BY OGUNGBILE EMMANUEL OLUDOTUN

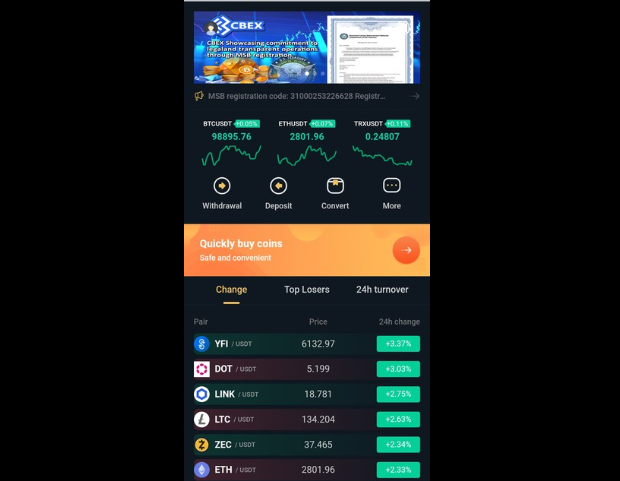

The tears are fresh once again. This time, they are flowing from victims of CBEX, a now-defunct digital asset trading platform that promised financial miracles but delivered heartbreak. Nigerians have woken up to the reality that over ₦1.3 trillion may have been lost to yet another fraudulent scheme, adding to the ever-growing graveyard of collapsed Ponzi ventures.

CIBEX had pledged an incredible 100% return on investment within just 30 days. To a population worn down by economic hardship, staggering inflation, and low wages, this promise seemed like a lifeline. But it was a lie dressed in glamour and digital sophistication.

The story of CIBEX might appear new to some, but it is merely a remix of an old, painful song. From MMM to Ultimate Cycler, from Loom to Racksterli, and a long list of forgotten platforms, Nigeria has seen this movie too many times. The names may change, the platforms may look more polished, but the script remains the same: an unsustainable offer is made, early participants are paid from the contributions of new investors, testimonies flood social media, and before long, the platform crashes. Investors are left stranded, and the masterminds vanish into thin air.

Advertisement

So why do Nigerians keep falling for the same trap? It is a combination of desperation, ignorance, misplaced trust, and systemic failure. Many Nigerians are looking for shortcuts out of poverty in a country where legitimate opportunities seem reserved for a privileged few. The idea of doubling your money in 30 days sounds far more appealing than toiling for years with little to show. Financial literacy is still sorely lacking, even among educated individuals.

Many do not understand how real investments work, and when confronted with unrealistic offers, they lack the tools to critically evaluate them. Moreover, trust is often placed not in the platform itself but in the people who promote them; friends, church members, influencers, creating a dangerous echo chamber where doubt is dismissed and questions are discouraged.

CIBEX, like others before it, operated as a fastest-finger game. Those who got in early reaped fake profits and became unpaid ambassadors, luring more people into the trap. The game relies on speed, on hype, on silence, and most importantly, on ignorance. When it inevitably collapses, the same cycle unfolds, denial, anger, and finally, bitter acceptance. By the time victims begin to understand what happened, the damage is done. Savings are gone, school fees lost, businesses destroyed, and in some tragic cases, lives are lost through suicide or severe mental breakdowns.

Advertisement

The consequences go beyond the financial. They erode public trust, destabilise families, and discourage investment in genuine opportunities. The trauma stays with victims for years, making them either completely averse to financial risk or, ironically, even more vulnerable to the next scheme in a bid to recover lost funds.

Government agencies, especially the SEC and EFCC, have often failed to act until it is too late. Many of these platforms operate in plain sight, using social media ads and influencer partnerships to build credibility. Yet there is no swift regulatory response, no early warning system, no visible crackdown until the collapse occurs. And even when they do move in, convictions are rare, and stolen funds are almost never recovered. This lack of accountability has made Ponzi schemes a low-risk, high-reward crime for fraudsters.

What Nigeria needs is a deliberate, sustained response, one that goes beyond post-crisis reactions. Financial literacy must be embedded into school curricula and adult education. Communities need to be sensitised using grassroots media, traditional leaders, and religious platforms. There must be collaboration between the tech space and regulators to identify and shut down suspicious activity before it gains traction. And perhaps most importantly, Nigerians must begin to reject the culture of “fast money” and return to the virtues of patience, diligence, and sustainable growth.

The CIBEX tragedy is only the latest in a long line of financial wounds. But it could be a turning point if we choose to learn from it. Or we can continue the cycle, from platform to platform, from hope to heartbreak, from brief riches to the sickbed of regret.

Advertisement

Ogungbile Emmanuel Oludotun can be contacted via [email protected]

Views expressed by contributors are strictly personal and not of TheCable.