The Nigerian National Petroleum Company (NNPC) Limited has projected revenue losses due to the suspended strike by the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), resulting from deferred production, missed liftings, and reduced gas sale.

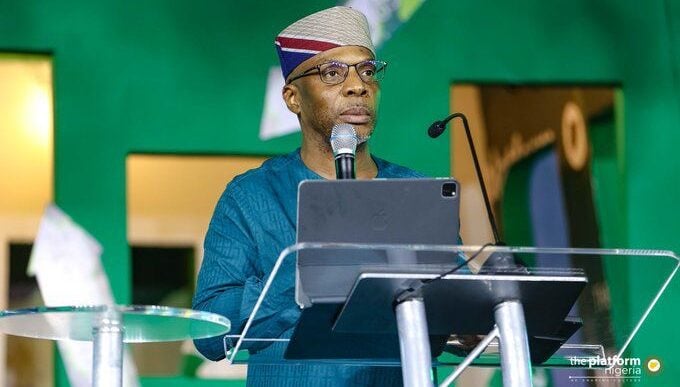

In a letter dated September 29, 2025, addressed to the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) and Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Bayo Ojulari, group chief executive officer (GCEO) of NNPC, said the suspended strike led to 16 percent oil production loss.

“Significant revenue losses are projected at current deferment levels, driven by missed liftings and gas sales. Cashflow pressures are immediate and compounding,” he said.

“NNPC continued engagement with operating partners and key stakeholders to enhance security and emergency protocols, activation of BCP with non-union staff taking over operations, where practicable.”

Advertisement

Ojulari added that the industrial action “has impacts that extend beyond the Dangote Refinery”.

He said the disruptions pose systemic risks to energy supply, personnel and asset security and the wider economy.

Within the first 24 hours of the strike, the NNPC GCEO said production deferments “stood at approximately 283 kbopd of oil, 1.7 bscfd of gas, and over 1,200 MW of power generation impaction”.

Advertisement

“This equates to around 16% of national oil output, 30% of marketed gas, and 20% of electricity generation,” he said.

Ojulari added that five planned critical maintenance activities during the period were affected.

“Knock-on effects will cause further deferments in subsequent periods. These include USAN TAM, AKPO GT-3 pigging, H2 Well Tests, Annual compressor maintenance, and SEPNU EAP IGE,” he said.

Ojulari said critical-path project activities experienced setbacks, resulting in delays to production growth timelines.

Advertisement

He also said the restoration of approximately 100,000 barrels per day of crude oil and 1.34 billion standard cubic feet of monetised gas across joint venture (JV) and production sharing contract assets (PSCs), originally scheduled for this week, had been delayed.

He added that although a limited number of non-unionised staff continued to facilitate crude exports, overall operations were significantly constrained.

Ojulari cautioned that ongoing and planned lifting operations across the terminals could face additional financial setbacks in the coming months, heightening the risk of demurrage claims from international buyers.

At the Brass terminal, he noted, the loading of an NNPC cargo that was nearly complete had been stalled after documentation could not be finalised due to the strike.

Advertisement

The delay, Ojulari added, had already resulted in demurrage costs.

According to the NNPC boss, the financial impact is escalating quickly, with significant revenue losses projected under current deferment levels.

Advertisement

On October 1, PENGASSAN suspended its nationwide strike against the Dangote refinery over the dismissal of Nigerian workers.

After the federal government’s intervention, the Dangote Group had agreed to redeploy the workers sacked by its subsidiary, Dangote refinery.

Advertisement