It’s been a full month since the Central Bank of Nigeria (CBN) floated the naira. For that whole month, I monitored the local currency across all the markets, noticing every little change and quiet policy step. For instance, did you know that the CBN has now removed the foreign exchange rate from the landing page of its website?

On Monday, the apex bank updated its website to announce the upcoming Monetary Policy Committee meeting scheduled for next week. It will be the first meeting without Godwin Emefiele, the suspended CBN governor. In line with that update, the bank also updated the foreign exchange rates but removed the details from the landing page. While you can still see the rates, if you look for them, it is no longer business as usual, where you see them without deliberately looking for them.

That is not our focus today. Our focus today is to evaluate the naira float — five weeks after the policy was announced. For context, on June 14, 2023, CBN instructed the banks to “sell forex freely at market-determined rates”. By the next day, the bank had released some guidelines on the rate unification promised by President Bola Tinubu. So what has happened in one month?

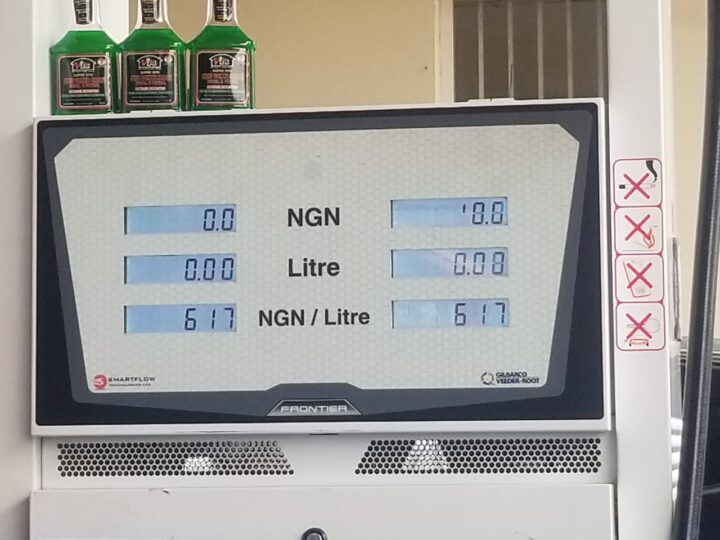

First, the naira has depreciated from 463 to the dollar at the official side of the market to 772.3 to the greenback as of Monday, July 17, 2023. This is the biggest official depreciation in recent times. In that month also, the local currency experienced some sort of rate convergence at 756 to 760 per dollar. As expected, the parallel (or not-so-parallel) market sold the dollar as high as N800/$1. Last Friday, the I&E window also closed at N803.9 to the dollar — the weakest rate since the float.

Advertisement

THE GAINERS

In my previous articles about the policy, I have highlighted those I believed would gain from the policy and those who will be hurt by the floating naira. One great group I did not envisage were the bankers! Though I had predicted that we would see record inflows into the country, I did not see much of that going to the banks.

The banks are however having a good half year, thanks to the month of June and the float of the naira. For the first time ever, Zenith Bank crossed the N1 trillion mark as its share price rose by over 3% after the devaluation to trade at N32 per share. The share price went as high as N35.25 in early July, before cooling down to about N34 on Tuesday morning.

Guaranty Trust Bank (GTCo) also crossed the N1 trillion Market cap when its share price crossed the N34 mark to sell as high as N36.70 per share. While UBA is far from the N1 trillion mark, the bank has gained more than 100 billion in market cap since the naira float. Most of the big banks have recorded similar gains.

Advertisement

While banks with dollar exposure (in debt or other liabilities) may have a hard time, they generally seem to be in a better place, thanks to the local currency float.

Also on the list of gainers are states and state governors. I had predicted that states will share as high as N1.1 trillion in FAAC payments in the month following the float. In June, they shared N786 billion as the Federation Account Allocation Committee (FAAC) adopted N436.38/$ at the June meeting to the dismay of many governors. For July, the case will be different and the governors will supervise a huge payout.

Did you hear that you can now pay as much as $500 for foreign goods and services using your naira card? For many Nigerians, that is a win. People just wanted the ability to pay for Google services, Netflix, YouTube, Apple, Spotify, and Amazon Prime subscriptions using their naira card. That is back now, and we will take that as a win, even if we have to pay more.

…AND LOSERS

As far as losers go, the first set of losers — in the interim — are the Nigerian people; the students who had gathered tuition to pay for school abroad at N463 per dollar using form A. They now suddenly have to pay 50% to 60% more for the same service.

Advertisement

I have seen a lot of those in the last month. Even online courses and other things that define Nigeria’s lower middle class have all seen an increase in price over the last month. Most Nigerians know what they’ve lost in the last month.

WHAT THE NUMBERS SAY ABOUT THE FUTURE?

The numbers are not looking great. In the one month I have spent monitoring the flow, it has become apparent that the dollars are drying up. On Monday, the liquidity in the I&E window hit a new low. On July 3, 2023, $263 million was traded by investors and exporters. That number dropped to $97.69 million a week later. As of Monday night, that was now down to $34.55 million.

The nation’s foreign reserves have also been on a decline. In the past month, foreign reserves have declined by about $800 million, which is not unusual, but rather unconventional at a time the country is expecting a lot of inflow due to naira float.

Conventional economics is back; but at a price. The float frenzy and multiple commendations are gradually coming to an end, at least the numbers suggest so. For Nigeria to keep benefiting from the float, we need more policy guidelines, direction and strategy implementation. Investors are waiting and watching.

Advertisement

You can reach ‘Mayowa on Twitter @OluwamayowaTJ

Advertisement