After postponing the monetary policy committee (MPC) meeting twice in the second half of 2023, the decision-making body of the Central Bank of Nigeria (CBN) will finally meet on February 26 and 27.

In September and November 2023, CBN postponed the MPC meeting without giving a reason.

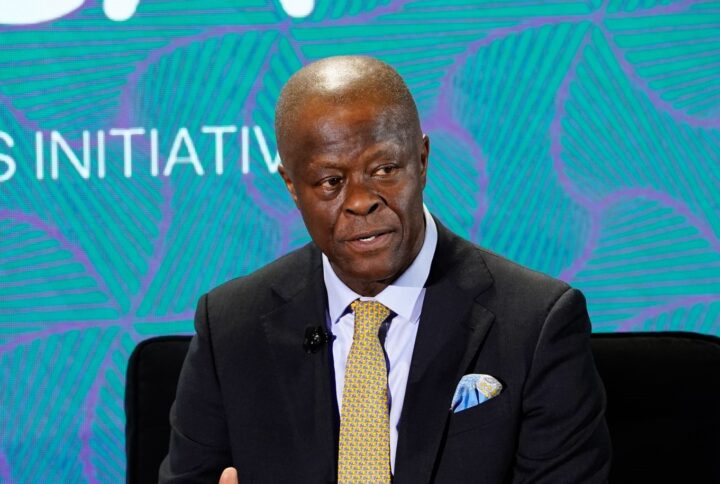

This would be the 293rd MPC meeting, but the first to be held during the tenure of Yemi Cardoso, CBN governor.

Ahead of the meeting, the senate, on February 22, 2024, confirmed Cardoso as MPC chairman.

Advertisement

The lawmakers also confirmed four deputy governors of CBN and seven others as MPC members.

At the last meeting in July 2023, the MPC, headed by Folashodun Shonubi, the former acting governor of the apex bank, increased the monetary policy rate (MPR) by 25 basis points to 18.75 percent, from 18.5 percent in May last year.

The monetary policy rate (MPR) is the benchmark interest rate used by commercial banks to disburse loans to businesses and individuals. A decrease in the MPR cuts the cost of credit and an increase raises the cost of borrowing.

Advertisement

Giving their projections, some analysts said they expect MPC to increase the MPR, however, they questioned the effectiveness of such measure due to underlying structural issues.

INVESTORS, ECONOMIC FRAGILITY BE CONSIDERED WHEN REVIEWING RATES

Abiodun Keripe, managing director of Afrinvest Research and Consulting Limited, said he believes the committee would increase the MPR rate further.

According to Keripe, this move has its pros and cons on the economy.

Advertisement

“If the MPR is increased further, it would improve Nigeria’s investment portfolio which would help to support the liquidation of the naira. However, the subsectors of the economy might struggle as the economic growth is weak. This would also increase the cost of capital for businesses,” Keripe said.

Speaking on how the committee can improve the effectiveness of their measure, he said they need to consider issues like the ways and means.

He said while the CBN tries to curb inflation by increasing the MPR, “they still go behind the scenes to expand the ways and means to the federal government which is used to fund the budget deficit”.

“I believe if the committee wants to increase the rate and curb inflation, they must block loopholes and avoid wastage,” he said.

Advertisement

On his part, Ayokunle Olubunmi, head of financial institutions ratings at Agusto & Co., said the majority of Nigeria’s economy is more of a fiscal issue and not a monetary problem.

“I look forward to seeing what the MPR would look like. There has been speculation that the MPR would be increased by 300 to 400 basis points,” the analyst said.

Advertisement

“It would be interesting to see what the CRR and MPR rates would be like as well as tell us where the foreign exchange challenge is from and what is being done to control the rates.

“However, a broad range of our issues are from the fiscal sector and not the monetary side. There is little or nothing to be done if both parties work hand in glove to ensure that the issues faced in the economy are minimised.

Advertisement

“Without effective collaboration between both, all policies made by the MPC will have no effect.”

On expectations of the new committee, Olubunmi said giving any projections would be like shooting in the dark because “we don’t know their thought process or stance of each of them on the state of the economy”.

Advertisement

Also, Abiodun Folawewo, a professor of Economics at the University of Ibadan, said policies from the MPC are not an issue to be concerned about.

The professor said tackling the root causes of inflation, which are seen as more structural than purely monetary.

Folawewo also said he expects the new monetary policy committee to clarify its approach and learn from past experiences.

He said: “The interest rate, MPR, is not in any way going to affect the major issues of the economy. The issues faced such as high inflation is more of a structural issue and until this is addressed, whatever decision made by the committee will still not have any new effect. The MPC cannot control what we do not have.”

“However, I would like to find out what new things the committee has. From the past scenario, what have they learnt and why past decisions were not effective? These are the things the new committee should ask themselves and give answers to the public.”

‘PERIODIC ENGAGEMENTS WITH STAKEHOLDERS, BANK TO IMPROVE MPC OUTCOME’

Giving his perspective, Olusola Ore-Oyeniku, head of research and strategy at Greenwich Merchant Bank, stressed the need to have consistent engagement with stakeholders, especially the banks to improve the outcome of the MPC meeting.

He also said the MPC will be expected to clearly outline the strategic next steps to consolidate the existing wins, attain price stability and moderate exchange rate volatility.

“The decisions around currency stability should be of paramount importance in the MPC’s pronouncements to emphasise the CBN’s unyielding appetite to rein in on the galloping inflation rate and naira devaluation,” Ore-Oyeniku said.

“Notably, the 96.3 percent FX devaluation (i.e., from N741.50/$ as at July 3rd 2023 compared to N1,455.59/$ of January 31st 2024) has contributed to the huge rise in inflation rate which stood at 29.9 percent as at the end of January 2024 compared to 24.08 percent in July 2023.

“So, increasing the rate would further reinforce governments’ interest to increase foreign investments, aggressively build capital inflows and reduce the negative real returns.

“We expect that the MPC, at its initial policy meeting in 2024, will be decisively hawkish regarding interest rates given the CBN’s commitment to achieving price stability and moderate currency volatility.

“Hence, we anticipate an increase of 100 basis points to 250 basis points at the end of its February 2024 meeting, however, there is the need to increase the policy rate by circa 300 basis points by H1, 2024.

“This is so that the negative real return on investments will reduce significantly as the government is interested in bringing in foreign investments.”

In addition, Ore-Oyeniku said periodic discussion on expectations around the cash reserve requirement (CRR) and liquidity ratio of the banks, if introduced, will improve the robustness of the policy meeting, as well as periodic engagement with banks is important in improving the outcome of the MPC.