The Federal Inland Revenue Service (FIRS) has directed banks to deduct withholding tax from all interest payments on short-term investments securities.

Withholding tax is an advance tax deducted at source from certain types of payments made to individuals or companies.

The tax, often withheld by the payer and remitted directly to the relevant tax authorities, is charged at different rates depending on the type of payment.

According to the FIRS, withholding tax is applicable to rents on properties at 10 percent, dividends and profits from companies (10 percent), interest on bank deposits or securities (10 percent), and royalties (5 percent).

Advertisement

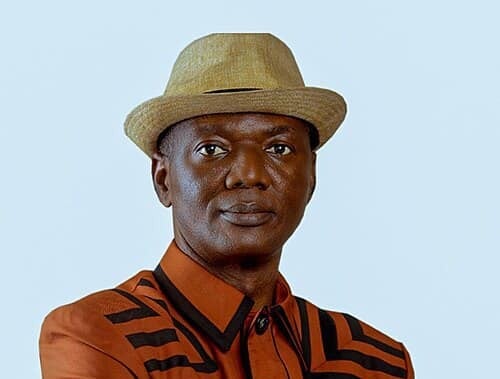

In a public notice dated September 19, 2025, Zacch Adedeji, chairman of the FIRS, said the directive applies to banks, discount houses, stockbrokers, corporate bond issuers, primary dealer market makers (PDMMs), government agencies, tax practitioners, and the general public.

Adedeji said the tax must be deducted from interests payable to any person, including non-corporate entities, on the date of payment.

“Sections 78(1) and 81(1) of the Companies Income Tax Act (CITA), (as amended), and the Deduction of Tax at Source (Withholding) Regulations, 2024 provide that tax be deducted from interests payable to any person (including non-corporate entities) on the date of payment,” the taxman said.

Advertisement

“Accordingly, tax shall be deducted from all interest payments on investments in short-term securities on the date of payment at the applicable rate.

“The tax shall be deducted and remitted to the relevant tax authority not later than the 21st day of the month following the month in which the payment occurred.”

The FIRS chief said persons from whom such taxes are deducted are entitled to a tax credit equal to the amount withheld and remitted, except where the deduction represents a final tax.

The notice clarified that interest on open market operation (OMO) bills issued by the Central Bank of Nigeria (CBN) is not liable to tax deduction, noting that federal government bonds remains exempted.

Advertisement

“Short-term securities include (but not limited to) government bonds, treasury bills, promissory notes, corporate bonds, financial papers, bills of exchange, etc,” the notice added.

The FIRS urged all relevant interest-payers to comply with the directive to avoid penalties and interest charges as stipulated in the tax law.

Nigeria is currently overhauling its tax architecture with the introduction of new rules to boost revenue and strengthen its fiscal position.

President Bola Tinubu had, on June 26, signed four tax reform bills into law.

Advertisement

The new tax laws are expected to take effect from January 2026.

Advertisement