Forte Oil Plc is maintaining profit recovery for the third year running despite that growth slowed down in the third quarter. The full year outlook indicates further improvement in profit after an outstanding growth of 432% last year. The company is in the third year of recovery, which is supported by both growing sales revenue and a gain in profit margin.

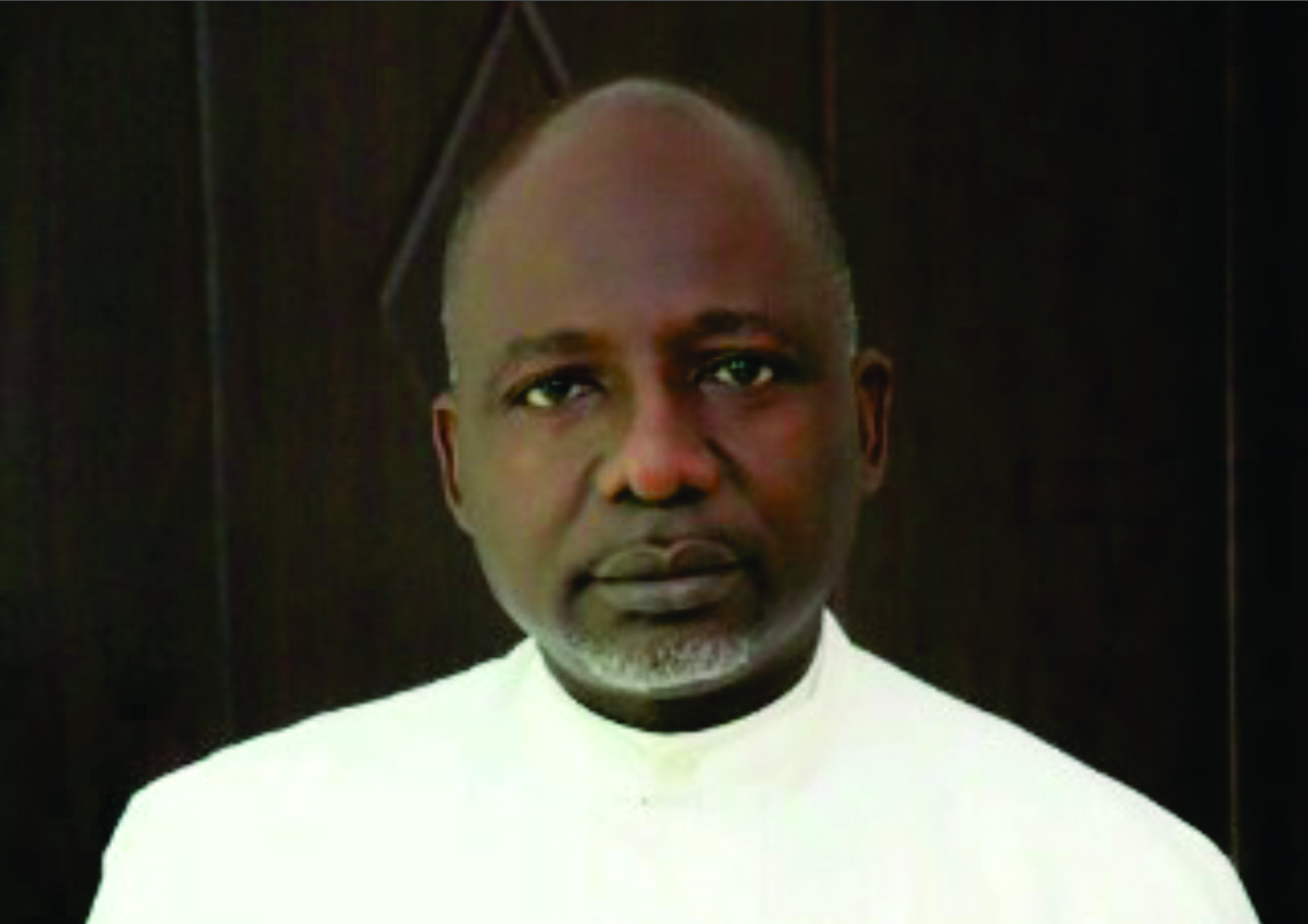

Mr. Akin Akinfemiwa, the company’s managing director/chief executive officer, has taken steps to put the company on a recovery and growth pedestal. These include recovery in market share, ending four years of sustained drop in turnover and growing sales revenue once again. He has also improved profit margin to one of the highest in the petroleum marketing sector. This means the company is now converting an increased proportion of growing revenue into profit.

The company reported a year-on-year growth of 33.1% in turnover to N122.58 billion at the end of the third quarter, accelerating from N79.61 billion in the second quarter. Based on the current growth rate, turnover is projected at N166.4 billion for Forte Oil in 2014. That will be an increase of 30% over the sales revenue figure of N128.03 billion in 2013. Revenue grew for the first time since 2009 last year at 40.7% after a sustained drop.

Forte Oil is expected to sustain profit recovery and growth for the third year this year with a new peak likely. It ended the third quarter with after tax profit of N4.02 billion, which is an increase of 46.7% over the same period last year. This is a slight slowdown from the profit figure of N3.13 billion in the second quarter.

Advertisement

Based on the current growth rate, the full year after tax profit is expected to stand in the region of N5.4 billion for Forte Oil in 2014. This will be an increase of 8% over the full year profit figure of N5.0 billion in 2013 and slightly ahead of the its peak profit of N5.10 billion in 2008. After tax profit had grown by 432% in 2013, marking a strong return to profit after a virtual break-even in 2012. The company made huge losses in the preceding three years to 2011.

Apart from improving revenue, management is also making progress in rebuilding profit margin. Net profit margin has improved from 1.0% in 2012 to 3.9% in 2013 and from 2.9% in the third quarter of last year to 3.3% this year. At 3.3%, Forte Oil is second to Mobil Oil Nigeria’s 9.9% net profit margin within the petroleum marketing group at the end of the third quarter.

The gain in profit margin follows both the strong growth in sales revenue and moderated growths in operating costs. Cost of sales grew slightly below turnover at 30.7%, which improved gross profit margin. At N109.28 billion, cost of sales represented 89.1% of turnover at the end of the third quarter, down from 90.7% in the same period last year. Gross profit margin therefore improved from 9.2% to 10.9% over the review period. This permitted a rise of 55.9% in gross profit to N13.29 billion at the end of the third quarter.

Advertisement

Another favourable cost behavior came from distribution expenses, which declined by 4.6% to N2.12 billion during the period. Administrative expenses also moderated slightly relative to revenue at an increase of 31.7% to N5.67 billion. Net interest cost however advanced by 146.1% to N1.15 billion following a rise of 211.6% in short-term borrowings. A major drawback on the side of revenue is a drop of nearly 50% in other income during the review period.

The high rise in short-term borrowings follows persisting cash flow pressures the company is experiencing. Net cash from operating activities dropped into negative N3.62 billion at the end of the third quarter against a positive figure of N7.77 billion in the same period last year. Further pressure on cash resources came from investing activities with the acquisition of plant and equipment worth about N4.0 billion.

The company earned N2.04 per share at the end of the third quarter, down from N2.52 in the corresponding period last year. The decline is due to increased volume of shares during the review period. Based on the projected profit for owners of the company, earnings per share is projected at N2.64 for Forte Oil in 2014.

Forte Oil Plc: 3rd Quarter Earnings Report |

|||

| Sept 2014 | Year-on-Year Growth -% | Full Year Projection Nb | |

| Turnover – Nb | 122.58 | 33.1 | 166.4 |

| Asset Turnover | 1.0 | – | – |

| After Tax Profit – Nb | 4.02 | 46.7 | 5.4 |

| Net Profit Margin – % | 3.3 | – | 3.2% |

| Earnings per Share – N | 2.04 | -19.1 | N2.64 |

| Dividend-N [2013] | 4.0 Ex Div | – | – |

| NSE Closing Price 28/11/14 – N | 222.0 | – | – |

| Share Price Year-to-Date – % | +127.1 | – | – |

Advertisement