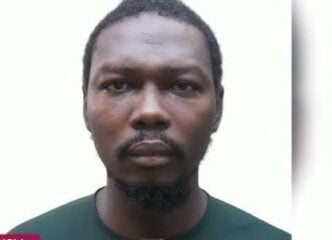

Gbenga Komolafe, the chief executive officer (CEO) of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), says the commission has secured over $400 million in decommissioning liabilities, setting stricter rules for recent asset transfers.

Decommissioning liabilities are the future costs a company anticipates incurring to dismantle, remove, and restore property, plant, and equipment to its original condition at the end of its useful life.

According to a statement on Thursday, Komolafe spoke during his remarks at the Nigerian Extractive Industries Transparency Initiative (NEITI) Companies Forum, held in Lagos.

The NUPRC, represented by Efemona Bassey, deputy director, human resources, corporate services & administration, spoke on the theme, “Divestments, Liabilities, and the Impact of Ongoing Reforms on Extractive Companies in Nigeria”.

Advertisement

“The results from 2024 speak for themselves. Over US$400 million in pre-sale decommissioning and abandonment liabilities have been secured through Letters of Credit and escrow accounts,” Komolafe said.

He said Nigeria is applying lessons from costly global divestment cases to safeguard its oil and gas sector.

Komolafe said the commission had studied global divestment experiences, drawing lessons from the North Sea, where decommissioning costs are projected at £27 billion by 2032, the Gulf of Mexico, with costs exceeding $9 billion, and Canada’s Alberta, where more than 97,000 inactive or abandoned wells carry estimated decommissioning and abandonment costs ranging from C$30 billion to C$70 billion.

Advertisement

He further cited Australia, where Northern Oil & Gas in 2019 left behind liabilities exceeding AU$200 million.

The NUPRC boss said the lessons from the experiences guided the recent divestment approvals from NAOC to Oando Energy Resources, Equinor to Chappal Energies, Mobil Producing Nigeria Unlimited to Seplat Energies, Shell Petroleum Development Company (SPDC) to Renaissance Africa Energy, and TotalEnergies to Telema Energies.

“Without a robust and enforceable framework for abandonment and decommissioning, divestment transitions can create lasting financial and environmental burdens,” he said.

The NUPRC boss emphasised Nigeria’s response to recent divestments, citing sections 232 and 233 of the Petroleum Industry Act (PIA), which assign full responsibility for the decommissioning and abandonment of petroleum wells, installations, structures, utilities, plants, and pipelines to licensees and lessees.

Advertisement

He added that each divestment in 2024 presented a crucial opportunity to test and implement the commission’s divestment framework.

“Host Community Development Trust obligations are fully honoured. Environmental remediation commitments worth over US$9.2 million have been pledged while awaiting the formal gazetting of the ERF Regulations,” Komolafe said.

The CEO said beyond the significant progress achieved “through our divestment framework, it is important to highlight another milestone”.

“Since April 2023, we have approved 94 Decommissioning and Abandonment (D&A) plans, in strict alignment with the PIA,” he said.

Advertisement

“These approvals represent total liabilities of $4.424 billion, arising from all Field Development Plans submitted within this period, and will be remitted progressively over the production life of the respective fields into designated escrow accounts.”

Komolafe noted that the commission has resolved a long-standing issue with international oil companies (IOCs) concerning the domiciliation of escrow accounts, and that the regulatory framework — developed after extensive consultations with industry stakeholders — is now awaiting approval and gazetting by the ministry of justice.

Advertisement