Heritage Oil has agreed a £924m cash takeover offer from a Qatari investment vehicle owned by the gas-rich Gulf state’s former prime minister.

The FTSE 250 Jersey-based company, whose main oil production is in Nigeria, said it was recommending the 320p a share offer from Al Mirqab, the equivalent of a 25 per cent premium on its closing price on Tuesday.

Heritage, founded by Anthony Buckingham, also produces oil in Russia and has exploration assets in Papua New Guinea, Tanzania, Malta, Libya and Pakistan.

Mr Buckingham, Heritage’s chief executive and largest shareholder with a 34 per cent stake, has agreed to remain as an adviser and retain a 20 per cent holding for at least five years.

Advertisement

Al Mirqab is owned by Sheikh Hamad bin Jassim Al Thani, the country’s influential former prime minister and former chief of Qatar’s sovereign wealth fund, and his family in a private capacity.

Al Mirqab said the acquisition provided “access to a high-growth, producing asset base in Nigeria and a diverse international exploration portfolio”.

Sheikh Hamad, one of Qatar’s richest men and a renowned global investor, stepped down from his official roles when the former emir, Sheikh Hamad, abdicated in favour of his son, Sheikh Tamim, last year. Since then, Sheikh Hamad, known as HBJ in banking circles, has kept a low profile.

Advertisement

The deal between the Qatar’s former prime minister group and Heritage is the second this month targeting Nigeria by an investment company.

Earlier this month, Temasek, the S$215bn (US$171bn) state-backed investment arm of Singapore, paid $150m to become one of the largest shareholders in Seven Energy, a Nigeria-based oil and gas company.

Ex-mercenary Anthony Buckingham appears to have snatched a measure of victory from the jaws of defeat by selling his business Heritage Oil to a prominent Qatari for £924m.

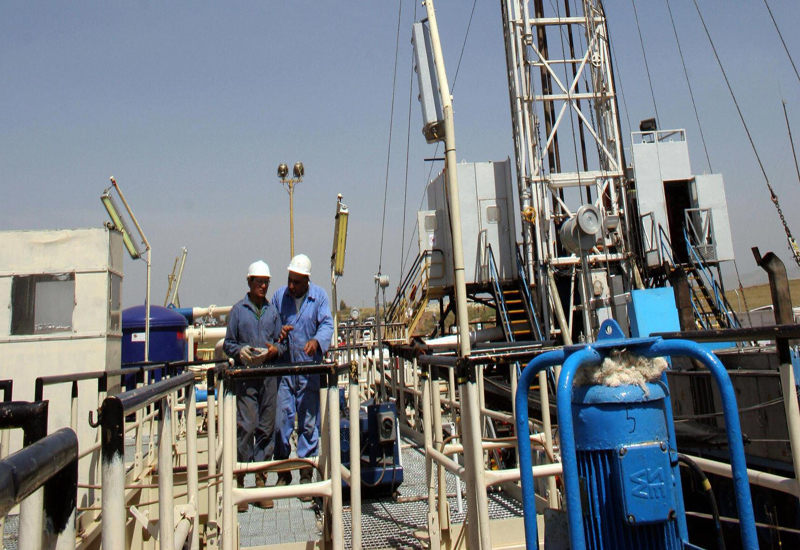

Heritage, which has previously profited from the quick buying and selling of exploration assets in Uganda and the Kurdistan region of Iraq, announced an $850m investment in onshore assets in Nigeria previously held by Royal Dutch Shell, Total and Eni less than two years ago.

Advertisement

The deal established Heritage as one of an increasing number of smaller oil companies, which also includes London-listed Afren, that have acquired underperforming Nigerian fields alongside local partners under a policy of indigenisation of the state’s oil industry. That trend has also seen oil majors reduce their exposure to the country.

Analysts at Mirabaud Securities said the offer implied a premium to the price paid by Heritage to acquire its Nigerian oil assets alongside its local partner Shoreline Power. “Not for the first time in its history it appears that Heritage’s management have proven adept at securing an impressive sales price for its shareholders,” they said.

However, Mark Henderson, analyst at Westhouse Securities, suggested that the offer price offered only a modest premium to his own conservative valuation of 300p a share. “We believe that this offer highlights the huge challenges and uncertainties involved in operating onshore in Nigeria and potential market volatility that will be caused by ongoing security issues with infrastructure leading to significant potential production delays,” he said.

Shares in Heritage rose 22 per cent to 313p.

Advertisement

– Finincial Times

Advertisement