Zacch Adedeji

Zacch Adedeji, the executive chairman of the Federal Inland Revenue Service (FIRS), says legal reforms are the starting point for overhauling Nigeria’s tax system, bemoaning the impact of tax evasion on the economy.

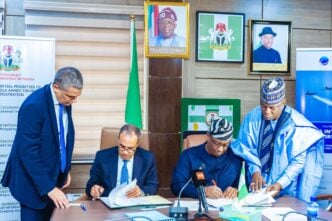

Adedeji spoke on Tuesday during the national conference on illicit financial flows (IFFs), themed ‘Combating Illicit Financial Flows: Strengthening Nigeria’s Domestic Resource Mobilisation’.

The event comes nearly a month after President Bola Tinubu signed four tax reform bills into law on June 26.

Adedeji said the conference reflects one of the most critical challenges currently facing Nigeria’s economy — the urgent need to safeguard national resources and build a resilient, equitable future.

Advertisement

The FIRS boss said IFFs through tax evasion, profit shifting, money laundering, and trade misinvoicing pose a structural drain on the economy, depriving the country of resources essential for inclusive development.

He said Nigeria loses billions annually to IFFs due to aggressive tax avoidance by multinationals, which undermines governance, erodes trust, and affects infrastructure, public services, and inequality.

“Under President Bola Ahmed Tinubu’s Renewed Hope Agenda, we have entered a new era of fiscal reform,” he said.

Advertisement

“The recent assent to four tax reform bills on June 26, 2025, signals this administration’s strong commitment to overhauling our tax system, modernising the legal framework, and institutionalising transparency in revenue collection.

“But legal reform is only a starting point. To deliver on its promise, we must reinforce enforcement, optimise digital compliance, and build public trust through fairness, predictability, and strategic communication.

“At the Federal Inland Revenue Service, we are responding with a deliberate, multi-dimensional strategy.

“First, we are championing voluntary compliance by promoting taxpayer education and simplifying systems. Our goal is to foster a culture where compliance is driven by trust, not fear.

Advertisement

“Second, we are harnessing technology and intelligence. We have launched an ambitious digital transformation programme, including the establishment of a Tax Intelligence and Automation Department.

“With real-time analytics, integrated third-party data, and anomaly detection, we are building a tax system that is proactive, smart, and secure. This is not just about digital infrastructure — but digital vigilance.

“Third, we recognise that combating IFFs demands collective action. As the designated coordinating agency under the Proceeds of Crime Act (2022), FIRS has established the Proceeds of Crime Management and Illicit Financial Flows Coordination Directorate.”

Adedeji said the unit will lead implementation efforts, support asset recovery, and coordinate with law enforcement, the judiciary, private sector actors, and international development partners.

Advertisement

In addition, he said the FIRS is also reviewing Nigeria’s double taxation agreements (DTAs), “some of which — due to outdated clauses — may inadvertently enable profit shifting”.

He said renegotiations have been initiated with several jurisdictions to align treaties with current economic realities and close loopholes that facilitate capital flight.

Advertisement

The FIRS boss stressed the need for an agile, intelligence-led, and globally coordinated response to counter evolving IFFs.

On May 27, Adedeji said studies have shown that only 19 percent of Nigerians pay tax.

Advertisement

AFRICA FACES $194 BILLION ANNUAL FINANCE GAP

Delivering her keynote address, Irene Ovonji-Odida, member of the Mbeki Panel on IFFs from Africa, said the continent faces an annual finance gap of $194 billion, despite being rich in natural, human, and other resources.

“Debt service for African countries in 2023 was projected at US$68.9 billion, with 21 African countries at risk of debt distress owing a total debt of US$644.9 billion to external creditors, with African countries’ debt amounting to 24% of their combined GDP as of 2021,” Ovonji-Odida said.

Advertisement

“Concurrently, Country Programmable Aid (CPA) for Africa plummeted to less than 50% of Official Development Assistance (ODA) as of 2023.

“A major factor preventing Africa from breaking out of this situation is the constant drain of resources out of the continent, through illicit financial flows (IFFs).”

She said Africa had taken early leadership on the issue through the AU/ECA High-Level Panel on IFFs from Africa, also known as the Mbeki Panel, which was established in 2012.

Ovonji-Odida said in 2022 and 2023, the African Group in New York, led by Nigeria, presented successful General Assembly resolutions supported by many G77 countries.

She explained that the resolution led to ongoing negotiations for a United Nations (UN) tax framework convention.