Market Analysis: Nigeria inflation, Fed minutes and oil in focus

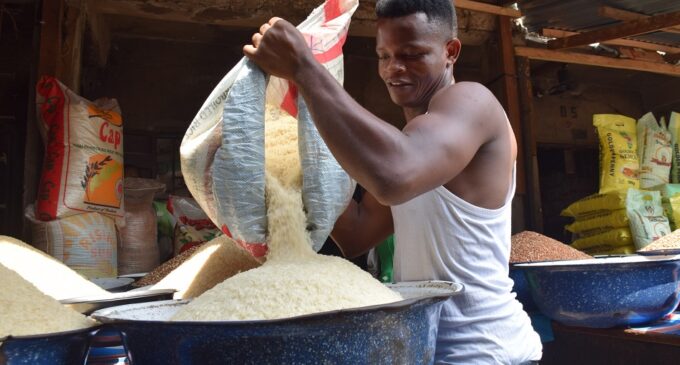

Inflationary pressures are gradually easing across the globe but remain rampant in Africa’s largest economy.

Unlike the United States which has witnessed consumer prices coming down from a peak of 9.1% in June 2022, Nigeria’s inflation remains hot, stubborn, and unyielding. The current annual inflation rate for Africa’s largest economy stands at a whopping 22.8 % – its highest since September 2005. With the inflation beast drawing strength from rising food prices, transportation, and import costs, it is forecast to tick even higher for July.

Ultimately, persistent signs of rising inflation may force the Central Bank of Nigeria to act once again at its next policy meeting in September. It is worth keeping in mind that the CBN has recently lifted its benchmark rates by 25bp to 18.75% – its fourth consecutive rate hike in 2023. While higher rates have the potential to cap and control inflation, it could come at the cost of economic growth which expanded by 2.31% during the first quarter of 2023.

In the currency space, the Naira took another beating on the black-market exchange last Friday. The local currency slumped to N932 as dollar shortages worsened two months after the CBN adopted a flexible exchange rate regime. Should the current themes negatively impacting the Naira remain present, prices may hit N1000 in a matter of time. Such a development that will most likely increase the cost of living and squeeze households further in the short to medium term. Outside of Nigeria, we have witnessed how higher interest rates have somewhat capped and controlled inflation albeit at a price. For Africa’s largest economy, the key question is when will inflation eventually peak?

The US Dollar & Fed Minutes

Dollar weakness could become a major theme in the second half of 2023 as the Fed concludes its hiking cycle.

With inflationary pressures easing in the United States and the Federal Reserve shifting to data dependence for future monetary policy decisions, the odds of another hike are falling significantly. According to Fed fund futures, traders are only pricing in only a 10% chance of a rate hike in September and 32% probably by November 2023. Should expectations become reality, the USD is likely to weaken against not only G10 majors but emerging market currencies over the next few months. The pending Fed meeting minutes are likely to accelerate the potential dollar selloff if they strike a dovish tone.

Commodity Spotlight – Oil

Oil prices have the potential to push higher amid growing optimism over the global demand outlook. According to the International Energy Agency, global demand for oil has surged to a record thanks to strong consumption from China. On the supply side, production cuts from OPEC+ have fueled concerns around tighter supply, further supporting upside gains. Focusing on the technical picture, Both WTI Crude and Brent are trading near key resistance levels and may experience a breach to the upside in the short to medium term. After experiencing a rebound back in June, an oil trade back to $100? Time will tell.

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Lukman Otunuga is a senior market analyst at FXTM

Views expressed by contributors are strictly personal and not of TheCable.

There are no comments at the moment, do you want to add one?

Write a comment