The Federal Inland Revenue Service (FIRS) says it has inaugurated a national intelligence gathering system to gather data and track tax evaders and defaulters across the country.

According to a statement released by Abdullahi Ismaila, the FIRS director of communications and liaison department, the tracking system will be used in collaboration with financial institutions and anti-corruption agencies including the Independent Corrupt Practices and Other Related Offences Commission (ICPC).

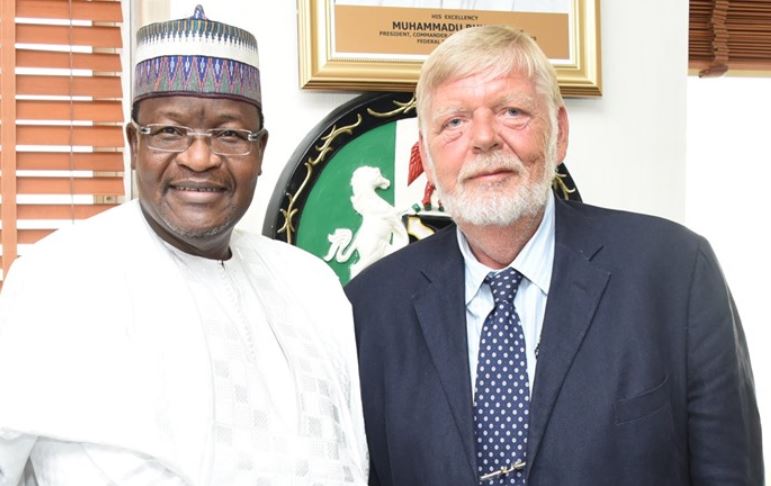

During a visit to the ICPC on Wednesday, Mohammed Nami(pictured), executive chairman of the tax agency, said the new system will bring tax evaders to book and make them pay their fair share of taxes.

“The ICPC is our critical stakeholder. We are improving our collaboration with the commission to track tax fraud and block all revenue leakages to ensure that we raise the revenue for the government to fund its budget,” Nami told Bolaji Owansanoye, ICPC’s chairman.

Advertisement

“We need the data and intelligence which you have to help us track tax evaders and bring them into the tax net.”

He said the service is also restructuring and revamping its system to enable it to surpass its 2020 revenue target.

Advertisement