Here are the seven top business stories you need to track this week — February 12 to February 17.

JANUARY 2024 INFLATION REPORT

The National Bureau of Statistics (NBS), on February 15, will publish the consumer price index (CPI) and inflation report for January 2024.

The inflation rate had increased in December 2023 to 28.9 percent due to the rise in food costs.

Advertisement

The federal government recently disclosed plans to release food items from the national reserves as part of measures to tackle the country’s worsening food crisis.

Food inflation was the highest contributor to Nigeria’s inflation in 2023, averaging 27.76 percent — from 15.96 percent in 2022.

The inflation rate is said to be majorly caused by insecurity, cost of inputs, energy crisis and farmers’ displacements due to insurgency.

Advertisement

Meanwhile, the CBN governor had hinted at a decline in headline inflation to 21.4 percent in 2024.

Also, the NBS is expected to release a report on oil and gas production (half-year 2023).

The bureau will also publish reports on household kerosene and premium motor spirit (petrol) prices for January 2024.

NNPC STRIKES DEAL WITH CBN OVER REVENUE MANAGEMENT

Advertisement

The Nigerian National Petroleum Company (NNPC) Limited and the Central Bank of Nigeria (CBN) have reached an agreement on the management of the oil firm’s revenue.

In a statement on Thursday, Olufemi Soneye, NNPC’s chief corporate communications officer, said the deal was reached when Mele Kyari, the group chief executive officer (GCEO) of the oil firm, and Olayemi Cardoso, CBN governor, met in Abuja.

Both Kyari and Cardoso had met to review the decision to transfer the revenue generated by NNPC to the apex bank.

Soneye said the duo “reviewed the decision of the NNPCL to domicile a significant portion of its revenues and other banking services with the CBN”.

Advertisement

‘NO WAYS AND MEANS LOANS TO FG UNTIL PAYMENT OF OUTSTANDING DEBTS’

Meanwhile, Cardoso has said the financial institution would halt its ways and means advances to the federal government.

Advertisement

Cardoso disclosed this on Friday when he appeared before the senate committee on banking, insurance and other finance institutions, in Abuja.

He said the apex bank will no longer be a part of Ways and Means agreement with the federal government until all outstanding debts are refunded.

Advertisement

The economist said the decision complies with Section (38) of the CBN Act (2007).

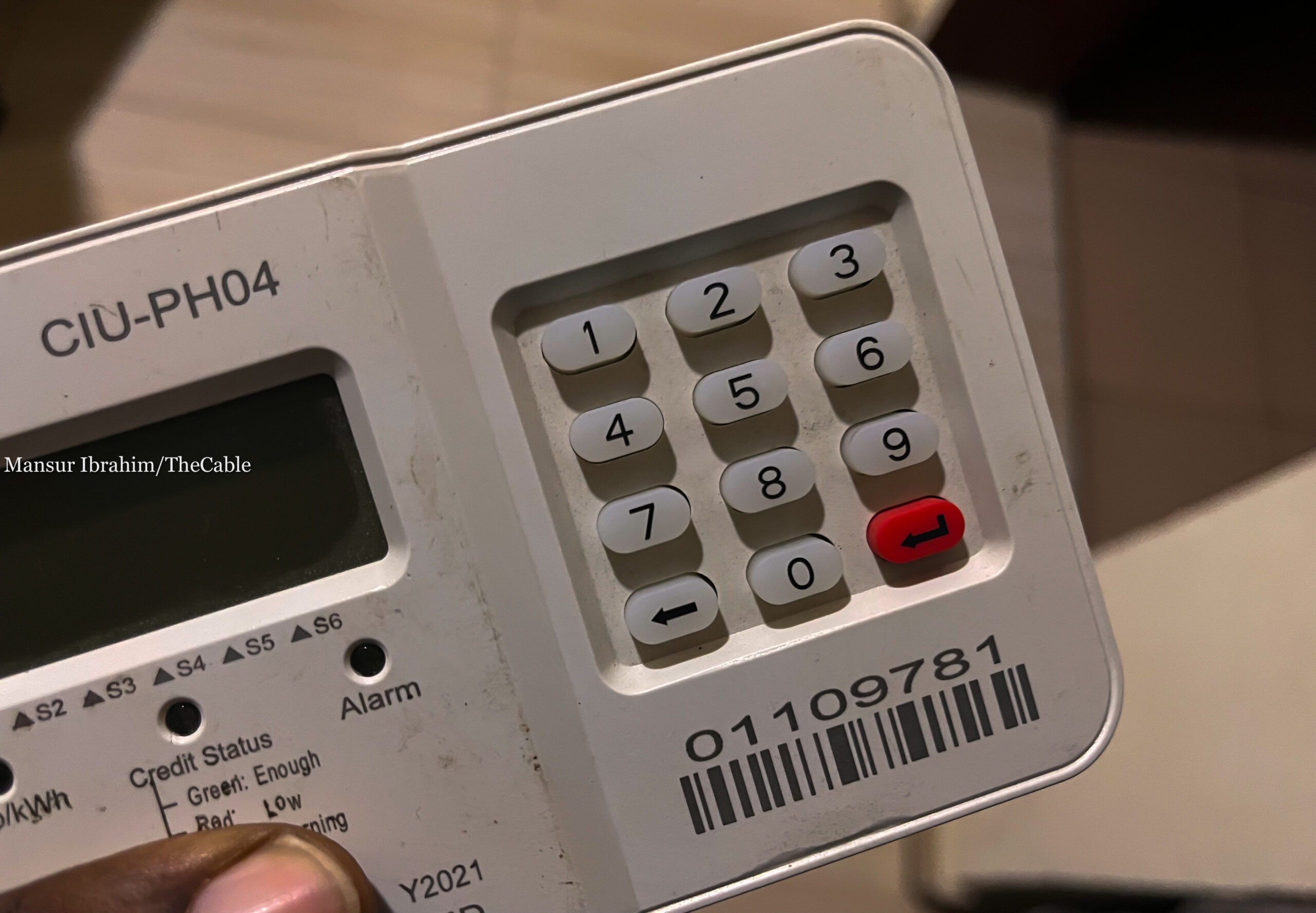

TINUBU SIGNS ELECTRICITY AMENDMENT BILL

Advertisement

President Bola Tinubu signed the Electricity Act (Amendment) Bill, 2024, into law on Friday, after it was passed by the house of representatives and the senate.

The bill, sponsored by Babajimi Benson, representative of Ikorodu federal constituency of Lagos state, was passed by the green chamber on July 27, 2023, and by the senate on November 14, 2023.

According to a statement by Ajuri Ngelale, special adviser to the president on media and publicity, the bill seeks to address the development and environmental concerns of host communities.

Ngelale said it also sets aside five percent of the actual annual operating expenditures of power-generating companies (GENCOs) from the preceding year for the development of their respective host communities.

‘FOCUS ON FX SUPPLY, NOT DEMAND’

Yemi Kale, KPMG Nigeria partner and chief economist, has asked the Central Bank of Nigeria (CBN) to concentrate on boosting foreign exchange (FX) supply rather than regulating demand.

The economist spoke in a statement on his X page on Saturday.

On February 9, 2024, Cardoso said the country must moderate demand for forex.

However, responding to the CBN governor’s stance, Kale said the country cannot curb demand in the near term without expanding the FX gap and worsening confidence.

On the other hand, Bismarck Rewane, chief executive officer (CEO) of Financial Derivative, had explained that low FX inflow and the lack of confidence in the local currency are part of the factors responsible for the continuous fall of the naira.

CUSTOMS MULLS WAIVERS FOR VEHICLE IMPORTERS TO PAY DUTIES

The Nigeria Customs Service (NCS) says it intends to grant waivers to “vehicle owners” to pay duties within a specific timeframe to avoid sanctions.

Adewale Adeniyi, comptroller-general (CG) of the NCS, spoke while presenting the 2024 budget of the service to the senate committee on customs at the national assembly, on February 5, 2024.

According to Adeniyi, the decision is to avoid sanctions and to regularise the importation of vehicles through payment of duties.

SHELL DELIVERS 475K OIL BARRELS TO PORT HARCOURT REFINERY

Shell Nigeria says it has “resumed” the supply of crude oil from its Bonny export terminal to Port Harcourt refinery.

Bamidele Odugbesan, Shell’s spokesperson, spoke to Reuters on Friday.

Odugbesan said oil deliveries to the refinery were made last week.

Also, Osita Nnajiofor, Shell’s Bonny oil terminal manager, in a statement on Friday, said a total of 475,000 barrels of oil was delivered to the refinery on January 18, 2024.