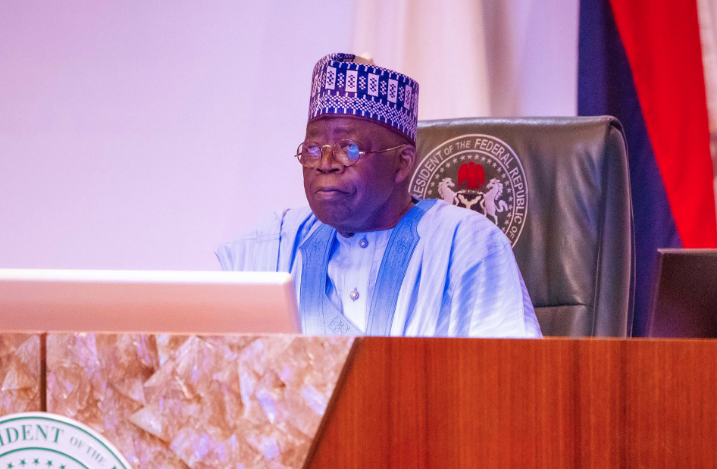

President Bola Tinubu

On Thursday, President Bola Tinubu wrote to the national assembly, requesting the repeal and reenactment of the student loan law.

To repeal and reenact a law means to abolish the existing law entirely and then reintroduce it with amendments.

In the letter, which was read on the floor of both chambers of the national assembly, the president said the student loan (access to higher education) (repeal and reenactment) bill 2024, seeks to enhance the implementation of the higher education student loan scheme by addressing challenges related to the management structure of the Nigerian education loan fund (NELF), applicant eligibility requirements, loan purpose, funding sources, and disbursement and repayment procedures.

After the letter was read by Godswill Akpabio, president of the senate, and Tajudeen Abbas, speaker of the house of representatives, both chambers gave the bill swift deliberation, passing it for first and second readings.

Advertisement

Tinubu signed the student loan bill into law in June 2023 to provide financial assistance to Nigerian students in tertiary institutions.

However, the implementation of the law has been delayed due to certain issues hindering its rollout.

TheCable highlights major amendments in the repeal and reenactment bill.

Advertisement

- GOVERNANCE AND MANAGEMENT

According to section 5 of the existing act, the fund is domiciled in the Central Bank of Nigeria (CBN), with the governor of the CBN saddled with the management and executive responsibilities of the Nigerian Education Loan Fund (NELFUND).

Critics have raised concerns about this section, arguing that it falls outside the primary mandate of the CBN, which should be the governor’s main focus.

Furthermore, responsibility and accountability for the Fund’s day-to-day management are not adequately stated in the Act.

Amendment

Advertisement

In the copy of the policy brief seen by TheCable, the bill seeks to repeal and reenact the act to separate the governance functions from the management operations of the NELFUND by establishing a board of directors with a chairman and secretary.

The board’s members are to be drawn from the relevant ministers, regulatory bodies, and participating agencies, including the ministries of finance and education, Federal Inland Revenue Service (FIRS), National Identity Management Commission (NIMC), National Universities Commission (NUC), National Board for Technical Education (NBTE), and National Commission for Colleges of Education (NCCE), as well as representatives of universities, polytechnics, and colleges of education, students of tertiary institutions, and the organised private sector.

A management team will also be established, to be led by a managing director and executive directors responsible for the day-to-day management and operations of the fund. The president will appoint the board and management.

- PURPOSE OF THE LOANS

Under section 3 of the current law, students can only apply for loans to pay tuition fees.

Advertisement

This implies that students cannot apply to the fund for loans to cover their upkeep costs or other institutional charges such as acceptance fees, miscellaneous fees, and examinations, as federal tertiary institutions do not charge tuition fees, thus defeating the purpose of the loan, which is to ease access to tertiary education for young Nigerians.

The section has been severely criticised by stakeholders.

Advertisement

Amendment

The bill aims to empower the fund to provide loans to qualified Nigerians for tuition, fees, charges, and upkeep during their studies in approved tertiary education institutions and vocational and skills acquisition institutions in Nigeria.

Advertisement

- ELIGIBILITY CRITERIA FOR APPLICANTS

Section 14 of the existing legislation allows only applicants with a combined family income of less than N500,000 per annum to apply for the loan.

The act also requires applicants to provide two guarantors who shall be a civil servant of level 12 and above, a lawyer with ten years post-call experience, a judicial officer, or a justice of the peace (JP).

Advertisement

This provision of the law has been described by critics as being discriminatory, as it sets a high bar to disqualify many Nigerians who may not be able to meet the demand.

The act also disqualifies the children of parents who have previously defaulted on any loans.

Amendment

The bill aims to repeal the law to remove the family income threshold so Nigerian students can apply for these loans and accept responsibility for repayment according to the fund’s guidelines.

It also proposes to delete the guarantor requirement so that students can apply for and receive loans subject to application and identity verification guidelines as provided by the fund, and student applicants will no longer be disqualified based on their parent’s loan history.

- REPAYMENT PROVISIONS

Section 18 of the law criminalises failure to repay loans obtained from the fund without consideration for circumstances, including unemployment, death, or disability, that may affect an individual’s ability to pay.

The law states:

- Any beneficiary of the loan to which this Act refers shall commence repayment two Repayment years after completion of the National Youth Service Corps programme.

- Repayment shall be by direct deduction of 10% of the beneficiaries salary at source by the employer and credited to the Fund.

- Any change of job shall be communicated to the Chairman of the Committee within 30 day of resuming with his new employer with details of the new job.

- Where the beneficiary is self-employed, he shall remit 10% of his total profit monthly to the Fund.

- For the purpose of subsection (4), a self-employed person shall within 60 days of assuming that status submit all information such as name of business, address and location, registration documents, if registered, name of bankers, names of partners, name of directors and shareholders to the Committee.

- Anyone in default of the provisions of subsection (5), or found to be aiding the default of subsection (5), commits an offence and is liable on conviction to a fine of N500,000 or imprisonment for a term of two years or both.

Amendment

The repeal and reenactment bill proposes that a beneficiary may request an extension of enforcement action by the fund by providing an affidavit indicating that he is not employed in any capacity and is not receiving any income.

The bill suggests that only a person who provides a false statement to the fund under this section is guilty of a felony and is liable to imprisonment for three years. It also seeks to make provision for loan forgiveness in the “event of death or acts of God causing inability to repay”.

- RECOVERY OF LOANS

In the act, NELFUND is not established as a corporate body. This could potentially pose issues regarding the fund’s capacity to enter into contracts, such as loan agreements with applicants, or to take legal action to reclaim loans from beneficiaries.

Amendment

The bill aims to establish NELFUND as a corporate body that can sue and be sued in its name and has the power to acquire, hold, and dispose of movable and immovable property. This ensures that the fund can legally enter into contracts, including loan agreements, and may also initiate action to ensure repayment by beneficiaries.