The Federal Inland Revenue Service (FIRS) has inaugurated an inter-agency steering committee to lead the national electronic invoicing (e-invoicing) solution.

The committee includes the Nigeria Inter-Bank Settlement System (NIBSS), office of the accountant-general of the federation, the Nigerian Customs Service (NCS), ministry of industry, trade and investment, the National Bureau of Statistics (NBS), the Nigerian Ports Authority (NPA), and private sector participants such as MTN, Seplat, United Bank for Africa (UBA), and Huawei.

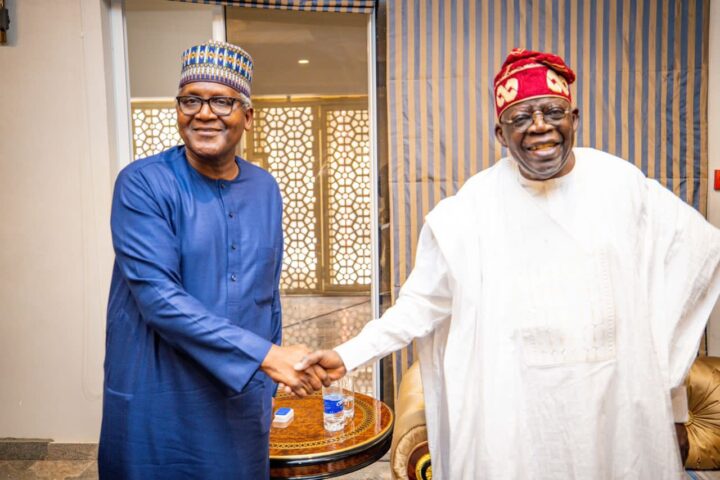

Tayo Koleosho, chief of staff to Zacch Adedeji, FIRS chairman, gave a welcome speech at the inaugural event on Tuesday.

Koleosho said the development phase of the e-invoicing system had been completed, and the pilot implementation was about to begin.

Advertisement

He said the system was developed through collaboration with key institutions and sectors, which is why the committee was set up.

“The Inter-Agency Steering Committee we are inaugurating today has been carefully conceived to provide high-level guidance, facilitate cross-agency coordination, and ensure that the e-invoicing solution is robust, practical, and sustainable,” he said.

“Your presence here and the calibre of professionals nominated by your agencies underscore the importance you place on this initiative and your shared commitment to a more transparent and accountable fiscal system.

Advertisement

“On behalf of the executive chairman and the entire leadership of FIRS, I want to sincerely thank you for honouring our invitation and for your continued support.

“We look forward to a productive engagement and to working closely with each of you as we move from vision to execution.”

‘E-INVOICING IS NOT COMPLETE WITHOUT PAYMENT INTEGRATION’

Sadiq Arogundade, technical lead for the national e-invoicing project, said the system had been tested by taxpayers, who had generated electronic invoices and connected to the local invoice interchange.

Arogundade said the project could not be fulfilled without integrating payment processes.

Advertisement

“Because when you generate an invoice, payment fulfilment has to happen, and that’s what is calculated as revenue for us,” he said.

“The e-invoicing system is not a payment fulfilment system; it is just a data-driven system. It allows businesses to report data to us, so we can have a transparent economy, create global digital competitiveness, and also accelerate investment attraction into the country, because our country now becomes more transparent and open in the way we do business.

“Countries that also have a money market engine and factoring companies can come into our country and fulfil invoice payments on our behalf, which allows us to drive in more foreign exchange into the country.

“There is no doubt in doing business with businesses in Nigeria because the government now stands for every business that is integrated into the e-invoicing system.

Advertisement

“To speak on where we are today, the system has been done; it is ready. It’s an API system; we did not build any commercial solution on it. What we have done is just build an API, and our API is not complete if we don’t have customs integrated into it, and we don’t have NIBSS as part of it, and we don’t have the office of the accountant-general.”

Arogundade said they planned to harmonise the system to have a single unique identifier for debit notes, credit notes, and proforma invoices.

Advertisement

“It is not just about having a description of the transaction for NIBSS or having the amount; we are also trying to keep an intelligence of the reason why I have transferred 100 million naira to the other party, so we also have that transparency to enable and enrich the data that exists with the Nigerian Financial Intelligence Unit today, and that’s why we’re here today to have that collaboration,” he said.

Arogundade said the system is being standardised to align with Nigeria’s digital public infrastructure (DPI) framework, with NIBSS ensuring payment compliance and enabling cross-border efficiency.

Advertisement