It has been a positive trading week for the Nigerian stock market with the All-Share Index pushing higher despite US-China trade talks pessimism denting global risk sentiment.

Local equity markets are seen pushing higher next week if Nigeria’s GDP growth for Q4 exceeds market expectations.

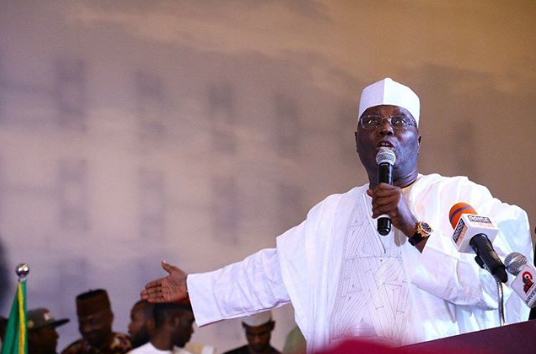

Away from macro fundamentals, the presidential elections will be in sharp focus. Whatever the election outcome, it will have a strong impact on the Nigerian economy.

Global risk sentiment hit by trade pessimism

Advertisement

The negative mood sweeping across financial markets late in the trading week continues to highlight how investor sentiment remains extremely sensitive to any changes in the narrative with US-China trade developments.

Global equities fell for a third straight day on Friday after Donald Trump said he would not meet with Chinese President Xi Jinping before the March 1 trade deadline. This unfavourable development has certainly raised concerns over trade talks dragging on beyond the 90-day tariff truce.

With geopolitical risks and fears around faltering world growth already leaving global sentiment on edge, there is a high risk that there could be another sell-off in the markets if the United States once again increases tariffs on Chinese goods early next month.

Advertisement

It is expected that investors will be watching US-China trade headlines very close to their radars for the remainder of February. With all the ingredients for another round of a stock market selloffs in place, equity bears are seen jumping back into the scene if US-China trade talks to take a turn for the worst.

The other trend that is keeping traders on their toes is the gradual recovery of the US Dollar that has taken place over recent trading sessions. It is difficult to pinpoint what exactly is driving the USD recovery, but I wouldn’t bet against investors bracing themselves for another potential escalation in trade tensions following the comments in recent days.

Another possibility is that investors have realized that even if the Federal Reserve does push the snooze button on higher interest rate policy in the United States, monetary and economic divergence is still in favour of the U.S than a number of its developed peers.

Let’s put it this way: a diplomatic spat between France and Italy is making its way across the major news headlines at the same time as when investors are still no way nearer to understanding what is going to happen with Brexit in the run-up to the March 29 Article 50 deadline, so it is quite possible that investors will prefer to have the USD in their portfolio until the necessary guidance is provided for what could happen with either the Euro or the British Pound over the coming weeks.

Advertisement