Citizen Monitors, a civic group focused on electoral and public accountability, has urged the federal government to ensure clear communication and protect household budgets amid the implementation of the new tax legislation.

In June, President Bola Tinubu signed the four tax reform bills into law.

The four proposed laws are the Nigeria tax bill, the Nigeria tax administration bill, the Nigeria revenue service (establishment) bill, and the joint revenue board (establishment) bill.

The Tax Act mandates a five percent fossil fuel surcharge on petroleum products, effective from January 2026.

Advertisement

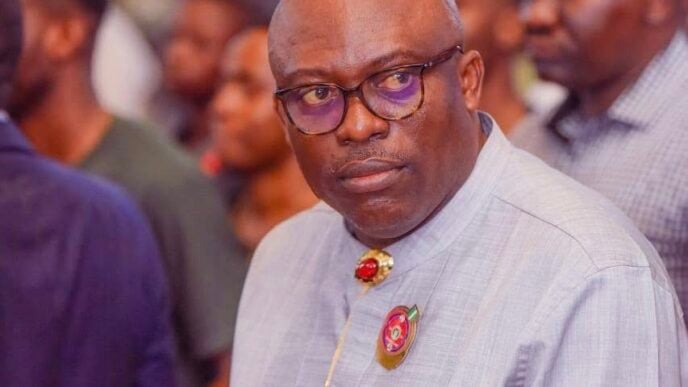

In a statement on Monday, Adeshope Haastrup, co-founder of Citizen Monitors, said while the reform is welcomed, there is a need for transparency to prevent public confusion and panic.

“Reform is welcome only if people understand it and can plan ahead,” Haastrup said. “Without clarity, even good policy causes fear. The public needs facts, not rumours.”

He called on the government to publish a plain-English guide that clearly explains “what is changing, what remains the same, and when these changes will take effect”.

Advertisement

Haastrup said the guide should include a “simple timeline to January 2026, frequently asked questions tailored for common jobs and small businesses, and a public helpline or portal for quick answers”.

He said this would help avoid the weekly trickle of rumours and panic that often accompanies major policy shifts.

Haastrup also emphasised the need to protect household budgets by reminding the public that the value-added tax (VAT) will remain at 7.5 percent, and that zero-rated essentials such as food, books, medicines, and some energy items must remain affordable in real shops and markets.

He said regulators should actively monitor prices to prevent fake VAT increases at checkouts, which could unfairly burden consumers.

Advertisement

Haastrup urged the government to ease the transition for workers and small businesses by publishing updated pay as you earn (PAYE) tables early and providing small and medium-sized enterprises (SMEs) with an easy onboarding window into the new e-invoicing and fiscalisation system.

“Make the rollout simple for workers and small businesses. Publish the updated PAYE tables early and give SMEs an easy onboarding window into the new e-invoicing/fiscalisation system without retroactive penalties during transition,” he said.

“Clear steps and free toolkits will raise compliance and reduce fear. As rollout begins, Citizen Monitors will track and report the real-life impact of the changes, helping Nigerians see what is working and where more clarity or correction is needed.”

Advertisement