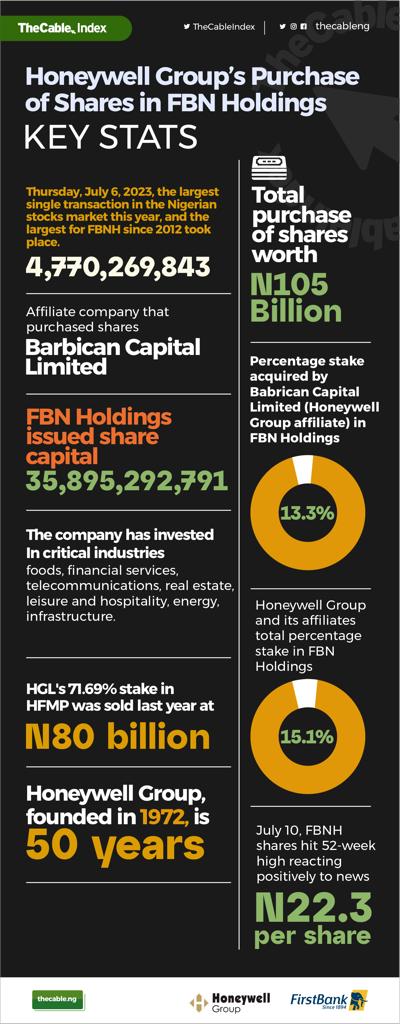

On July 6, 2023, Honeywell Group Limited (HGL) bought 4,770,269,843 shares in First Bank Holding (FBNH). It was just one transaction but with multiple effects on the company, the Nigerian stock exchange and the financial history of modern Nigeria.

Let us break it down.

The transaction is the largest single transaction in the Nigerian stock market so far this year, and trust us, there have been lots of transactions on the local bourse, especially since the float of the naira in June 2023.

For FBN Holdings, it is also the largest transaction since 2012. The size and influence of this transaction speak to the capacity and competence of the Honeywell Group. In 2022, the same group, led by Obafemi Otudeko (pictured), also consummated the biggest capital market deal in Nigeria.

Advertisement

After a deal in December, billionaire businessman Femi Otedola became the highest shareholder in FBN Holdings, the parent company of First Bank of Nigeria (FBN). But going by the numbers in this most recent deal, Honeywell Group just became the largest shareholder — by far — in FBNHoldings after the execution of the deal by its affiliate company, Barbican Capital Limited. Since becoming the largest shareholder, Honeywell’s transaction has made the company’s shares more attractive to other investors and has increasingly pushed the company’s market value.

How FBN Holding gained N136.41 billion in 72 hours

Data by the Nigerian Exchange Group (NGX) shows that FBNHolding’s shares traded at N18.50 per share on July 5, 2023, just before Honeywell Group made its record investment.

Advertisement

Immediately after the investment was made, more investors, with faith in the current management of Honeywell Group, began to vote more money into FBNHoldings. In the next 72 hours or three trading days, the company’s market capitalisation jumped from N664.06 billion to N800.46 billion — a vivid increase of N136.41 billion.

This has significantly pushed the holding company close to the famous N1 trillion market cap mark. But beyond the significant increase in market cap, the numbers tell a more interesting story about the trust that the market has in Honeywell Group as the new leader and defining voice in the future of FBNHoldings.

Infusing 21st Century Values

Advertisement

The deal is no accident at all; Oba Otudeko, the longest-serving chairman of FBNHoldings, is conscious about infusing a value-driven approach and skillsets from HGL into the team at the bank. Beyond the legacy that the Honeywell Group brings to the table at First Bank Holdings, the group also brings a suite of values that enhances the bank’s position in the industry.

For example, 56% of the leadership team at Honeywell Group are leading women. This is one of the absolute best gender-conscious companies in the industry and on the continent. Its interesting to note that at FBN Holdings, only 22% of leadership are female. Investors believe that HGL’s influence in the bank could drive gender equity at FBN Holdings.

The top brass at Honeywell Group also projects a great future for any business they venture into. Obafemi Otudeko, the Managing Director of Honeywell Group, is not just a seasoned investment professional, he also comes with immense capital market experience. He led the company’s partnership with Bharti Airtel on Airtel Nigeria and the subsequent multi-million-dollar divestment. He also completed the biggest capital market transaction of 2022 – the sale of Honeywell Flour Mills to Flour Mills of Nigeria.

For over 50 years, Honeywell Group has defined what it means for a going concern to thrive in Nigeria despite the odds and more-than-occasional challenges in the business environment. The group has invested in critical industries, including food, financial services, telecommunications, real estate, leisure and hospitality, energy, infrastructure, and security management. HGL is a picture of excellence and diversity.

Advertisement

It is clear why investors across all these industries have come to trust the Investment and follow its investing direction, and business dexterity. The numbers show Honeywell’s investment has been good for business, and will remain great for business if the group’s history is anything to go by.

With the influence of Honeywell Group, FBN Holdings will not only speak to a strong legacy of the past but continued dominance in the present and an assured future as the industry leader.

Advertisement