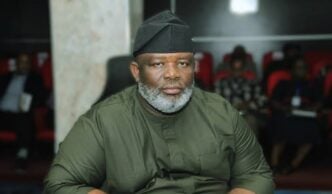

Abbas Jega, a former executive director (ED) at Asset Management Corporation of Nigeria (AMCON), says Arik Air never cooperated with the corporation in debt payment.

Jega testified on Wednesday at the special offences court in Ikeja, Lagos, presided over by Mojisola Dada, the judge.

He provided the court with the details of what he could recollect about the Arik Air-Union Bank business relationship.

On January 20, Ahmed Kuru, former managing director of AMCON (second defendant), was arraigned alongside Roy Ilegbodu, managing director of Arik Air, (third defendant); Kamilu Omokide, receiver manager of Arik Air, (first defendant); Union Bank Plc (fourth defendant) and Super Bravo Limited (fifth defendant), before the Lagos court.

Advertisement

The defendants were accused of defrauding Arik Air (currently in receivership) of N76 billion and $31.5 million by the Economic and Financial Crimes Commission (EFCC).

In February 2017, the airline was taken over by the federal government via AMCON due to the company’s huge debt profile, which was over N300 billion.

Consequently, the government immediately dissolved the airline’s management team and appointed a receiver manager.

Advertisement

Appearing as the third prosecution witness in the ongoing trial on Wednesday, Jega said in line with a directive from the Central Bank of Nigeria (CBN) to transfer non-performing loans to AMCON, Union Bank informed AMCON of the apex bank’s instruction to convert Arik’s guarantee into a loan.

He said this was necessary because the substantial amount involved caused Union Bank to exceed the single obligor limit set by the CBN.

Jega, whose directorate in AMCON was in charge of the transaction (as executive director, credit), said it was in a certain meeting held in London that “we first knew that what Union Bank sold to us was not a loan”.

“It was a guarantee given to some foreign lenders that in the event Arik died or burned out, Union Bank will pay the installments,” Jega said.

Advertisement

“When we came back to Nigeria, we invited the Union Bank to explain why AMCON should pay for the guarantee.

“At the end of the deliberations, AMCON agreed with Union Bank that the money paid should be returned to AMCON, so that if Arik does not pay any installment, AMCON will make the payment on behalf of Arik. We (AMCON) invited Arik to resolve the issue with Union Bank.”

‘ARIK CHAIRMAN AVOIDED DISCUSSION WITH AMCON’

Jega also said Johnson Arumemi-Ikhide, chairman of Arik, avoided a discussion with AMCON, “probably because he believed he should not be talking to the debt recovery agency” because he did not have a non-performing loan (NPL) with Union Bank.

Advertisement

“But he didn’t realise that some of the measures put in place by the system were that if AMCON takes over your loan, you cannot borrow in the banking industry,” the former ED said.

“This forced him to come to the table. We signed some agreements on how to restructure the loans.”

Advertisement

The witness said following the restructuring agreement, the AMCON provided Arik with additional funds to address their working capital issues.

As a result, Jega said, AMCON extended further loan facilities to the airline, but Arik still failed to fulfill its repayment obligations to AMCON.

Advertisement

“At the time AMCON took over Union Bank that the guarantee was performing, but since AMCON took over Arik, it stopped performing because the nature of the facility had changed, and Arik was not amenable to that change,” he said.

“It was unable to source its working capital from the money market. This complicated both the relationship between Arik/AMCON and the ability of Arik to honour its obligations.

Advertisement

“We tried in AMCON to save the situation through a debt equity swap, but the burden in AMCON’s books cannot be sustained by the airline.”

Jega said the corporation also proffered a solution “where AMCON becomes a shareholder in Arik, and the legacy owners will lose some control”.

“We took steps to implement this option, but Arik refused. The second option was to have management control in Arik. To appoint MD and CFO, so that AMCON can have both oversight and financial control,” he said.

“Initially, Arik agreed. But they dragged in the implementation. This was the stage at which the matter was when I left AMCON.”

‘OMOKIDE, ILEGBODU DIDN’T PLAY ANY ROLE IN THE LOAN PURCHASE’

Upon cross-examination, Jega confirmed that Omokide and Ilegbodu never played any role in the purchase of the loan from Union Bank, nor did they play any role in the London meeting between the bank, AMCON, and Arik’s foreign lenders.

The witness also said Arik’s failure to repay was due to over-trading, as the airline had operated beyond its capacity, which hindered its ability to service existing and outstanding debts.

Jega said Arik’s indebtedness to AMCON was over N100 billion as at the time of his exit in 2015, and “the debt remained unpaid”.

He further said the Arik loans acquired by AMCON were not limited to Union Bank but also included Keystone Bank.

However, Jega said the Zenith Bank loan was purchased after his exit, leading to the level of exposure Arik had to AMCON.

The matter was adjourned to June 30, July 1 and July 2, for the continuation of Jega’s cross-examination.