Nigeria has finally solved its revenue crisis. Forget oil theft. Forget billionaires hiding money in Dubai.

From January 2026, sex workers, popularly called “hookup girls” or “run girls”, will be required to pay tax under the federal government’s new tax reforms. Yes, you read that correctly — the government now wants prostitutes to file tax returns.

Nigeria has officially become the only country where you can go to jail for prostitution in the morning and then get a tax bill for it by evening.

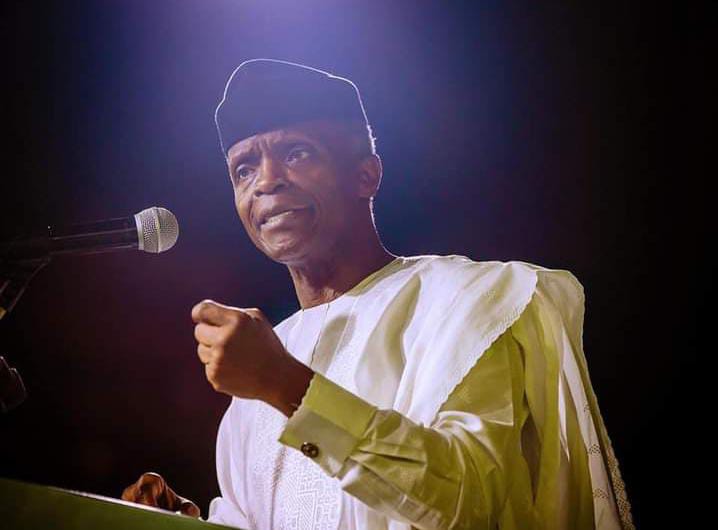

President Bola Tinubu’s tax reform lead, Taiwo Oyedele, who chairs the Presidential Committee on Fiscal Policy and Tax Reforms, explained that the new tax law makes no distinction between legitimate and illegitimate sources of income.

Advertisement

Speaking at the Redeemed Christian Church of God, City of David parish in Lagos — yes, he announced this in church — Oyedele told the congregation that anyone earning money for services rendered will be taxed, including those engaged in sex work.

“If somebody is doing ‘runs’, they go out to meet men and get paid for sex – that’s a service,” Oyedele said. “They will pay tax on it.”

Imagine standing in the City of David parish on a Sunday morning and hearing, “If you are doing runs, you will pay tax.” I half-expected him to add, “Please pay your tithe first, then your tax.”

Advertisement

I’m still waiting for the altar call where ushers hand out tax clearance certificates instead of envelopes

My reaction to this development? This is where tax policy meets reality, and the collision is both logical and absurd in equal measure.

Let me start by saying the logic is sound from a purely economic perspective. The law doesn’t separate whether what you’re doing is legitimate or not. It simply asks: Did you earn an income from providing a service or selling a product? If yes, then you pay tax. This principle makes sense — governments worldwide tax illegal income, which is why drug dealers and gangsters often get caught for tax evasion rather than their primary crimes.

The United States famously jailed Al Capone not for bootlegging or murder, but for tax evasion. The principle is simple: you can’t enjoy the protection and services of the state without contributing to its coffers, regardless of how you make your money.

Advertisement

But here’s where logic meets Nigerian reality and things get complicated. How exactly does the government plan to enforce this? Will there be tax collectors stationed outside hotels? Will sex workers be issued tax identification numbers and invoices? Will there be a special tax office for “adult entertainment services”?

Come to think of it, prostitution is illegal in Nigeria. So the government is essentially saying, “We know you’re breaking the law, but please pay your taxes on your illegal earnings.” This is like a thief being told to declare stolen goods for tax purposes. The cognitive dissonance is staggering.

The announcement in a church setting adds another layer of irony. Oyedele stood in a house of God to announce that the government will be taxing sexual immorality. I wonder what the congregation was thinking. Were they nodding in approval at the expansion of the tax net, or were they uncomfortable with the implicit recognition of prostitution as a legitimate business?

Beyond sex workers, the law will also cover social media influencers, freelancers, and remote workers who earn in naira or foreign currencies.

Advertisement

This part makes more sense and is long overdue. Many influencers and digital workers have been operating in the informal economy, earning substantial incomes without contributing to the tax system.

But let’s return to the sex work question because it raises fundamental issues about tax policy and morality. If the government is going to tax prostitution, isn’t it implicitly legitimising it? You can’t tax something while simultaneously criminalising it without creating a moral and legal contradiction.

Advertisement

This is where Nigeria’s approach differs from countries that have decriminalised or legalised sex work. In places like the Netherlands, Germany, or New Zealand, sex workers pay taxes because their work is legal and regulated. They receive health services, legal protection, and social benefits in return for their tax contributions.

In Nigeria, we want the taxes without providing any of those protections.

Advertisement

We want sex workers to contribute to the state while the same state criminalises their existence. That’s having your cake and eating it, too.

The practical challenges are enormous. How will the Federal Inland Revenue Service (FIRS) identify and track sex workers? Will there be a registration process? What happens when someone refuses to identify themselves as a sex worker for tax purposes? Will FIRS agents start raiding hotels and nightclubs?

Advertisement

And what about the safety implications? If sex workers are required to register and pay taxes, won’t that make them more vulnerable to harassment, blackmail, and exploitation by both law enforcement and criminals? The government needs to think through these consequences.

There’s also the question of fairness. While I understand the principle of taxing all income, sex workers are among the most vulnerable people in society. Many are driven to prostitution by poverty, abuse, or lack of alternatives. Taxing them without addressing the underlying social conditions that push people into sex work seems punitive rather than progressive.

However, I must acknowledge that many “hookup girls” today are not desperate victims but educated young women who choose this lifestyle for quick money. Some drive better cars than their professors, governors, and senators and live in luxury apartments. For this category, paying taxes makes perfect sense. If you’re earning a substantial income, you should contribute to the system.

The challenge is distinguishing between survival sex work and commercial sex work, between those who need help and those who need to pay their fair share. The blanket approach proposed by the tax reforms doesn’t make this distinction.

What really annoys me about this whole discussion is the hypocrisy. The same society that will demand taxes from sex workers is the one that stigmatises them, denies them basic rights, and looks down on them. You can’t have it both ways — either we recognise sex work as legitimate labour deserving of rights and protections, or we continue to treat it as criminal activity that should be stamped out.

The government also needs to explain what happens to pimps, madams, and those who profit from organising prostitution. If sex workers must pay taxes, shouldn’t those who facilitate and profit from their work also be taxed? Or is this tax only targeting the most vulnerable people in the transaction chain?

For decades, prostitution and related trades have gone untaxed in Nigeria. With the new reforms signed into law by President Tinubu, the government is seeking to widen the tax net and boost revenue for the struggling economy. This is understandable given our fiscal challenges, but expanding the tax net shouldn’t mean creating legal and moral contradictions.

A better approach would be to first decriminalise sex work, then regulate and tax it properly. This would allow sex workers to operate safely, access healthcare, report crimes against them, and contribute to the tax system without fear. Several countries have demonstrated that this approach reduces violence against sex workers and improves public health outcomes.

But I doubt Nigeria is ready for that conversation. We prefer our hypocrisy — condemning prostitution publicly while consuming it privately, criminalising sex workers while taxing their income.

The inclusion of influencers and digital workers in the tax net is more straightforward and should have happened years ago. The digital economy is booming, and many people are making substantial incomes that have escaped taxation. Bringing them into the formal economy makes sense and should be enforced.

What the government must avoid is making the tax system so burdensome that it drives economic activity further underground. The goal should be compliance through simplification and fair enforcement, not harassment and overreach.

My advice to the government is simple: if you’re going to tax sex work, you need to address the legal status of sex work first. You can’t criminalise something and tax it simultaneously without looking foolish. Make a choice — either decriminalise, regulate, and tax it properly, or continue criminalising it and stop talking about taxation.

Until then, this tax reform will remain what it is: a well-intentioned policy that creates more questions than answers and highlights the contradictions in our approach to morality, law, and economics.

Let’s face it. This is less about morality or justice and more about desperation. The government needs money and will tax anything — bread, airtime, even sin.

So, don’t be surprised when, after “runs girls”, they announce a tax on side chicks, sugar daddies, and even boyfriends who collect “urgent 2k”. Nothing is safe.

But until the state starts taxing the truly rich, this whole exercise is a circus. Fair taxation begins at the top. Until then, taxing “runs” is comedy — funny for the memes, tragic for the country.

And to all the “runs girls” who will soon get tax clearance certificates, good luck explaining that one at the embassy when you apply for a visa.

I heard FIRS is reportedly testing a new slogan: “Pay As You Lay.”

These are the issues.

Views expressed by contributors are strictly personal and not of TheCable.