Despite being the backbone of the economy, the manufacturing sector is often at the receiving end of many government policies. With several ongoing fiscal and monetary reforms under the administration of President Bola Tinubu, the manufacturing sector has been experiencing multiple shocks, which threaten its contribution to Nigeria’s gross domestic product (GDP).

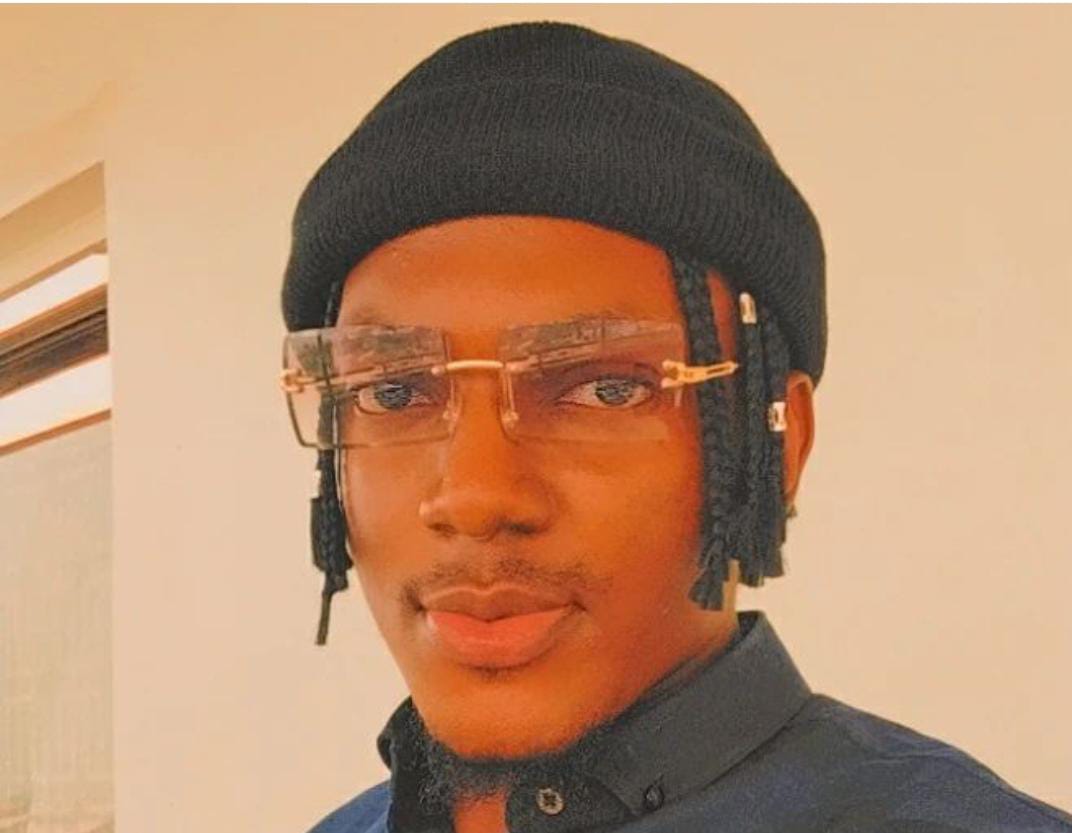

In this interview, TheCable’s BUSOLA ARO spoke to Segun Ajayi-Kadir, director-general of the Manufacturers Association of Nigeria (MAN), on the impact of monetary and fiscal policy changes on the sector, and how manufacturers plan to resolve unsettled FX backlog, amongst other issues.

TheCable: The Central Bank of Nigeria (CBN) recently released a directive for banks to stop using foreign exchange (FX) as collateral for naira loans. Do you think this is a good decision, especially for manufacturers?

Ajayi-Kadir: The CBN has implemented quite a number of measures aimed at improving the supply of FX and at the same time ensuring that they shore up the value of the naira. As an association, we have always maintained that since we are Nigerians and we have a currency, everything should be done to boost the confidence of business operators in the national currency which is the naira.

Advertisement

So, measures taken by the CBN including this one in particular, have tended to show the readiness of the bank not only to ensure that there is more supply, [but also] that more dollars are available for transaction of business in terms of maybe sourcing raw materials and machines that are not locally available that they are interested in ensuring that the value of the naira is sustained.

So to that extent, this policy that has been taken should be a positive one for the manufacturing sector, because there is actually no need for any Nigerian businessman to want to hedge against the naira. So, any dollar that is available in the domestic market should not be tied as collateral to any loan obligation that is denominated in Naira. I believe it is a positive one and it should help in the dollar sufficiency that the CBN has committed itself to.

TheCable: The federal government has been clamouring for increased production but the country recorded a trade deficit of N1.4 trillion in Q4 2024 — how can this be fixed?

Advertisement

Ajayi-Kadir: We have always maintained that the surest way for you to guarantee that you have a buoyant economy, the only way that you can guarantee that you have a positive balance of trade, the only way you can guarantee that you reduce your vulnerability to shocks from the international market is for you to grow your economy by actively promoting and intentionally promoting domestic production.

So long as what you require is denominated in a foreign currency and you do not produce competitively to be able to export, you will always have this hiccup in terms of your balance of trade.

Manufacturing, as we have said, has the greatest potential for ensuring that you operate in an environment that is production-centred and production-driven. So, if you are able to create that conducive environment for domestic production, you will be able to export and that will improve your balance of trade. So, I will see our continued deficit in that area to be a direct reflection of how we have failed to grow our domestic production. How we have not incentivised enough investment in the domestic environment and to intentionally grow our exports.

You can imagine that even exporting (is) so difficult in terms of the process. Apart from producing in an environment that is not conducive, there are macroeconomic issues and infrastructure issues that have limited our performance as a manufacturing nation. After even producing, the process of export is such that it is cumbersome and the regulatory environment that should support it actually limits it, which makes it a disincentive for export.

Advertisement

So, I believe that if you are to talk in terms of resolving the matter, we have to get it squarely in the promotion of domestic production.

TheCable: Prior to its last monetary policy committee (MPC) meeting, the CBN announced that all verified FX backlogs had been paid, however, reports claim manufacturers still have dollar requests unsettled — how true is this?

Ajayi-Kadir: Well, it is true. It is not only the manufacturers that are saying so, the CBN also said that it is refusing to honour $2.4 billion that it has issues with. There are so many manufacturers that were affected.

TheCable: What efforts have been made to rectify this and in what way has this situation affected the industry?

Advertisement

Ajayi-Kadir: What has happened is that the CBN has indicated that there are issues that need to be resolved and they found it questionable but the challenge that one has with that is the fact that you have completed a transaction, as a manufacturer for instance, you have been able to successfully pay what you are supposed to pay to be able to secure your dollar. The central bank has promised that, maybe in 60 or 90 days, you are going to have the dollar which is the forward contract that is there and at the expiration of that period you didn’t have it.

It extended to two months, three months, four months, five months, six months, a year, a year and a half, in some cases, almost two years. And then at the end of the day, you are being told that you are not going to have the dollar because the process of processing that transaction is faulty. After you have imported the items because you have gone to your bank, your bank has facilitated it through their overseas partners and you have been able to secure the forex, you have imported, produced and even sold. So now, you are probably asked to do what? Those are the issues. Those forwards that have not been cleared need to be done so that you can free yourself from the obligations you have to your bank.

Advertisement

So what we are doing is that we are engaging the CBN and we are making representations to the CBN even through the ministry of industry, trade and investment.

We are presenting the dire consequences that this continued non-redemption of the forwards is having on manufacturing. What it has done is that it has truncated the businesses of our members who continued to be saddled with the loan obligations that have arisen from that transaction.

Advertisement

TheCable: What exactly is the amount that is being owed to manufacturers?

Ajayi-Kadir: We are compiling the figures, but it is huge. As we speak, we are correlating and when all the figures are in, we will be able to say so. No matter the figure that it amounts to, it is inimical to business. Manufacturers actually have quite a number of challenges and now another is added — that is avoidable.

Advertisement

It has very serious implications for the recovery that the federal government has committed itself to. On one hand, we can see the excellent effort that the government is making to stabilise the economy and improve on it, so when we have avoidable setbacks like this to slow down our recovery, it’s not good for the economy.

TheCable: In a recent report, it was stated that you said MAN may approach the court over the unsettled FX backlogs, how true is this?

Ajayi-Kadir: I must thank you very much for asking this question. Yes, I did the interview, but I believe that the headline belies the truth. If you read the body of that report, my first statement was ‘no’. I said no, I do not think that this should get to the courts, because, like I said, we are already in talks with the CBN and the minister of industry, trade and investment is intervening and we will continue to have this conversation with the CBN. The court is never the best alternative. I mean, the court also has its process and there are several layers of jurisdictions and you may remain endlessly in court and your business cannot wait for the verdict.

So, I believe the CBN, in view of other measures they have taken, have demonstrated tremendous efforts, and initiatives that are supposed to improve the economy. I believe as we continue to engage the CBN and try to convince them that they should let it go because the transactions are properly done, the profits have been repatriated for the efforts that have taken place.

So what should be focused on is whether there was a transaction, whether it was done legitimately or fulfilled all the requirements asked for. And if we have done all that, I do not think there should be any delay in letting it go — that is the direction we are looking at.

And like I said, we are engaging and we will continue to engage with the CBN till the matter is resolved. Going to court is never anybody’s best choice and I do not think that it will resort to that. I believe that the CBN governor is going to, with time, appreciate the issues we have raised and recognise the very negative impact that this has continued to have on Nigerian manufacturing and then they will be able to find an amicable solution to it.

TheCable: You recently said diesel consumes 80% of manufacturers’ profits. What period did this occur and how does this impact on prices of goods and contribute to inflation?

Ajayi-Kadir: I never granted that interview. In terms of our cost structure as a manufacturer, the cost of power could be anywhere between 30 percent to 40 percent depending on how intensive your manufacturing process is. What I could have said is that the price of diesel has risen in recent times by that percentage, but I never said it’s 80 percent of our profits. Where will you put the cost of other factors that go into the production? So I never said that.

TheCable: Why has the appreciation of the naira not reduced the prices of goods, and when should Nigerians expect a decline?

Ajayi-Kadir: It should be expected that prices should come down because you are mitigating the factor that is responsible for the increase in the price of goods. But you will agree with me that all the products that you have in the market now, the factors that went into those products were funded by the old rates.

For example, you have products that were manufactured when the dollar was about N1,800, N1,600, N1,500, and you have already put a price tag on one, those that are still in your warehouse, those that have left your factory and with the wholesalers, and for those ones that are on the shelf of the retailer, there has to be a cycle that will flush those. It is hardly possible for you to buy something and then hear in the news or experience it even in the banks that the rate has improved and then you go and lower your price. That is not a possibility.

So, I think there has to be a timeframe that may happen, but that is one side. The other side of it is that it is not only FX that has led to the increase in those prices, so for you to be able to notice any significant reduction, you may need to check to see how other cost factors have performed. Just like the price increase is occasioned by a number of factors, the reduction would also be occasioned by some other factors. Now, for instance, the FX has improved, and the cost of power has gone up, will it counterbalance the expected cost of production? I believe that there has to be a combination of positive developments that would lead to qualitative change to the prices that we have in the market.

TheCable: How have the fiscal and monetary policies affected manufacturers in the last 10 months?

Ajayi-Kadir: You have asked a very important question that allows one to cast back to mind as to how this administration came in, what was on ground, what they had to do, what has resulted from what they did?

I can say straight away that some of the outcomes were not what was expected but it’s all part of what happens when you are implementing the reform. You cannot always completely envisage what the reaction would be or what the fallout will be or how it will be received by the business community.

So what I have seen in this topic you have mentioned is the fact that we have seen, particularly in times of government policy, how the reforms (they) have taken has put a strain and a lot of demand on the monetary authority to manage the floating of the naira rate. The removal of the subsidy has seriously aggravated inflation. It has led to a push in the interest rate and of course, the exchange rate originated the dramatic movement.

It has been a period of trying to manage the fallout of this initial pronouncement by the government. Incidentally, it came at the very beginning of the administration. So far, I have seen that the CBN has responded through a lot of measures and it has in many cases worked. There are those, particularly the forwards, that needed to be fine-tuned and that needed to be resolved in order for us to fully restore confidence in the process because it is now a matter of process.

Can you believe a CBN when it gives its word? Can the CBN say that in 90 days, we give you the dollar cover for the naira you have given me if you do not fully discharge your part? So I can understand why the CBN is apprehensive about redeeming those inputs and the actions you need to take to build confidence. On the fiscal side, we have also seen that the government has reaped a lot from this removal of fuel subsidy and the floating of the naira rate.

I think that to a larger extent, those two have interplayed to drive some form of sanity. I believe that more cooperation needs to be done. We need to see more cooperation happening. There has to be a complete handshake between the monetary and fiscal policies. We have seen that there is improvement but more needs to be done. And to continue to say that these two are of primary importance in the government’s reform agenda and there has to be a synergy that does not allow one to counter the gains that have been made by the other.

TheCable: Other stakeholders have called for the collection of customs duties in naira and not in dollars. What is your opinion about this?

Ajayi-Kadir: Yes, all transactions in Nigeria should be naira-denominated. That is our currency, and it’s even the law. So, we are paying duty to Nigeria Customs Service and it should be denominated in naira and it should be delinked from the prevailing rate, at least now that there is some measure of high cost of forex. We had recommended that there should be a freeze on the rate that is used for assessment of duty because it is directly related to fanning inflation.

If we increase the cost of production, which is what the higher import duties on your raw material, spares and machines amount to, then you are indirectly increasing the cost of products that would go into the market. So, it should be denominated in naira and not just in terms of customs duty but in all transactions, including the price of gas. My take is since we have seen CBN going in the direction of imposing a ban on using dollars as collateral for naira-denominated loans, it should be extended to all transactions. Let us build confidence in the naira. That’s our currency.

Our inflation is cost-pushed, so it is important to drive down costs. There are things that can be done to bring down cost which has for a very long time been a major driver of inflation in Nigeria. One of the ways we can do that is by seeing that we do not escalate costs on the import of raw materials that go into the direct production process. That is one sure area.

TheCable: What is the situation of sachet alcoholic drink producers whose businesses were banned recently?

Ajayi-Kadir: We have made our case that you (the federal government) will not succeed in controlling underage consumption because they are in a sachet, you should rather restrict access because it is not produced for children and what should be done if it gets to that is to make sure that it does not get into the wrong hands.

It was again seen as an elitist policy because it completely deprives adults who have the right to consumption but do not have enough money to consume larger volumes. More so, if you want to discourage consumption of a particular product, are you saying that what is best to leave is the higher volumes?

Producing in smaller volumes is a business strategy. I believe that in resolving issues there is a need to undertake measures that would not kill business but allow you to achieve your objective. In the process, you must ensure that you do not create more damage.