibility Act.

Advertisement

According to the finance ministry, the TSA sub-accounts currently operated and maintained by the agencies for receiving revenue from the public shall be blocked from access, and placed under the full control of Wale Edun, the minister of finance and co-ordinating minister of the economy and the accountant-general of the federation.

It was also learnt that the new accounts shall be credited with inflows in the “old accounts based on the new policy implementation of 50 percent auto deduction in line with Finance Act,2020 and Finance Circular, 2021, 50% cost to revenue ratio”.

Advertisement

“The Office of the Accountant General of the Federation (OAGF), subject to the categorization of Agencies shall map and automatically effect direct deduction of 50% (fifty percent) on gross revenue of Self/partially funded Agency/Parastatals and 100% (one hundred percent) for fully funded Agencies/ Parastatals as interim remittance of amount due to the Consolidated Revenue Fund,” circular reads.

The federal government said the move is meant to improve revenue generation, fiscal discipline, accountability and transparency in the management of government financial resources and prevention of waste and inefficiencies.

While this may be unsavoury for the agencies, the deductions may be applauded by pundits who believe some agencies generate too much money than they may need.

For instance, in the 2024 budget of government enterprises, NPA projects N538 billion in revenue, and an expenditure of N349 billion, with a CRF remittance of N149 billion (28 percent). NUPRC expects to generate N232 billion but is billed to remit only N2 billion (0.88 percent).

The CAC, on the other hand, projects a N28 billion revenue, a CRF transfer of N11 billion (40 percent), and an expenditure of N14 billion. Similarly, the NMDPRA said it will rake in N212 billion and transfer only N84 billion (40 percent) to the CRF.

Analysts view such humongous revenue generation by agencies as problematic and often counter-productive as some organisations tend to prioritise money at the expense of their core mandates or impose unnecessary costs on businesses which could undermine national competitiveness.

‘DEAFULTING ACCOUNT OFFICERS WILL BE PUNISHED’

The effective implementation of the deduction means that agencies will have just enough revenue to fund their expenditures as the federal government will now collect the excess.

Therefore, the ministry urged all accounting officers, directors of finance and accounts, directors of internal audit, heads of accounts and heads of internal audit units of MDAs “to give this circular the widest circulation and ensure strict compliance”.

The ministry also said it would partner with the OAGF on appropriate disciplinary actions and sanctions against “defaulting accounting officers of agencies/parastatals found culpable of violating the contents of this Finance Circular and in accordance with the Fiscal Responsibility Act”.