The Federal Competition and Consumer Protection Commission (FCCPC) says the joint committee tackling violation of consumer rights in the money lending industry will shut down illegal businesses.

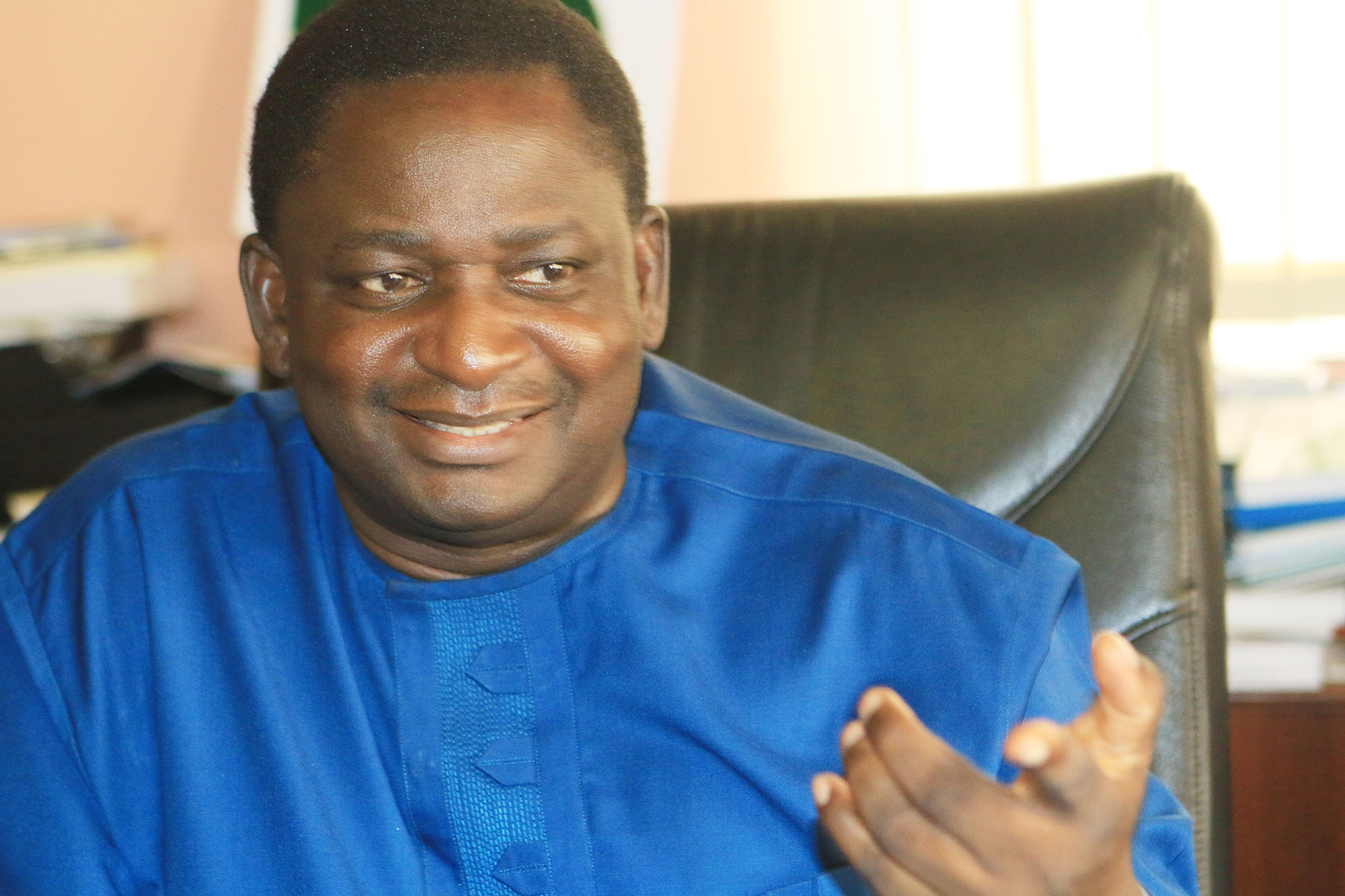

Babatunde Irukera, the chief executive officer of FCCPC, told NAN in Abuja on Sunday.

He said that the committee would commence operation soon.

The joint committee is made up of representatives from FCCPC, the Central Bank of Nigeria (CBN) and the Economic and Financial Crimes Commission (EFCC).

Advertisement

Other agencies participating in the committee are the National Information Technology Development Agency (NITDA) and the National Human Rights Commission (NHRC).

Irukera said that the committee would also be writing provisional regulations for the money lending companies.

“The joint committee is meeting and agreeing on how to proceed, but I can say that two of the entities of the joint committee will be going on the field and doing enforcement work now, very shortly,” NAN quoted Irukera as saying.

Advertisement

“They will be closing down businesses and engaging App stores to shut down certain applications that are infringing and abusive.

“We are also going to be writing interim regulations and some basic information for all these money lenders to provide information so that people will know who they are.

“Some of them are just apps that we do not even know who the promoters are.

“So we are going to provide certain frameworks for them to comply with before doing business.”

Advertisement

On the increasing number of consumer complaints about services by insurance companies, Irukera said that the commission was progressing in their memorandum of understanding (MoU) with the National Insurance Commission (NAICOM).

According to him, it is anticipated that as the MoU will be completed early next year, there will be more industry-wide interventions in that space.

“We get a lot more complaints about the insured who have paid their premium and have not been settled, and so we are engaging NAICOM on that,” he said.

Advertisement