The federal executive council (FEC), presided over by President Bola Tinubu, has approved the appointment of 17 insurance underwriting firms to manage the Group Life Insurance Scheme for the 2025-2026 policy year.

The policy covers the president, vice-president, ministers, senior officials, and thousands of federal public servants.

This aligns with the Pension Reform Act 2014, which mandates employers to maintain life insurance policies covering at least three times an employee’s annual total emoluments.

The government had increased the allocation to group life assurance by 80 percent in the proposed Appropriation Bill for 2025.

Advertisement

Listed under the service-wide votes, N17.31 billion was allocated to “group life assurance for all ministries, departments and agencies (including the Department of State Services/insurance of sensitive assets/members of the National Youth Service Corps, plus administration & monitoring)”.

According to the provisions of Section 4 (5) of the Pension Reform Act (2014), employers of labour were mandated to set up group life insurance policies for their workforce.

Speaking to state house correspondents on Monday, Didi Walson-Jacks, head of service of the federation, said the scheme, backed by a N17.3 billion budget allocation, provides life insurance coverage that pays out benefits to the next of kin of public servants in the event of death, offering financial relief to bereaved families.

Advertisement

The policy, which ensures that dependents of a deceased employee receive three times their total annual emolument, was meant to cushion the effect of death on a deceased worker’s family.

“I would like to quickly take you through the actual approval for today,” Walson-Jacks said.

“The approval for today was for the appointment of 17 insurance underwriters for the group life insurance cover and for 2025/2026, as I mentioned earlier.

“And the premium is paid to the insurance companies for the duration of 12 months. So this policy will expire next year.

Advertisement

“I just like to say that in as much as this policy has existed throughout this administration and even previous administrations, we find that not too many people know about the policy, and so we have, from my office, even planned to carry out a sensitisation, which will be coming up very soon.

“But I’m so happy to be given the opportunity today to talk about this policy.”

She also said the scheme’s premium is paid annually, and coverage commences upon payment under the “no premium, no cover” policy.

Walson-Jack added that “this policy affects every public servant, and we are planning a sensitisation campaign to raise awareness, as many are still unaware of this vital benefit”.

Advertisement

FG OKAYS INITIATIVES TO TACKLE UNEMPLOYMENT

The FEC also approved two major policy initiatives targeted at tackling unemployment and expanding Nigeria’s revenue base through creative and cultural industries.

Advertisement

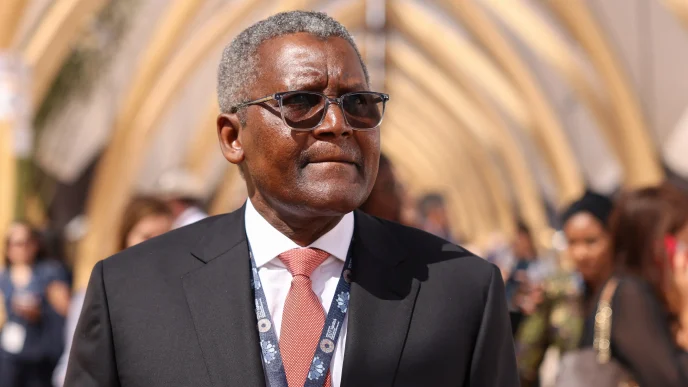

Maigari Dingyadi, minister of labour and employment, said the council approved the revised national policy on employment, which has been under review for six years.

He said the updated framework was designed to reflect current economic realities and provide new strategies to address widespread unemployment and poverty across the country.

Advertisement

“This is a very important memo to the labour sector in general. The reviewed policy aims to create economic opportunities that promote productive employment for Nigerians,” Dingyadi said.

“It aligns with our preparation for the upcoming International Labour Organisation (ILO) meeting in Geneva, where we will proudly present our renewed employment framework.”

Advertisement

Dingyadi also stressed that the updated employment policy was developed after extensive consultations and would now be sent to key stakeholders for implementation.