The Nigeria Tax Act (NTA) has granted the finance minister the authority to determine the take-off date for the 5 percent surcharge on petroleum products.

A surcharge is an additional charge, fee, or tax added to the cost of a good or service beyond the initially quoted price.

On July 25, TheCable reported that the new tax law imposed a 5 percent surcharge on chargeable fossil fuel products.

The Act stipulates that the surcharge will apply to a “chargeable transaction” such as the supply, sale, or payment for the product, “whichever occurs first”.

Advertisement

The tax law said the surcharge will be calculated based on the retail price of all chargeable fossil fuel products.

According to provisions of the Act, the Federal Inland Revenue Service (FIRS) — which will rebrand as the Nigeria Revenue Service (NRS) when the law takes effect next year — will administer and collect the surcharge on a monthly basis.

However, the commencement date of the new policy is subject to the decision of the finance minister.

Advertisement

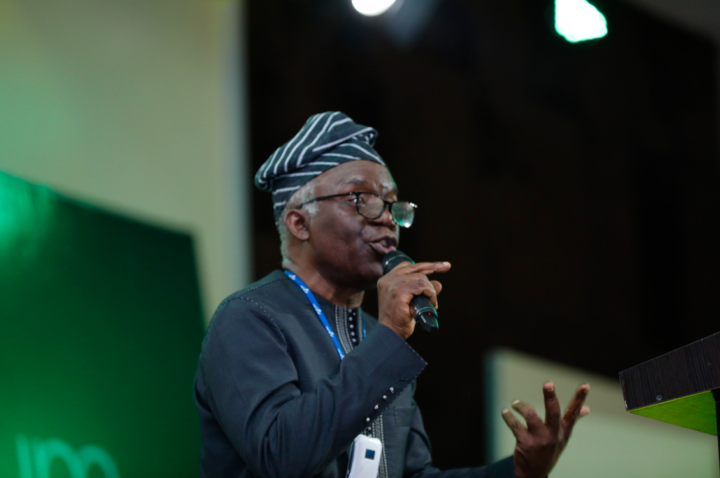

First appointed as President Bola Tinubu’s special adviser on monetary policies, Wale Edun is Nigeria’s current minister of finance and coordinating minister of the economy.

“The Minister may by an Order issued in the Official Gazette indicate the effective date of commencement of the administration of the surcharge on fossil fuel products under this Chapter,” the Act said.

“The Service shall administer and collect the surcharge on a monthly basis and may issue regulations for its administration.”

The law, however, noted that the surcharge will not apply to clean or renewable energy products, household kerosene, cooking gas, and compressed natural gas (CNG).

Advertisement

The NTA is among four tax reform bills signed into law by Tinubu on June 26.

The others are the Nigeria Tax Administration Act, the Joint Revenue Board (Establishment) Law, and the Nigeria Revenue Service (Establishment) Act.

The laws are expected to take effect from January 1, 2026.